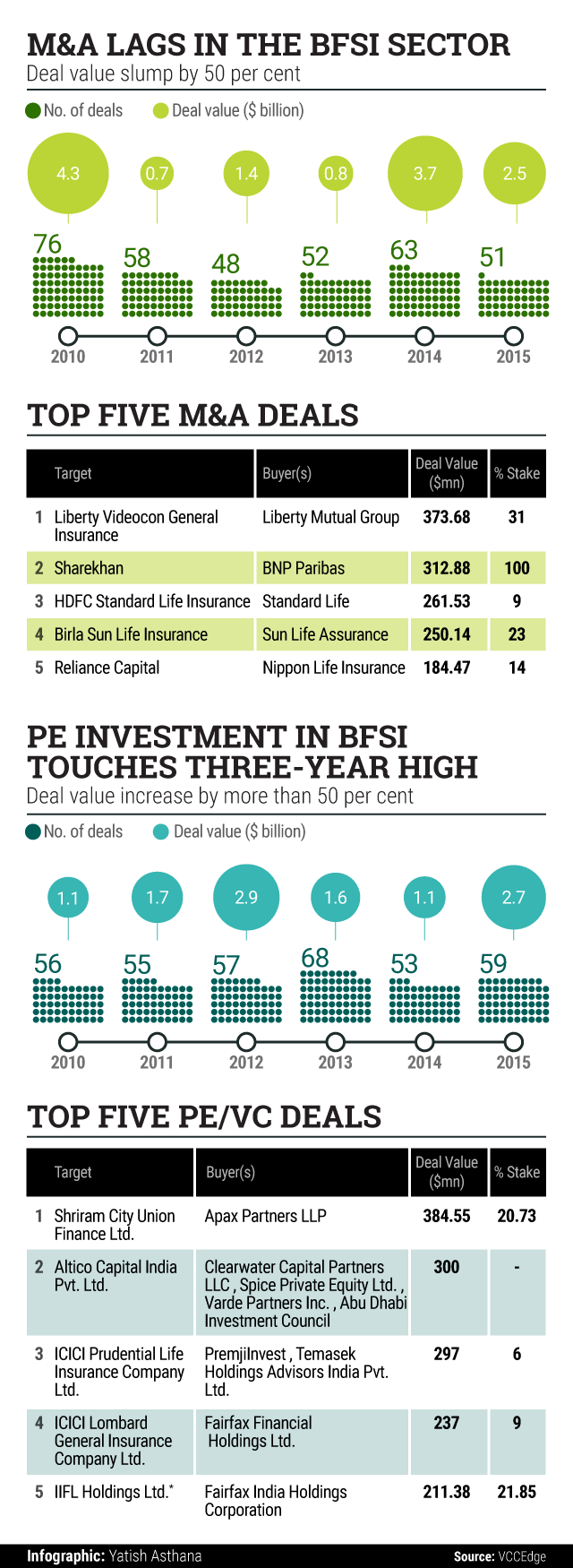

Private equity investors, who have been consistently backing banking and financial services companies in India, did not disappoint this year either.

The aggregate value of PE investment in the sector hit a three-year high of $2.7 billion as investors sealed more than a deal a week through 2015, as per VCCEdge, the data research platform of VCCircle.

However, there was a drastic slowdown in mergers and acquisitions in the banking, financial services and insurance sector as the number of transactions and deal sizes slumped compared with last year.

The overall M&A deal value and volume fell despite the hike in foreign direct investment ceiling in the insurance sector prompting many MNCs to raise their holding in local ventures.

Click here for this year's highlights of the BFSI sector.