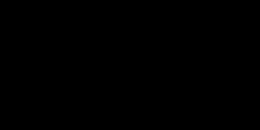

- India’s current account deficit remains challenging ($22.3 billion or ~5.4 per cent of GDP in Q3 12), but stronger capital flows have been supportive for the country’s balance of payments (BoP) in recent quarters, limiting funding risks and additional pressure on the INR.

Current account deficit is likely to stay elevated

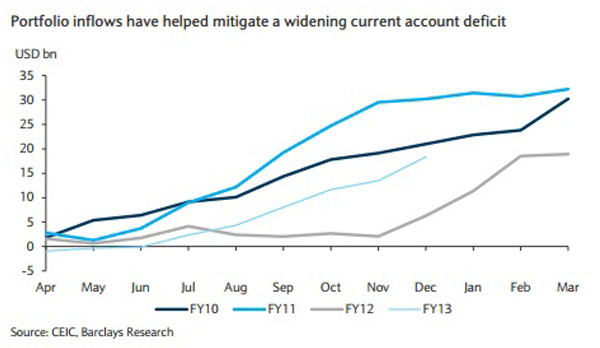

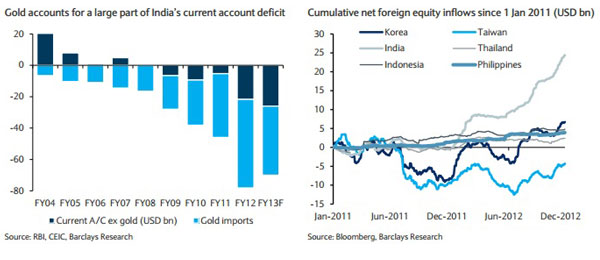

India’s merchandise trade deficit and current account deficit have been elevated in recent months, and are set to remain so for the near future, in our opinion. With export growth considerably weaker (a decline of ~6.0 per cent y/y during April-November) than import demand (a decline of ~1.6% y/y), there is little respite for the trade balance. Gold imports softened to some extent in FY 12-13 ($27 billion during April-October 2012 versus nearly $ 36 billion the same period last year), reflecting several policy restrictions. However, they are still high and continue to put significant pressure on the trade account. While services exports have picked up in recent months, the current account balance remains under pressure. We sense that with monetary policy likely to turn more growth supportive, merchandise trade deficits will continue to be elevated – we project the trade deficit reaching close to $180 billion in FY 12-13, only slightly below the ~$190 billion in FY 11-12.

Remittances and service exports provide some respite

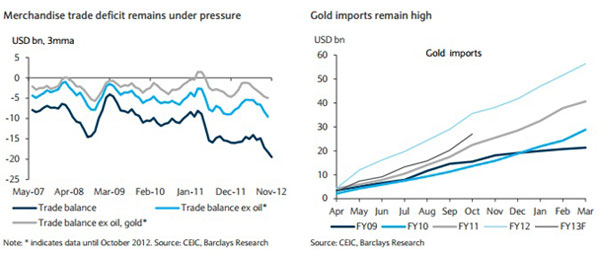

Nonresident deposits and workers’ remittances continue to provide medium-term support for funding the merchandise trade deficit. Under the liberalised regime for nonresident Indian (NRI) deposits, inflows have increased significantly, and a weak INR has contributed to an uptick in remittances as well. In the fiscal year to October, nonresident deposits have amounted to more than USD8bn, up from ~USD1.5bn in the same period in the last fiscal year. We believe real rates will keep the NRI deposits attractive and a viable source of funds for India’s overall external balance despite the likelihood of a slightly lower interest rate differential over the coming months. India’s services trade surplus is improving, along with the outlook for the global economy.

Indeed, service exports have been rising, and grew positively since September, after a brief spell of negative growth. The monthly services trade surplus has moved above USD5bn on average, a trend that is likely to be sustained with improved global demand. On balance, these factors have led us to increase our current account deficit forecast to ~USD70bn in FY 12-13, from ~USD65bn previously.'

Better capital inflows provide a buffer

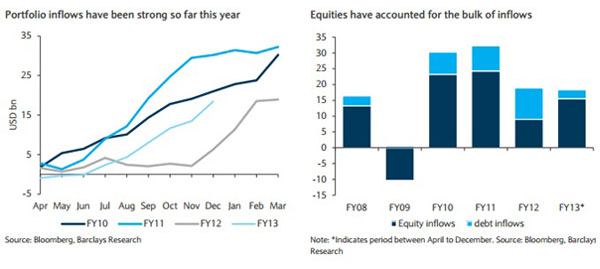

A wider current account deficit will increase the sensitivity of India’s currency to capital account flows. However, capital flows have broadly been supportive in recent months.

Portfolio inflows were strong in H2 12 since the government moved to break the slowgrowth, high-inflation gridlock. In the current fiscal year, India has already received nearlyUSD16bn of equity inflows, and nearly USD3bn in debt related inflows. Portfolio inflows have already surpassed our existing forecast of around $16bn for FY 12-13 and, hence, created some breathing space for a larger financing gap from the trade deficit.

Foreign equity inflows into non-Japan Asia have been the largest in India (Figure 10). Indeed, net foreign inflows into India equities totalled USD24.5bn in 2012, compared to USD15bn in Korea and USD5bn in Taiwan. Over the past four weeks, net foreign inflows into Indian equities have totalled USD4.7bn versus USD3.4bn in Korea and USD0.9bn in Taiwan.

Foreign demand for Indian bonds has been more mixed with foreigners’ purchases totalling $6.3bn in January to November 2012 versus USD9.2bn in Malaysia, USD7.6bn in Korea, USD5.8bn in Thailand and $2.5 billion in Indonesia. We think foreign inflows to the INR local bond markets are largely dependent on government policies. For instance, these inflows were strong in October 2012 following the announcement of reforms in September, but they were lacklustre in November amid political fatigue. Despite this, our interest rate strategists expect bond portfolio flows into India to pick up modestly in early 2013 as funds are drawn towards the highest yielding EM Asia market (see India FII quota auction: Catalysts in place for 1H13 rally, 19 December 2012).

Further, the outlook for portfolio inflows appears to be resilient, unless we see any deterioration in global risk sentiment in the near term. There are three factors which support further inflows:

- First, the government’s push to divest more assets could potentially provide some impetus to the IPO cycle in India, which is often a good source of equity flows.

- Second, more signs of a bottom in economic growth, along with nascent improvement in industrial production is likely to encourage further equity flows.

- Third, expectations of an impending rate cut from RBI have helped support sentiment, and if the central bank surprises with its monetary easing, equity inflows are likely to be quite supportive. Also, debt inflows should remain steady as likely softer inflation and monetary easing enhance the appeal of Indian debt securities.

Foreign direct investment (FDI) too has been encouraging at nearly USD14bn in the first seven months of the current fiscal year despite considerable slowdown in economic growth in 2012.

Further, since October 2012, the government has been more proactive in clearing FDI projects, which means that numbers in the coming months are also likely to remain supportive.

After the currency sell-off, RBI has significantly liberalised commercial borrowing regulations, making it easier for more corporates to access foreign funds in order to finance their capex and working capital spending. As such, we have seen a wave of corporate issuance and borrowing to facilitate either new borrowings or refinance loans. However, with expectations of an imminent monetary policy easing cycle from the central bank, we anticipate only modest growth in commercial borrowing. Further, with trade declining, the demand for trade credit may also moderate at the margin, thus leading to smaller inflows. As such, we expect India’s BoP to remain roughly in balance in FY 12-13.

Scope for INR to appreciate to 54.0/USD in 1M

With India’s current account deficit widening by more than we expected, the INR’s trajectory depends on the extent to which this gap will be filled by capital flows. Equity inflows into India have been particularly strong over the past year relative to the country’s non-Japan Asia peers, as noted above, providing INR support in the face of persistent current account deficits. Looking ahead, long-overdue interest rate cuts are likely to support economic growth to an extent and foreign equity inflows in 2013. We find that equity flows are significant in explaining INR returns, controlling for domestic risk sentiment, as proxied by equity returns (see FX Focus: Go with the equity flows, 19 March 2012).

We expect global factors to support capital inflows near term. The recent fiscal-cliff resolution brings forward the possibility of INR appreciation that we previously expected to occur in Q2. High-carry EM currencies such as the INR will likely be supported by ample liquidity provided by accommodative monetary policy globally, framed by diminishing tail risks related to US fiscal issues, a eurozone break-up and Chinese growth. At some stage improving risk sentiment could face roadblocks in the form of the budget ceiling and the sequester cuts debate in the US, still-subdued global economic activity, or stalled reform and/or economic momentum in India. Nonetheless, we expect these factors to be overwhelmed by ongoing loose monetary conditions for the time being, providing scope for USD/INR to move down to 54.0 in 1 million and 53.5 in 3 million.

(Siddhartha Sanyal & Rahul Bajoria are research analysts with Barclays Capital)