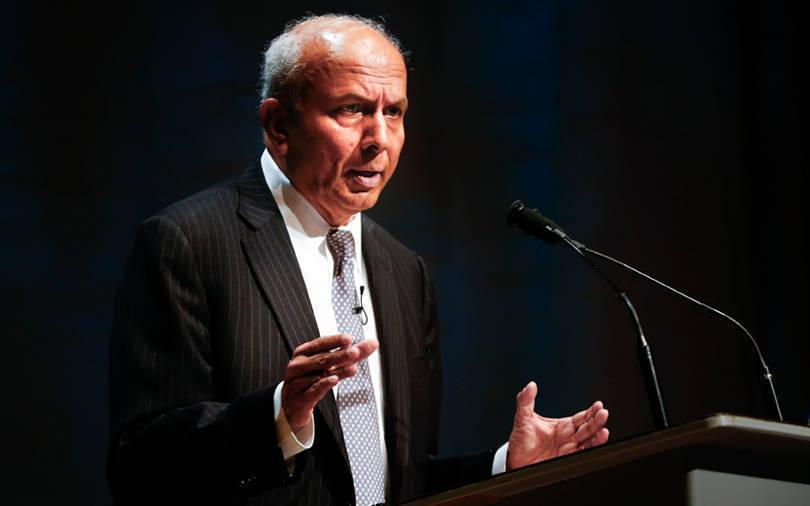

India is Fairfax Financial Holdings’ top investment spot since it is the world’s fastest growing major economy, the financial holding company’s founder and chief executive officer Prem Watsa said, calling the country a startup economy.

“When you’re thinking of starting a company, it doesn’t make a difference what your background is. You come up with a good idea and you can raise money. This was the idea in the US till now and now it’s in India. There are opportunities to do well,” Watsa said at the annual general meeting (AGM) of Fairfax India 2022.

“Public debt is very manageable. So, if you put it all together, India, we think is in the number 1 spot only because it’s got a population of nearly 1.4 billion. That’s a lot of people that can contribute to development,” Watsa said according to a speech transcript shared on Twitter.

Watsa also said that as India is recovering from COVID-19, it could register 8%-plus growth surpassing China’s estimated 5.3% growth in 2023. Oil consumption that was significant in the past “is much less significant” now for India, Watsa further added.

Moreover, Watsa said that Prime Minister Narendra Modi’s privatization push is already drawing foreign currency into the country and going forward, it will further attract foreign companies and foreign talent.

But that’s what makes India attractive. A democracy that can attract businesses like Samsung, Facebook, Amazon and contribute significantly to their market share. The share of state enterprises in China is 50%, but in India, it is only 10% and get lesser with time. Hence, India is more business-friendly allowing more entrepreneurs and companies to flourish,” Watsa said.

Watsa’s comments on India’s growth prospects come at a time when many global rating agencies have slashed GDP forecast for 2022-23 (FY23) citing high inflation and the disruption caused by the ongoing war in Europe. Moreover, the Reserve Bank of India, too, has cut its GDP forecast for FY23 to 7.2% from 7.8% projected earlier, while increasing inflation estimates for the year.

Founded in 2014, Fairfax has been investing in India across public and private firms and counts cloud insurance unicorn Go Digit Infoworks Services Pvt Ltd on its portfolio. Unicorns are startups with a valuation of over $1 billion.