The deals space saw customer support software maker Freshdesk raise $55 million in its Series F round from venture capital firms Sequoia India and Accel.

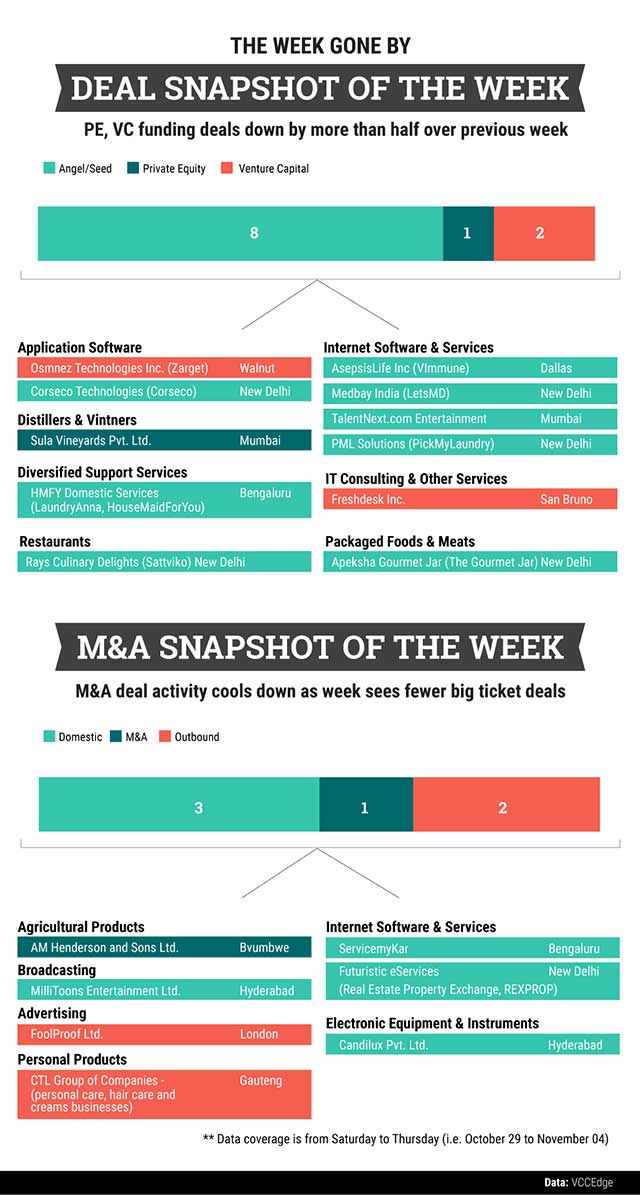

With just 11 deals, private equity and venture capital funding activity during the week was down by more than half over the previous week, which had seen 23 such deals.

In the mergers and acquisitions (M&A) space, the week saw just six deals, three of which were domestic and two outbound. Dabur India, one of the country’s biggest manufacturer of ayurvedic products, acquired personal care, hair care and cream businesses of South Africa-based CTL Group of Companies through its subsidiary Dabur South Africa for $1.5 million.

Like this report? Sign up for our daily newsletter to get our top reports.