British bank Standard Chartered has regained the top position as the largest foreign bank in India after being trumped by Citibank for two years and HSBC closing in. StanChart that was always (and remains) the largest foreign bank in terms of number of branches in the country reported the highest total income and net profit among all the foreign banks in India for the year ended March’10.

What’s more, the British bank that depends heavily on Indian operations to generate global earnings was the only one among the top three foreign banks in the country to grow both total income as well as net profit for FY’10, a year when the Indian economy saw a sharp bounceback and pickup in corporate activity.

What’s more, the British bank that depends heavily on Indian operations to generate global earnings was the only one among the top three foreign banks in the country to grow both total income as well as net profit for FY’10, a year when the Indian economy saw a sharp bounceback and pickup in corporate activity.

Data on foreign banks is not readily available as they are not listed companies but VCCircle dug out numbers of the last three years to analyse who has raised their game in India at a time when the country is poised for the next big leap.

The numbers speak for themselves. StanChart was relegated to the number two spot in terms of profits and revenues beginning FY’08 (incidentally when markets peaked out) as Citibank unleashed an aggressive India play. During FY’09, HSBC also pressed on the gas pushing StanChart to number three spot in terms of total income even as in profits StanChart continued to be number two. But last year, it pulled up its socks and emerged as the clear leader growing its revenues and profit even as its two close rivals saw a significant fall in both topline and bottomline.

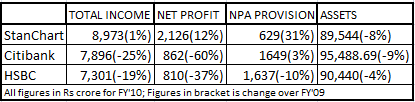

Although StanChart’s total income managed to grow just about 1% in FY’10 it was much better placed than HSBC and Citibank who saw total income crumbling 19% and 25% respectively. Even more spectacular was its bottomline performance compared to peers. StanChart’s net profit (adjusted for extra ordinary income) rose 12% at a time when HSBC’s earnings shrunk 37% and Citibank’s crumbling 60% and is now less than half compared with StanChart.

Even as Citibank's interest income remained higher than StanChart for FY’10, it took a big hit in other income as gains due to forex transaction halved. Citi saw its interest income decline 12% due to drop in interest from advances and bills and income from commission, exchange and brokerage shrink by a fifth. In contrast, StanChart saw interest income decline by a modest percentage and in fact trumped Citibank in terms of interest from advances and bills.

Citi managed better interest income due to higher income from sale of investment, even though StanChart grew its own income from sale of investment much faster. Ditto HSBC that continues to have higher interest income compared to StanChart, almost half of which comes from income from sale of investment. This shows all the top three banks have been supporting their total income generation from sale of investment.

Among the top three Citi boosted its capital base 44% by adding over Rs 1,100 crore. But HSBC still has the most paid up capital with around Rs 4,500 crore.

HSBC also saw a relatively moderate decline in asset base and in the process became number two in asset size on balance sheet behind Citi during FY'10. HSBC is close on the heels of StanChart in terms of net worth even as Citi remained at the top of that chart last year. But both Citi and HSBC have high levels of NPAs (over Rs 1,600 crore each compared to StanChart’s Rs 630 crore).