Deeptech startup Mindgrove Technologies on Thursday said it has secured seed funding of $2.325 million (around Rs 19.5 crore) led by Sequoia Capital India.

The round also saw participation from Speciale Invest and Whiteboard Capital, with angel investors Ashwini Asokan (Mad Street Den) and Nischay Goel (Duro Capital).

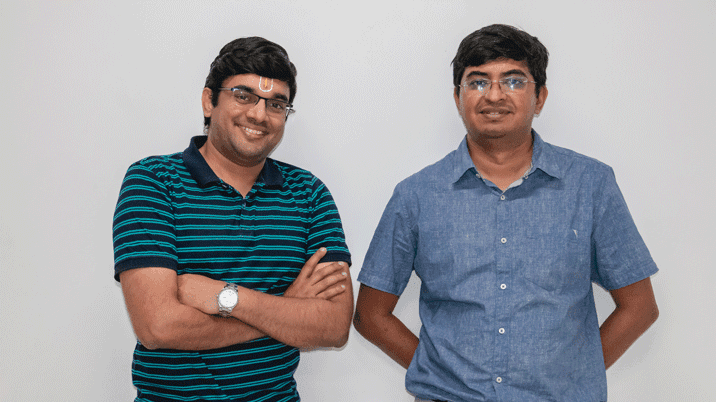

Founded in 2021 by Shashwath T R and Sharan Srinivas J, Mindgrove is a deeptech startup focused at designs cost-effective and power-efficient system-on-chips (SoCS) for use in internet-of-things (IoT), automobile, consumer electronics, industrial automation, security and aviation sectors.

The Chennai-based startup plans to use the fresh capital to scale up its technology and hiring.

“Mindgrove’s mission of designing chips in India, for the Indian market aligns well with India’s semiconductor needs,” said Shashwath.

Mindgrove’s investment comes at a point when India’s deeptech space has seen an uptick in deal activity since last year. Earlier in January, deeptech startup Praan raised $1.56 million in a round led by Social Impact Capital.

During the same period, Bengaluru-based Chara Technologies raised $4.75 million (around Rs 39 crore) in a pre-series A funding round led by VC firm Exfinity Venture Partners.

Meanwhile, Sequoia Capital India, which has backed startups like Byjus, CRED, Freshworks, Groww, Mamaearth, Pine Labs, Razorpay, Truecaller, and Zomato amongst others also has been investing in a significant number of early-stage deals.

In February, the firm through its accelerator program Surge led the $3.7 million seed funding round of software-as-a-service (SaaS) startup Hatica. During the same period, it also led the $12 million Series A funding round of SaaS startup Freightify.

Last year, the VC firm led venture capital investments in India in 2022, completing 71 deals as per data from the market analytics platform Venture Intelligence.