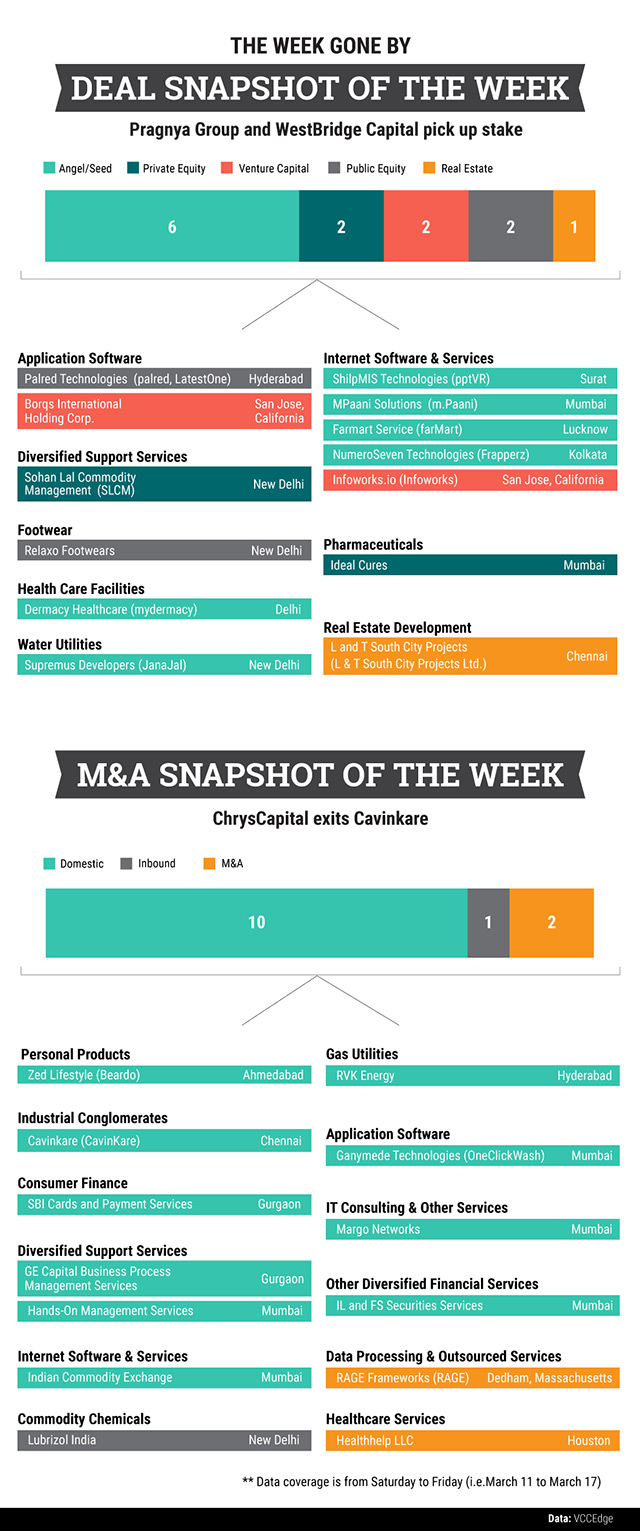

In the deals space, impact funds Incofin Investment Management and ResponsAbility Investments AG invested $20 million in agri-logistics company Sohan Lal Commodity Management in a mix of primary and secondary transactions.

In a real estate deal, L&T Realty sold its entire stake in L&T South City Projects Pvt Ltd to real estate private equity firm Pragnya Group for $28.5 million.

In public equity deal space, WestBridge Capital Partners increased its stake in Relaxo Footwears to 3.4% by buying an additional 1.39% stake for $11.3 million, and Hyderabad-based Palred Technologies received $3.3 million from a clutch of investors.

In another deal, IoT products and solutions provider Borqs International Holding Corp raised an undisclosed amount in a funding round led by Qualcomm Ventures.

In the M&A space, NYSE-listed business process management firm WNS acquired Houston-based Healthhelp for $95 million and Genpact is set to acquire Dedham-based Rage Frameworks Inc for an undisclosed amount.

In another major transaction, ChrysCapital exited from its four-year-old investment in FMCG company CavinKare with two times returns of close to $78 million.

Also, State Bank of India said it will increase its stake in the credit card joint ventures with GE Capital to 74% by infusing an additional capital of up to $178 million.

Besides, IndusInd Bank is set to acquire IL&FS Ltd’s securities services subsidiary for an undisclosed amount.

In the startup space, PickMyLaundry acquired rival OneClickWash in an all-cash deal and Zee Entertainment Enterprises Ltd picked up 80% stake in Mumbai-based Margo Networks for $11.27 million.

Like this report? Sign up for our daily newsletter to get our top reports.