Online retailer Snapdeal Pvt. Ltd has raised funding from Piramal Group executive director Anand Piramal, ending a two-year drought for fresh capital that began in 2017 when it explored and then scrapped a merger with bigger rival Flipkart.

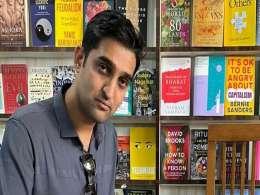

Anand Piramal, executive director at the diversified Piramal Group, invested in Snapdeal in his personal capacity, the e-commerce company said in a statement. It did not disclose the value of the investment.

The company had last raised funding in March 2017, from existing investor Nexus Venture Partners. The VC firm, which was against the merger with Flipkart, had injected Rs 96.3 crore into Snapdeal at the time.

Piramal's investment comes as Snapdeal continues to focus on the turnaround strategy it had adopted after calling off the merger with Flipkart. The company had tweaked its business model, cut costs and slashed its headcount as part of the strategy.

Snapdeal had also divested some businesses to streamline its operations. It sold its mobile wallet business FreeCharge to Axis Bank and logistics arm Vulcan Express Pvt. Ltd to Future Group's supply chain services subsidiary.

As its performance improved, Snapdeal began looking for targets itself. The company engaged in talks to acquire rival Shopclues earlier this year but the discussions appeared to have hit a roadblock subsequently.

Snapdeal co-founder and chief executive officer Kunal Bahl said Piramal’s investment was an endorsement of the company and its transformation in the past couple of years.

The company grew its consolidated revenue to Rs 925.3 crore for 2018-19 from Rs 535.9 crore the year before. It narrowed its net loss to Rs 186 crore from Rs 611 crore. Snapdeal claims to have on-boarded more than 60,000 seller partners, who have collectively added over 50 million listings to its platform.

Piramal said Snapdeal had expanded in the mass-market segment in Tier-II and III cities because of its ability to leverage its product selection and growing internet penetration in those regions. “With hundreds of millions of first-time e-commerce buyers yet to transact, Snapdeal is well poised to grow in the future,” he said.

This is not the first investment by Anand Piramal. He has previously invested in the Mumbai-based luxury homes developer Isprava Vesta Pvt. Ltd.