Tech-focused 3one4 Capital said it has marked the final close of its opportunities fund and seed fund with oversubscription, joining a slew of small and big venture capital firms to hit fundraising milestones this year despite rumours of a funding winter coming for the startup ecosystem.

The opportunities fund -- Continuum I -- has received confirmed commitments of Rs 400 crore ($56 million) against the target corpus of Rs 350 crore, said early-stage venture capital firm 3one4 Capital in a statement. Continuum I had hit the first close at Rs 150 crore ($21 million) earlier in February.

Continuum I has received commitments from new Limited Partners (LPs) or investors, as well as existing larger LPs from its previous funds. New LPs include Emory Investment Management, a large US endowment that manages the assets of Emory University, Emory Healthcare, and The Carter Center; Sojitz, a diversified Japanese corporation; Catamaran Infina, a private investment company owned by the Kotak family; and Indian institutions and family offices.

Sojitz will also partner Continuum I to explore deeper technological and business relationships with the startups the fund invests in.

Continuum I will seek to invest in select portfolio firms that are raising funding from Series B stage onwards with cheque sizes between $3 million and $5 million.

Simultaneously, its seed fund -- Rising I -- has received confirmed commitments of Rs 45 crore ($6.5 million) against the initially targeted Rs 25 crore.

LPs in the seed fund include existing investors in previous funds as well as new family offices that have been working with the firm as co-investors at the seed stage.

Rising I will invest at the idea stage or the seed stage in tech startups with a ticket size between Rs 50 lakh ($100,000) and Rs 3.5 crore ($500,000).

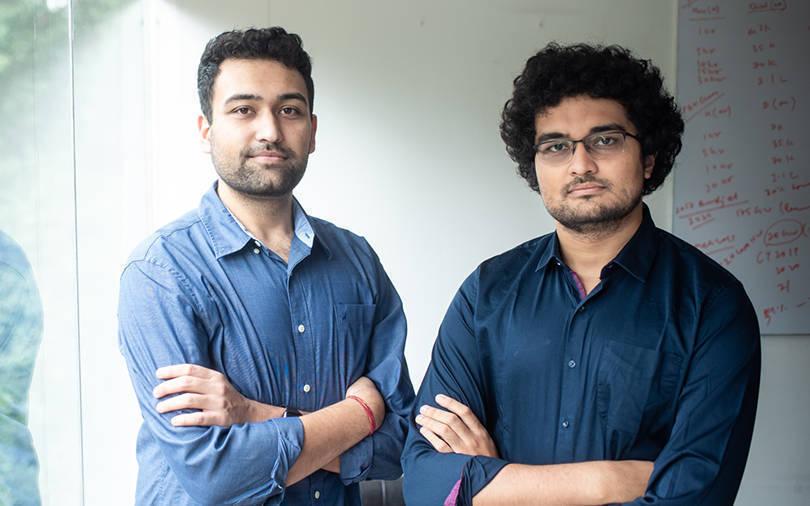

Established in 2015, tech-focused 3one4 Capital is managed by Pranav Pai and Siddarth Pai, sons of TV Mohandas Pai, a former finance chief at software services firm Infosys Ltd and an active angel investor.

The venture capital firm had launched its first fund in early 2016 and raised Rs 100 crore (about $15 million). It had marked the final close of its second fund last year at Rs 250 crore ($39 million), exceeding its target corpus after exercising the overallotment option.

3one4 Capital invests in machine intelligence services for enterprises, automation, ambient intelligence technologies, ed-tech, fin-tech, media and content development, and health. It also allocates a portion of its capital to US-focused companies with an India play.

The venture capital firm’s portfolio includes human resources startup Darwinbox; online meat and fish ordering startup Licious; biotech firm Bugworks; ed-tech startups Magic Crate and Oust Labs; fintech startups Faircent.com and SwitchMe Technologies; farm-tech firm Aibono; digital media company Yourstory Media; and data analytics firm Tracxn.

Its recent investments include vernacular news aggregator Lokal and audio platform Kuku.

Fundraising by VCs

3one4 Capital joins a number of India-focused funds in hitting fundraising milestones this year.

This has come despite the economic slowdown faced by India and murmurs of a funding winter that is expected to hit the startup ecosystem.

Last month, Deepak Shahdadpuri, founder of consumer-focused venture capital firm DSG Consumer Partners, which also announced the final close of its third fund earlier this year, sent a letter to its portfolio companies warning them of a funding winter citing weak consumer sentiment, The Economic Times reported.

Earlier this month, Accel raised $550 million (Rs 3,942 crore) under a new fund to make seed and early-stage investments in Indian startups.

Last month, Inventus Capital Partners hit the final close on its third venture capital firm, raising Rs 369 crore ($52 million), with the bulk of the money coming from local investors.

In June, A91 Partners, a venture capital firm floated last year by former Sequoia Capital executives, closed its debut fund with a $351 million (Rs 2,403 crore) corpus, the largest fund raised by a new VC firm.

In May, homegrown venture capital firm Nexus Venture Partners received commitments from a few more LPs for its fifth fund that has a target corpus of $450 million.

Also in May, Endiya Partners marked the first close of its second fund at $40 million. Vertex Venture Holdings Ltd, an early-stage venture capital firm backed by Singapore's Temasek Holdings, and Japanese VC firm GREE Ventures also announced fundraising milestones the same month.

Early-stage VC firm Artha Venture Fund marked the second close of its debut fund at more than Rs 100 crore in June.

Other VC firms that have announced fundraising milestones this year include impact investor Omnivore, deep-technology and B2B-focused VC firm StartupXseed, and Entrepreneur First.