Japanese telecom and technology firm SoftBank Group Corp. said on Friday it will set up a global fund along with Saudi Arabian sovereign wealth fund Public Investment Fund (PIF) to invest as much as $100 billion in the technology sector.

Christened SoftBank Vision Fund, it will be managed in the UK by a SoftBank subsidiary. SoftBank said it expects to invest at least $25 billion over the next five years. It has signed a non-binding agreement on October 12 with the PIF where the Saudi fund will consider investing in the fund and becoming the lead investment partner, with the potential investment size of up to $45 billion over the next five years.

In addition, a few large global investors are in active dialogue to join the two partners to participate in this fund. The overall potential size of the fund can go up to $100 billion.

SoftBank will use its operational expertise and network of portfolio companies to add value to the fund’s investments.

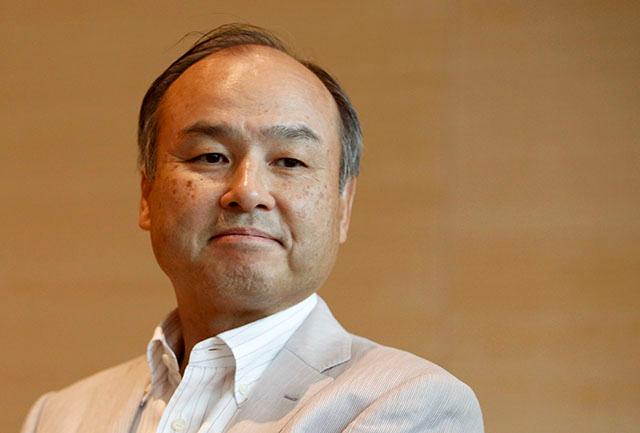

Masayoshi Son, chairman & CEO of SoftBank Group Corp., said, “With the establishment of the SoftBank Vision Fund, we will be able to step up investments in technology companies globally. Over the next decade, the SoftBank Vision Fund will be the biggest investor in the technology sector.â€

Rajeev Misra, head of strategic finance, SoftBank Group, is leading the fund project for SoftBank. SoftBank has also engaged former Deutsche banker Nizar Al-Bassam and ex-Goldman partner Dalinc Ariburnu for the project.

This comes a little over a year after SoftBank, which has backed Indian firms Ola, Snapdeal, Oyo and Grofers, said it is winding down its venture capital division SoftBank Capital. This signaled how the Tokyo-headquartered company will no longer make small bets in early-stage companies and instead focus on bigger investments in more mature businesses.

The development may also revive SoftBank’s game plan in India that seemed to suffer a setback as Nikesh Arora quit the firm. In 2014, SoftBank said it will invest about $10 billion in India's internet and communications sector. It was also scouting to build a full-fledged team in India and had already mandated a Mumbai-based headhunter firm for the same.

But SoftBank has gone quiet this year, especially after Arora resigned in June. Arora, who was serving as president and chief operating officer, said his decision stemmed from Son’s desire to stay at the helm of the company he founded for the next few years.

Like this report? Sign up for our daily newsletter to get our top reports.