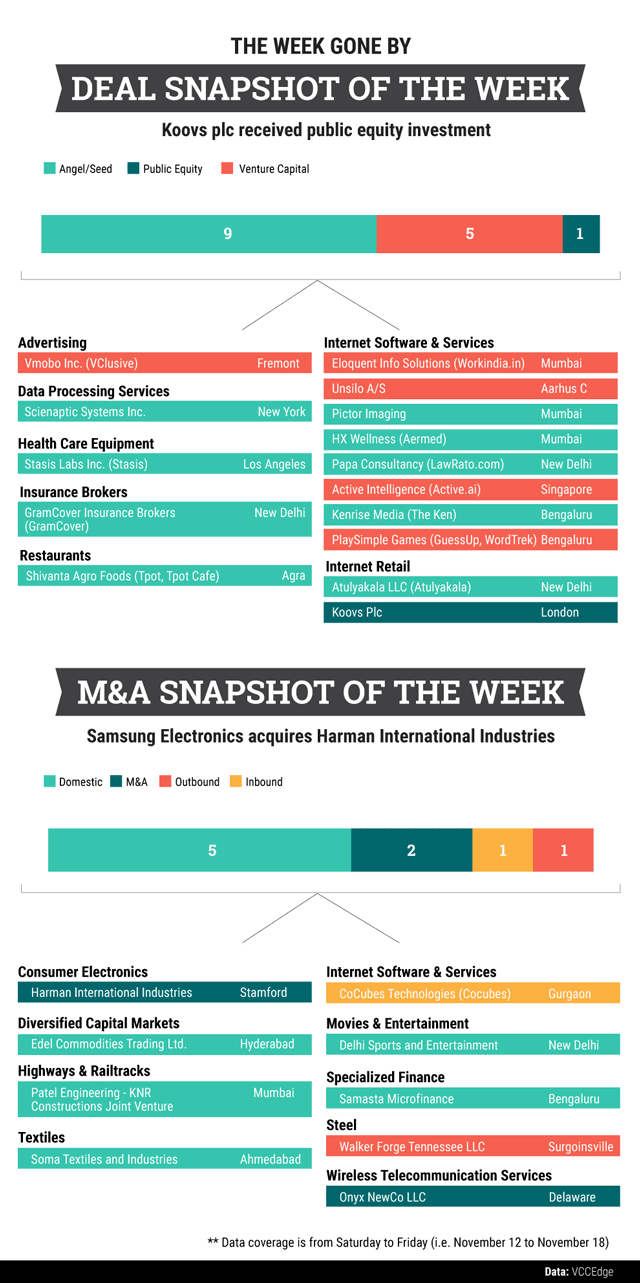

London Stock Exchange-listed Koovs plc, the parent of online fashion marketplace Koovs, led the funding activity last week as it secured $13.52 million from a clutch of investors including Times Group, Ruffer LLP, Coller Capital and others.

In other deals, venture capital firm Hunch Ventures invested in luxury brands marketplace vClusive while RTP Healthcare Ventures, Wonder Ventures and others backed health-tech company Stasis Labs in a seed funding round.

In the M&A segment, South Korea’s Samsung Electronics announced the acquisition of car infotainment and audio company Harman International Industries for $8 billion. In another deal, Essel Infraprojects acquired two road assets for $126.12 million from a joint venture of KNR Constructions and Patel Engineering.

Like this report? Sign up for our daily newsletter to get our top reports.