The tragedy of Indian banking is that most banks are plays on the Government bond cycle (rather than being plays on the thriving economy). Strip out such ephemeral capital gains from Government bonds and most Indian banks posted sub-15% RoE even between FY06-09, the most benign period ever for Indian banks! With Government bond yields now hardening we recommend that investors reassess their exposure to Indian banks.

HOW BLUE WAS MY SKY?

Over the past five months, whilst we have been Negative on most of the banks that we cover, Indian banks’ share prices have had a stellar run (with the BSE Bankex outperforming the BSE Sensex by 41%). However, investors are now faced with a dilemma.

On the one hand the stock market is on a sustained bull run (driven by heavy inflows of FII capital at a time when India, alongside China, is the only large economy to post 6%+ growth). Since banks are almost universally perceived to be geared plays on the economy and the stock market, the strength of conventional wisdom could push up banks’ stock prices. On the other hand, Indian banks face two fundamental challenges in the coming months:

- Poor cross-cycle core banking profits: Cross-cycle ‘core’ banking profitability

data suggests that a number of Indian banks are basically bets on the Government bond cycle (between FY99-09 and FY06-09 Treasury gains accounted for ~35% and ~15% of the reported returns for the fourteen banks covered here). So if Government bond yields are

hardening, banks’ stock prices are unlikely to run up.

- A Government spending dependent economic recovery: The Indian economy, like many thers around the world, is being propped up by Government spending (fiscal deficit expected at 6.8% of FY10 GDP). If one adjusts for this, the Indian economy will grow at a mere 3% in FY10, its lowest growth rate since FY02. This we believe has negative ramifications for the banks’ NPAs, something that has been masked over the past six months by restructured assets (which now account for ~4% of Indian banks’ loan books).

INVESTORS NEED PROTECTIVE SHELTER

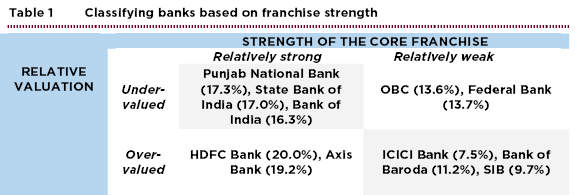

The way forward for investors could be a market neutral long-short trade. One such strategy could be to go ”long” on high quality and relatively undervalued banks (State Bank of India, Punjab National Bank and Bank of India) and “short” the relatively lower quality overvalued banks (ICICI Bank, Bank of Baroda).

Over the past 1, 3 and 5 years, such an equally weighted long-short strategy would have

produced annualised returns of 2%, 21% and 13%.

Over the past five months, whilst we have been Negative on most of the banks that we cover, Indian banks’ share prices have had a stellar run. Since 9th March’09, the BSE Bankex has risen by 134% as compared to the BSE Sensex which has risen by only 95%. Moreover, Indian banks have very strongly outperformed Emerging Markets more generally. In terms of relative valuations, the Indian Public Sector Banks (PSBs) are now trading at 1.2x FY10E P/BV (up from

0.7x FY10E P/BV as on 9th March’09) and the large Private Sector Banks are trading

at 2.2x FY10E P/BV (up from 1.2x book on 9th March’09).

Our discussions with clients highlight that almost universally, investors see Indian banks as a geared play on the overall growth of the Indian economy. Hence, the theory goes, if the economy is recovering, banking stocks are bound to outperform.