History shows that Indian investors have a bias towards “growth” stocks which results in them overpaying for such stocks. On the other hand, they have a bias against “value” stocks. By going long on value stocks and shorting growth stocks, investors can create a high performing market neutral portfolio.

CALCULATING “PERFECT FORESIGHT” VALUE

With perfect foresight we would be able to forecast the financials of all stocks for all years going forward. The bad news obviously is that we don’t have perfect foresight for years going forward. The good news is that we can pretend to that we are sitting in the past, say in FY99 or FY04, and then confidently say that we can predict the future. More importantly, if we go back in time, we can then use data from FY99-09 and use that to calculate the “perfect foresight” value (PFV) of stocks by discounting dividends and then using the current market cap as a terminal value (see Table 1).

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

\n

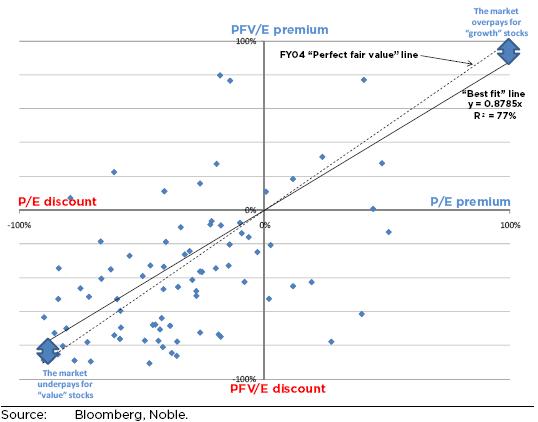

Calculating PFV is useful because we can then compare PFV with the prices prevailing for stocks in, say, FY99 or FY04, to understand the market’s biases. We find that the Indian stockmarket (see Figure 1):

• Successfully identifies out/underperformers: we find a ~90% correlation between the premium/discount in past P/E and the “perfect foresight” premium/discount.

• Overpays for “growth” stocks: the market pays a premium of ~50% (relative to the “perfect foresight” value) for “growth” stocks. On the other hand, it puts a ~10% discount (relative to the “perfect foresight” value) on “value” stocks.

• Generates underperformance from “growth” stocks and outperformance from “value” stocks: although the market successfully identified high performing stocks, because it pays such a hefty premium for them, these stocks usually fail to generate strong returns (~10%% negative correlation between FY04 forward P/E and subsequent price performance). The opposite holds true for value stocks – the market’s neglect of this stocks, helps them outperform!

CREATING AN INVESTMENT STRATEGY TO EXPLOIT THE MARKET’S BIASES

We highlight a long-short market neutral strategy wherein you go “long” on the cheapest ten stocks in India on a forward P/E basis and you “short” the dearest ten stocks (see Table 2). Had you implemented such a strategy on 31st March 2004, you would have generated 90% returns over the 12 subsequent months (whereas the BSE 100 rose a mere 14%). We note the current FY10 P/E premium for “growth” stocks (200%+) and the P/E discount for “value” stocks (65%) is comparable to FY04.

INTRODUCING PERFECT FORESIGHT VALUE (PFV)

William Sharpe, the Nobel laureate who was one of the creators of CAPM, came up with the notion of “clairvoyant value”. This refers to the value of a stock if we could look forward into the future and forecast (for every year in the future) the financials

of a stock with 100% accuracy.

In a recent article in the Financial Times, Rob Arnott, a noted financial economist, highlighted that this concept, which we call Perfect Foresight Value as it is easier on the tonque, could be used to good effect.

In this note, following in Arnott’s footsteps, we have used PFV in the following manner:

1. We go back in time, say to FY04, and then use actual dividends to calculate the PFV. 1 So PFV in FY04 is equal “present of FY05-09 dividends plus the present value of the stock’s current market cap”.

2. We can then compare PFV with the price of the stock in FY04 to see whether the market can identify winners and losers

3. We can also compare the PFV with the price of the stock in FY04 to see if the market has certain biases which can be exploited.

Note that the data set used in this analysis is the 92 largest stocks in India which were

listed in FY99, FY04 and FY09.

THE INDIAN MARKET IS GOOD AT PICKING WINNERS/LOSERS…

Using dividends we conduct the exercise highlighted above for both FY04 and FY99. We find that the Indian market is good at identifying winners & losers:

• In FY99, we find a correlation of ~20% between premium/discount placed on stocks by the market and the premium/discount justified by fair market value.

(Arnott found this correlation to be 50-60% for the UK market.)

• By FY04, this has improved to ~90%. To some extent this is improvement in the correlation is to be expected given that around 88% of the FY04 PFV is driven by the current market cap (as opposed 80% of the FY99 PFV being driven by the current market cap). However, the extent of the jump in the correlation (from 20% in FY99 to 90% in FY04) also suggests that the efficiency of the Indian market improved between FY99 to FY04.

...BUT IT HAS PRONOUNCED BIASES…

We rank the top 100 stocks in FY04 as per their forward P/E. We then call the stocks with above average forward P/E, “growth” stocks. If we compare the P/E of these growth stocks with their PFV/E, we find that the market attaches a ~50% premium to these stocks (note: the premium is calculated by comparing the P/E premium to the

PFV/E premium).

We then call the stocks with below average forward P/E, “value” stocks. If we compare the P/E of these growth stocks with their PFV/E, we find that the market attaches a ~10% discount to these stocks.

…WHICH IMPACTS INVESTMENT PERFORMANCE

We have highlighted that market is good at identifying winners, it then overpays very

significantly for these winners. As a result, the FY04 “growth” stocks have produced annualised share price returns of only 20% since 31st Mar 2004 (bang in-line with the BSE 100’s returns i.e. no outperformance at all).

On the other hand, the Indian market underpays for “value” stocks. As a result, these stocks generate clear price outperformance – the FY04 value stocks have produced annualised share price returns of 33% since 31st Mar 2004 (compared to the BSE 100’s 20% returns).