The past year has seen the rivalry between Amazon and Flipkart further intensify. From funding to shopping extravaganzas, the e-commerce behemoths went all out to outdo each other.

With both parties contesting third-party research findings about market share, the jury is still out on who sold more products.

But a look at a few other metrics provides some interesting insights on how the e-commerce giants grab eyeballs.

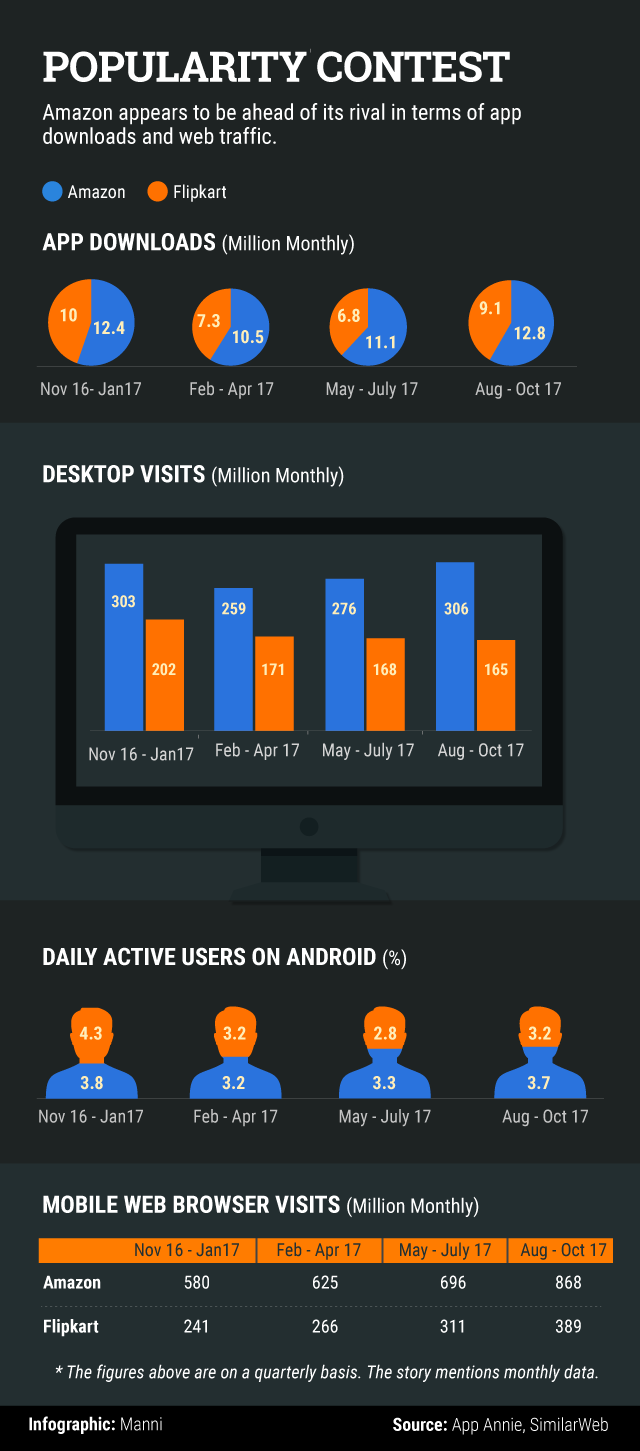

According to data from three independent platforms, Amazon's app and website are more popular than rival Flipkart's offerings.

Between November 2016 and October 2017 - the 12-month period for which the latest data is available - Amazon was consistently ahead of Softbank-funded Flipkart on desktop and mobile browser visits, app downloads and average daily active app users.

Amazon ended October last year with 5.4 million downloads for the month to Flipkart's 4 million, according to app metrics tracking website App Annie (The number includes both Android and iOS downloads, but Apple has a minuscule market share in India).

Last October, Amazon and Flipkart had each crossed 100 million cumulative app downloads.

However, adding Flipkart's subsidiaries PhonePe (digital payments) and Myntra and Jabong (both fashion) to the mix will see India's largest e-commerce company well ahead of Amazon on this parameter. Each of those apps has between 10 million and 50 million downloads.

Google's Play Store provides a wide range data for the cumulative app downloads. While downloads for e-commerce rival Snapdeal's app range between 50 million and 100 million, smaller players such as Paytm Mall and Shopclues have between 10 million and 50 million downloads each.

Customer retention

According to data from digital marketing analytics firm SimilarWeb, around 4.8% of users who installed the Amazon app visited it daily. This also means that more users visit the Amazon app daily than Flipkart and Snapdeal combined.

But even as the overall app customer base grew, both Flipkart and Amazon struggled to sustain regular interest. Between November 2016 and October 2017, Flipkart saw a particularly sharp drop - from 5.6% to 3.2% - in daily active users on its app. In the process, it also lost its leadership position on this front to Amazon.

But Flipkart says quantity isn’t the priority when it comes to viewers.

"Flipkart focuses more on quality of traffic coming to its app, mobile site and website properties rather than traffic volume,†said a Flipkart spokesperson. “While traffic volume can be bought with marketing dollars, the majority of our user traffic comes to us on its own. And this traffic is of higher quality with a much higher user intent to purchase, directly leading to higher sales."

Satish Meena, senior forecast analyst at market research firm Forrester Research Inc, warned against reading too much into these numbers.

"App downloads could be the result of paid advertisements," he said. "If we assume that Flipkart has higher sales, that means Amazon's conversion rate of traffic to sales is below par. But the traffic gap is big enough between them that the players could still be equals in terms of sales."

He said that customers of Amazon Prime - its paid membership service - are high spenders and an estimated 30% of Amazon's customers are Prime subscribers.

Another analyst with an international research company, who did not wish to be identified, said that Amazon could be ahead of Flipkart on sales on a standalone basis.

The analyst noted that Myntra and Jabong (which combined have more than a billion dollars in gross merchandise sales), together with PhonePe, could see a consolidated Flipkart beat its rival.

​​Browser traffic

Amazon's browser traffic is impressive too.

Data from Similarweb shows Amazon's monthly desktop visits rising nearly 25% to 102 million between November 2016 and October 2017.

During the same period, Flipkart saw its monthly desktop visits go up from 50 million to 60 million.

However, browser visits may not be a fair comparison. In 2015, Flipkart had focused on selling via its app while considering shutting down its website altogether. It has not managed to regain its leadership position in web traffic since then.

Before launching its existing web application on the Chrome browser, Flipkart had even briefly shut down its mobile site.

On mobile browsers, Amazon had around 340 million visits in October 2017, more than doubling its tally in a year. Flipkart, too, doubled its monthly visits in that period but only notched up 120 million views.

"Amazon.in was the most visited destination as per all standard traffic reports," said an Amazon India spokesperson. "We know that our deals that already draw the maximum online traffic have a huge impact on customers' buying patterns. "

​​Continuing trend?

Despite Amazon's clear advantage till October last year, it's not clear whether the trend is continuing.

Multiple visits to the Google Play Store in January this year found Flipkart and PhonePe among the top 10 most popular apps on several days. Amazon did not find a place in the top 50. Myntra was also consistently among the top 50 most popular apps.

Forrester Research's Meena pointed out that Amazon had led Flipkart in a consumer survey on customer satisfaction done by the research firm in 2016 and had strengthened its position as the top-rated platform in 2017 as well.

"There is no way we can track consumer spending though," he said.

Harish HV, partner at accounting giant Grant Thornton, says the real numbers are hard to come by.