VCCEdge has released its Quarterly Deal Update for Q3 2010.

Highlights

• Total private equity investment went up by 1.6 times in the first three quarters of 2010 as against the $4.37 billion received in the four quarters of 2009.

• On a quarter-on-quarter basis, private equity deal count increased by 18.5% in Q3 2010, with the deal value increasing by 24.6%.

• Financials was the most targeted sector for private equity investments, receiving an investment of $922 million, followed by Utilities ($502 million) & Industrials ($452 million).

• Compared to Q2 2010, Q3 saw a significant decline in investments in the Energy, Materials, and the Healthcare sectors.

• In comparison with the 35 private equity backed exits in Q2 2010, Q3 saw 42 exits, though the overall value of the exits declined 43% from $1.73 billion to a little under a billion.

• M&A activity in India noticed a drop in Q3 2010 both in terms of deal value and deal volume compared to last two quarters with announced deal value of $11.7 billion.

• The median deal amount in Q3 2010 decreased to $18 million as compared to the previous two quarters of 2010, but was higher than that seen in 2009.

• From a sectoral standpoint, Energy, Healthcare, Industrials and Materials emerged as the top four sectors for pursuing inorganic growth, together accounting for 85% of the total deal value so far this year.

Report Contents

I. Executive Summary

II. Private Equity Deal Flow

- Introduction

- Deal Breakdown

- Sectoral Breakdown

- Regional Outlook

- Top 10 Private Equity Deals

- 2010 YTD

III. Private Equity Exits

- Introduction

- Deal Breakdown

- Sectoral Breakdown

- Top 10 Private Equity Exits

- 2010 YTD

IV. M&A Round Up

- Introduction

- Deal Breakdown

- Sectoral Breakdown

- Regional Breakdown

- Top 5 M&A deals

- 2010 YTD

Publication Date: October 8, 2010

Format: Pdf

Price: Rs. 5,000/- (Plus 10.3% Service Tax)

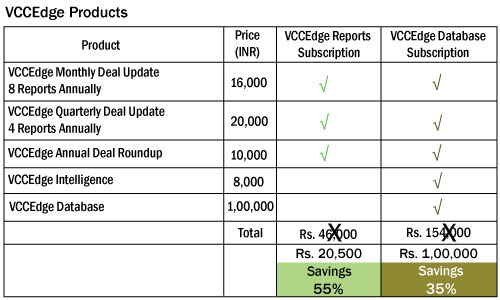

Special offer: Order an annual subscription and save 55%. Plan details below.

For a sample issue or trial login contact sales@vccedge.com.