VCCEdge has now released its Quarterly Deal Update Q2 2010. This report was compiled using the VCCEdge platform and offers deep insights into the private equity and M&A industry in India.

Highlights

Private Equity

• Total private equity investment in India went up by more than 130% from $0.99 billion in Q2 2009 to $2.3 billion in Q2 2010.

• The median deal amount and the average value of private equity deals in Q2 2010 increased from that in 2009.

• Financials, Energy & Utilities were the most targeted sectors for investment.

• Exit value increased by 78% in Q2 2010 as compared to the same period last year.

Mergers & Acquisitions

• Deal value touched $24.8 billion in Q2 2010 taking the total M&A value in the first half of 2010 to $48.1 billion, up from $16.3 billion clocked in the whole of 2009.

• The value of domestic deals increased from $1.7 billion in Q2 2009 to $14.0 billion in Q2 2010 while the number of outbound deals tripled from 22 in Q2 2009 to 66 in Q2 2010.

• Telecommunication Services, Healthcare and Financials were the most targeted sectors.

Report Contents

I. Executive Summary

II. Private Equity Deal Flow

- Introduction

- Deal Breakdown

- Sectoral Breakdown

- Regional Outlook

- Top 5 Private Equity Deals

- 2010 YTD

III. Private Equity Exits

IV. M&A Round Up

- Introduction

- Deal Breakdown

- Sectoral Breakdown

- Regional Outlook

- Top 5 M&A deals

- 2010 YTD

Publication Date: July 12, 2010

Format: Pdf

Price: Rs. 5,000/- (Plus 10.3% Service Tax)

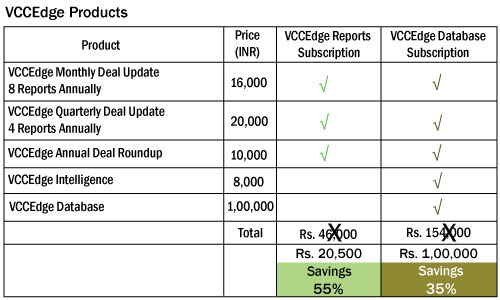

Special offer: Order an annual subscription and save 55%. Plan details below.