The Indian Income tax laws exempt income of a SEBI registered Domestic Venture Capital Fund (DVCF), from its investments and such income is taxable in the hands of investors, thereby granting “tax pass through” status to DVCF. As per the amended provisions in force, this exemption is granted if DVCF makes investments in VC undertaking engaged in 9 specific sectors (eligible VCU). If DVCF makes investment in non eligible VCU, it would not be able to avail such benefits.

\n

The intention of the legislature was to tax the income at the level of DVCF instead of taxing at the level of the individual investor. Thereby it was intended that only the point of taxation should change and not the tax position.

\n

Taxability of income, other than from investments in eligible VCU is governed by the structure of the DVCF entity. Since most DVCF are structured as trust, the taxability is based on the provision of trust taxation.

Income-tax Concerns

\n

Are management fees deductible for computing capital gains?

\n

DVCF makes investments in start-up companies and the typical income streams are dividend or capital gains which generally arise only after a time frame of 3-5 years. During this time, DVCF primarily incur management fees paid to the fund managers. The issue that arises is whether DVCF would be able to claim deduction for expenses incurred by it from its taxable income. Generally DVCFs make investment with a long term objective and hence, the income earned on such investments is investment income as against the business income.

\n

Since dividend income is exempt in the hands of the shareholders, there is no scope of claiming deduction against dividend income. In fact Rule 8D of Income-tax Rules, 1962 disallows a portion of expenses under section 14A of the Income tax Act, 1961 (‘the Act’) treating it as incurred for earning exempt income.

\n

DVCF also earns capital gains on sale of its investments. Capital gain computation mechanism under the Act contemplates deduction of cost of acquisition, cost of improvement and expenses incurred on sale. Hence it would need to be examined whether management fees could be treated as cost of acquisition, cost of improvement and / or expense on sale of investments.

\n

Cost of Acquisition

At the time of investments, fund managers spend lot of time in not only identifying the right investment but also, after preliminary identification, for the evaluation of investment, associated investment risk, documentation, approval, etc. The investment process generally goes on for 3-6 months and even longer. All expenses incurred in respect of acquisition of asset are capitalized as cost of acquisition. Even section 43 (1) of the Act recognizes this principle and requires that the tax assessee capitalizes interest cost incurred before the asset is put to use.

\n

Cost of Improvement

Fund Managers provide not only investment advisory services to the fund but also monitor the investments, assist the management of portfolio companies to effectively run the VCU, assist in outlining the strategy for the VCU, etc. It therefore needs to be evaluated whether such assistance can be treated as cost of improvement in the value of investment.

\n

Improvement in the value of the investment is driven primarily by improvement in the business of the VCU, which has following key attributes:

\n

provision of seed capital at the right time;

effective management of the company by the entrepreneurs; and

- assistance by the fund manager.

Hence, one can argue that the fees paid during the period between investment and sale is for improvement of the business of the company thereby improving the value of DVCF’s shares.

\n

Expenses in relation to sale

Even during divestment stage, fund managers spend substantial time and energy in not only negotiating the right price of investment but in ensuring the exit is in tax efficient and in regulatory compliant manner. They also ensure that no liabilities attach on the fund or investor in respect of investment sold by the fund. Hence, management fees payable in respect of sale of investment could be argued as deductible for computing taxable capital gains.

\n

Attribution of management fees

If one argues and claims that management fees as deductible for tax purposes, one would need to identify the amount attributable to each investment. The determination of amount attributable to investment should be done on a scientific basis. The fund could either apportion management fees based on

\n

a) time spent by the Fund Manager in respect of each investment (based on time summary details, if any, maintained by the fund management team) or

b) based on the investment value of different investment, or

any other scientific basis.

\n

In case tax authorities do not allow the management fees as deductible expenses then the investors would be required to pay the capital gains tax on gross amount of capital gains derived from the investments in the non eligible VCUs (ie without adjustments for management fees).

\n

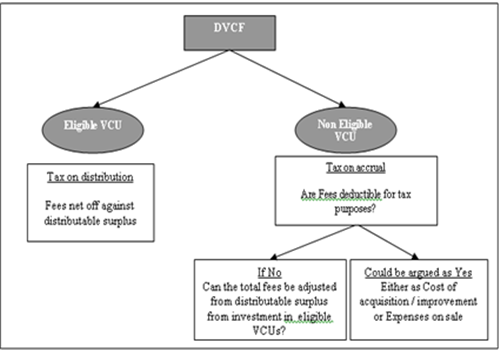

What if DVCF has both Eligible and Non Eligible investment

In case DVCF has made investment in both eligible and non eligible VCUs the challenge of apportion of expense is even greater. This issue arises as the income from investment in eligible VCU is taxable on distribution, whereas, the income from non eligible VCUs is taxable once it is received / accrued to DVCF, irrespective of its distribution.

\n

In such an event, the DVCF would ideally like to offer to tax the amount received from investments in non eligible VCU as and when received / accrued and offered to tax only the amount distributed from investments in eligible VCU. This could allow the DVCF to effectively claim deduction for expenses that it incurs. Summary of the above discussion can be captured by way of the following flowchart:

Taxation of DVCF under the current regime is evolving based on the tax interpretations. Considering the fact that domestic investors investing through DVCF should not be put to any hardship on account of change in taxation point, legislature should clarify that the deduction for expenses incurred by DVCF should be allowed while computing the taxable income of the investors.

\n

- By Pranay Bhatia, Partner, and Rachana Kapadia, Associate, Economic Laws Practice