VCCEdge has released its Monthly Deal Update for January 2011.

Highlights:

Private Equity

- Private Equity Investment grew 24.72% from $453 million in January 2010 to $565 million.

- The median deal amount and the average value of private equity deals was $8 million and $18 million respectively.

- Utilities and Financials were the most targeted sectors for investment recording deals worth $139 million and $118 million respectively.

- Private equity exits continue to see momentum in terms of deal value recording $605 million in total of 9 exit deals, nearly 2.9x the deal value of $208 million seen in January 2010.

- Private Equity investors offloaded their stake worth $522 million across 5 M&A exits and $83 million across 4 Open Market exits.

Mergers & Acquisitions

- M&A deal value during January 2011 slightly dropped by 15.83% and stood at $2.3 billion compared to $2.8 billion during the same period in 2010.

- The number of inbound deals increased to 20 from 13 during the same period last year. The value of inbound deals also increased from $450 million to $1253 million.

- The average deal size increased drastically from $79 million in January 2010 to $92 million.

- Information Technology and Energy were the most targeted sectors with deals worth $1,078 million and $875 million respectively.

Report Contents

I. EXECUTIVE SUMMARY

II. PRIVATE EQUITY

Private Equity Investments

- Overview

- Deal Type Analysis

- Sector Analysis

- Top Private Equity Investments

Private Equity Exits

- Overview

- Deal Breakdown

- Sector Analysis

- Top Private Equity Exits

III. MERGERS & ACQUISITIONS

- Overview

- Deal Type Analysis

- Sector Analysis

- Top Mergers & Acquisitions

Publication Date: February 8, 2011

Format: Pdf

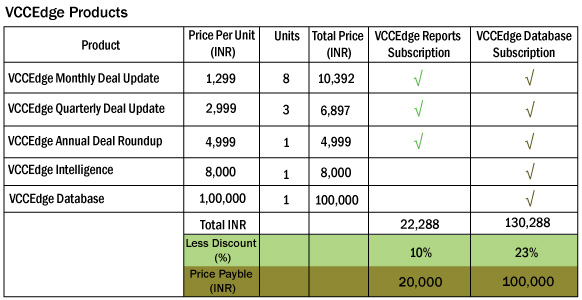

Price: Rs. 1,299/- (Plus 10.3% Service Tax)

Special offer: Order an annual subscription and save 10%. Plan details below.

For a sample issue or trial login contact sales@vccedge.com.