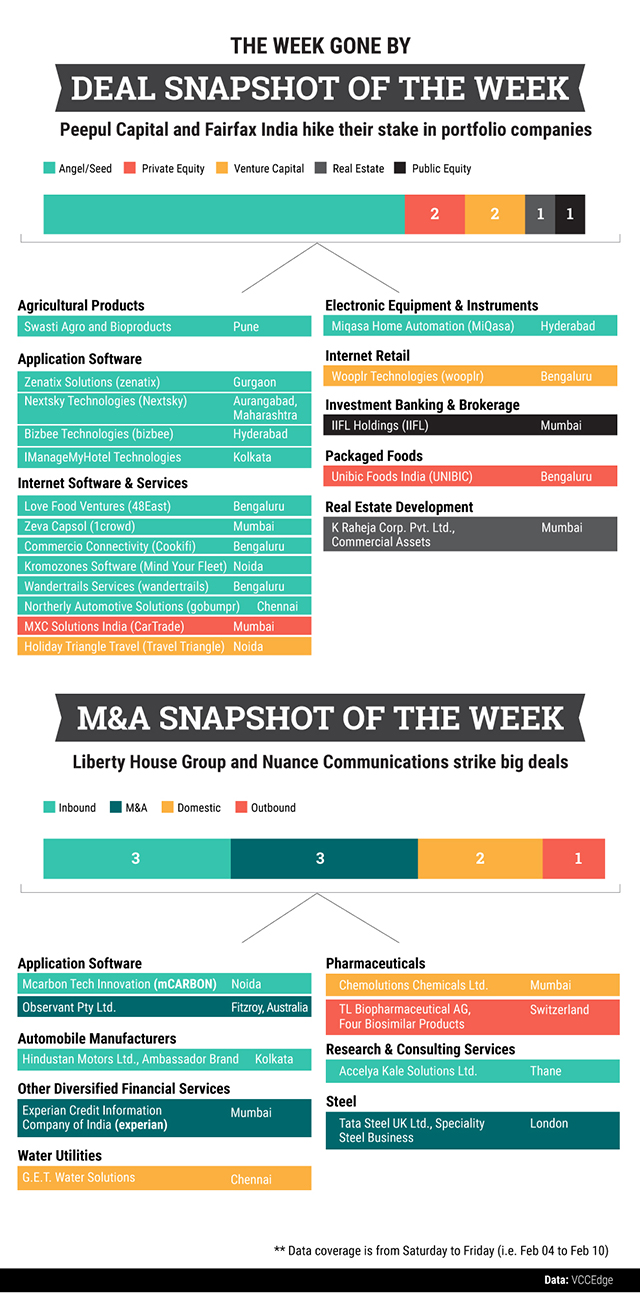

In the deals space, MXC Solutions India, which runs automobile classifieds portal CarTrade, received $55 million in funding from Singapore’s Temasek Holdings and a US-based family office.

Among the other deals, private equity fund Peepul Capital hiked its stake in Unibic Foods India to 97.69% by buying out 24.7% stake held by Lighthouse Advisors in the company while Fairfax India Holdings bought an additional 5% stake in IIFL Holdings for $75.2 million.

In the M&A space, Liberty House Group agreed to buy Tata Steel UK’s specialty steel business for $125.6 million.

In another deal, US-based software company Nuance Communications acquired JP Morgan-backed mCarbon Tech Innovations for $36 million in a cash-and-stock deal.

The week also saw CK Birla Group-owned Hindustan Motors sell its iconic Ambassador car brand to French auto manufacturer Peugeot for $11.95 million.

Like this report? Sign up for our daily newsletter to get our top reports.