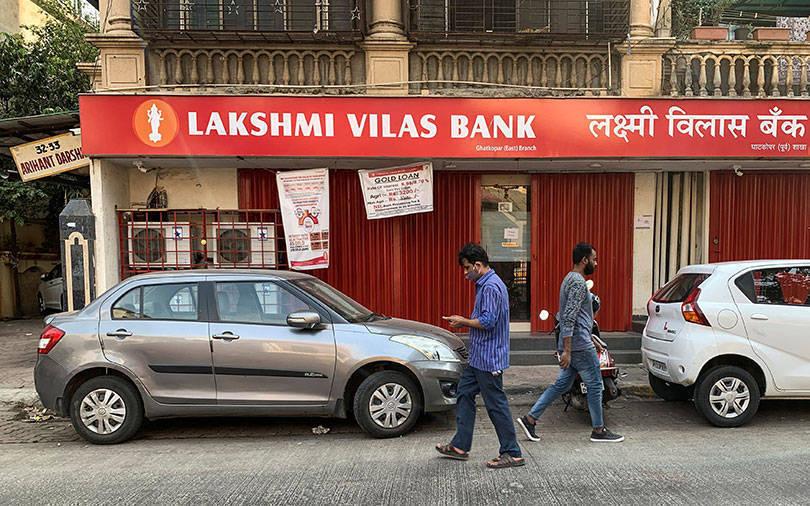

Singapore’s DBS Group said on Monday it had completed its takeover of distressed Lakshmi Vilas Bank, helping it shift from a largely digital presence in India to having hundreds of branches.

The 94-year old Chennai-based private bank was folded into DBS’s Indian subsidiary at the request of the Reserve Bank of India which cited a serious deterioration in its finances.

Southeast Asia’s largest lender, which will pump in 25 billion rupees ($338 million) into its India unit, until recently had just over 30 branches in India but has now added more than 550 and 900-plus ATMs.

Rebranding of LVB branches has begun and ATM screens have also been reconfigured to reflect DBS’s logo, according to a source familiar with the matter who added the exercise is likely to be completed within a week.

The source declined to be identified as the information was not public. DBS India did not immediately respond to a request seeking comment on the rebranding.

DBS confirmed it will continue to employ some 4,000 LVB staff.

The takeover has, however, not been smooth sailing for LVB bondholders, after the lender was asked by the central bank last week to completely write down Basel III-compliant tier 2 bonds worth 3.20 billion rupees.

“RBI has set a precedence with the proposed write off as it first time a Tier II bond is being written off,” said Anil Gupta, an analyst at credit rating agency ICRA.