Essar Steel India Ltd has offered to pay Rs 54,389 crore ($7.4 billion) to its creditors to come out of bankruptcy, threatening to thwart a joint effort by ArcelorMittal and Nippon Steel to acquire the Indian steelmaker.

The company said on Thursday its shareholders, primarily the Ruia family, have submitted a proposal to fully settle the entire admitted claims of the financial and operational creditors as well as its employees.

The amount involves an upfront cash payment of Rs 47,507 crore to the creditors. This includes Rs 45,559 crore to the senior secured financial creditors, the company said. It didn't specify how it is arranging the amount.

“We believe our proposal will provide 100% recovery to secured creditors and maximum recovery for unsecured creditors,” said Prashant Ruia, director at Essar Steel. “This is well in excess of that offered in the proposal under consideration.”

Ruia was referring to the proposal by ArcelorMittal, led by steel tycoon LN Mittal, and Japan’s Nippon Steel & Sumitomo Metal Corp to acquire the Indian company.

ArcelorMittal, the world’s largest steelmaker, and Nippon have offered to pay Rs 42,000 crore, of which Rs 39,500 crore will be given to lenders upfront, multiple media reports have said.

ArcelorMittal has also offered to inject an additional Rs 8,000 crore into Essar Steel after the deal goes through. Media reports said on Thursday Essar’s lenders had cleared the joint plan.

Essar Steel is among the 12 large non-performing assets identified by the Reserve Bank of India last year in its first list for loan resolution under the Insolvency and Bankruptcy Code. The company has a debt of around Rs 49,000 crore and was pushed into bankruptcy court last year.

Apart from ArcelorMittal, London-based mining group Vedanta Resources and NuMetal, a company led by Russian lender VTB, were also in the race to acquire Essar Steel. The Ruia family was initially part of NuMetal but later exited the consortium to make it eligible to bid for Essar.

On 4 October, the Supreme Court had directed ArcelorMittal and NuMetal to clear their dues classified as non-performing assets in related companies.

On 17 October, ArcelorMittal said it had approved a payment of Rs 7,469 crore ($1 billion) to the creditors of Uttam Galva and KSS Petron in order to comply with the order and become eligible to bid for Essar Steel.

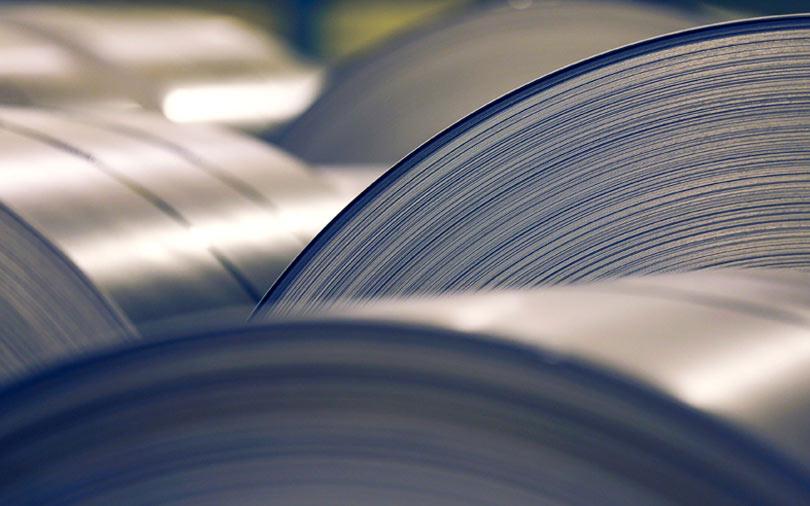

Essar Steel is one of several steelmakers that have been pushed into bankruptcy, leading to a churn in the Indian steel industry. It has a capacity of 10 million tonnes per annum at its Hazira plant in Gujarat. It also has beneficiation and pellet making capacity of 20 million tonnes per annum spread across Visakhapatnam and Paradip.