Even as top global fashion brands such as Zara, Mango, Vero Moda, H&M, Forever 21 and Marks & Spencer vie for a share of the Indian market, the country’s textile sector continues to reel under the burden of mill closures and sagging exports.

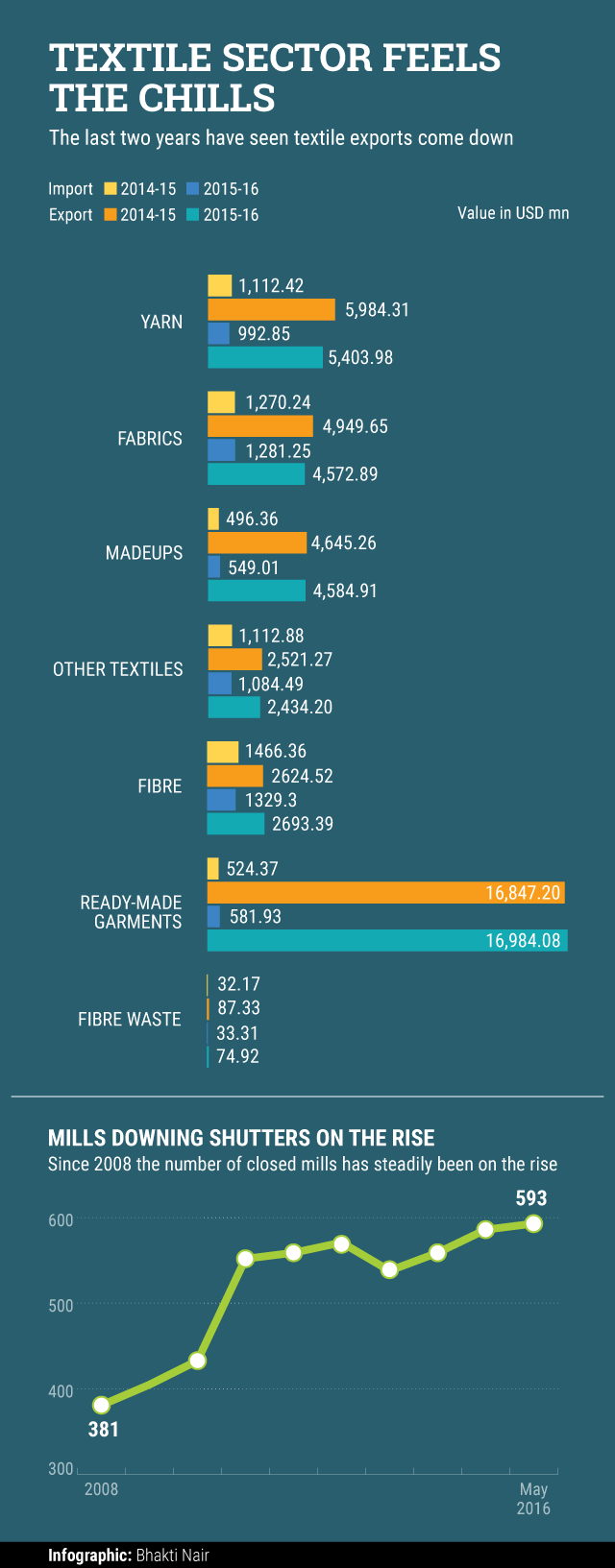

Data sourced from the textile ministry show that not only have exports of several types of textiles from India declined in the past three years, mill closures across the country, too, are at a record level. While in 2008, India had 381 closed textile mills, the number steadily rose to 593 by May this year.

This means that almost 3 lakh textile mill workers remain unemployed, according to the government’s own figures.

Ever since the government allowed Foreign Direct Investment (FDI) in single brand retail outlets - first at 51% in 2006 and later 100% in 2012- top global fashion brands have rushed into the country. While H&M has announced plans to invest Rs 730 crore to set up 50 stores in the country, the US-based fashion label Gap is reportedly eyeing a revenue of Rs 1,000 crore from the 40 stores it plans to open across 15 cities in the country in the next five to six years

Even the online fashion space has seen its fair share of action, including the acquisition, first of Myntra and later of Jabong by the country’s largest e-commerce company Flipkart in the recent times.

None of this, however, seems to have helped in turning around the fortunes of the Indian textile sector.

Among the states that have witnessed the highest number of mill shut downs are Tamil Nadu and Punjab. To be sure, although some other states like Madhya Pradesh, Gujarat, Maharashtra, Rajasthan, Andhra Pradesh and Telangana have seen new mills opening up, the growing number of shutdowns has meant that a third of the country’s mills have continued to remain shut in the past four to five years.

Like this report? Sign up for our daily newsletter to get our top reports.