Foreign investors have begun to price in a slower rebound for Indian stocks this year on concerns that the relatively meagre stimulus the government has delivered for businesses and consumers will leave the economy trailing its main rivals.

Mumbai's equity indices have bounced about 43% since crashing to a four-year low in March, as the huge flows of cheap capital provided by global central banks when COVID-19 struck made heavily-discounted stocks attractive.

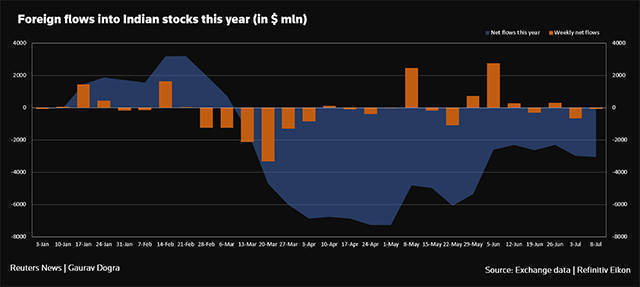

Despite pouring about $1.98 billion into Indian stocks since late March, foreign investors are still net sellers this year with outflows of $2.75 billion. In March alone, they pulled out $8.35 billion, according to stock exchange data.

"There are a lot of macro issues that make India a little less of an easy story," said Rashmi Gupta, emerging markets (EM) portfolio manager at JP Morgan Private Bank in New York.

"It has to walk a fine line as it has a higher debt-to-GDP (gross domestic product) ratio and doesn't have much room compared to some other EM economies in terms of its ability to provide fiscal stimulus," she said.

At the heart of the problem for any economic recovery, investors say, is the pain felt by India's poor since lockdowns in March stranded millions of migrant workers, or left them to walk home from major cities.

"People who need the help aren't the ones getting the help," said Sailesh Lad, head of active emerging markets fixed income at AXA Investment Managers in London.

"A lot of people in India live hand-to-mouth. If you don't know when the next salary is coming, then your consumption spending reduces."

While India presented a monetary and fiscal stimulus package of $266 billion, or 10% of GDP, economists say new spending commitments will only come to about 1% of national output, or roughly $20 a head, on top of its original 2020 budget.

At the same time, China is pumping more than 4% of its GDP into the economy with its coronavirus rescue packages.

Analysts say India is constrained by its public debt-to-GDP ratio, which stood at 71% early in 2020, second only to Brazil in the BRICS group of major emerging markets and ahead of South Africa, China and Russia.

It was also above levels the International Monetary Fund recommended for developing economies exposed to swings in growth and currencies.

Market participants now predict further cuts in India's official interest rate but the weakness of the rupee, down 9% in the past year, may also give policymakers pause.

And few expect Prime Minister Narendra Modi to deliver much more.

"With the fiscal deficit threatening to cross 6% even in the absence of larger stimulus, and individual states also having to borrow more, it's not possible to issue a larger package," said Abheek Barua, chief economist at HDFC Bank in New Delhi.

With India's COVID-19 outbreak now the third worst globally after the United States and Brazil, Mumbai's main indexes are down about 11% since the start of the year compared with 3.5% for emerging markets as a whole.

By contrast, markets in mainland China, where the authorities are pumping funds through the financial system at a record pace, have recovered all their pandemic losses to trade 13% higher so far this year.

Manishi Raychaudhuri, head of Asia-Pacific equity research at BNP Paribas in Hong Kong, said he had a 2020 target of 35,000 for India's S&P BSE Sensex, implying a fall of 4.6% from current levels.

"In view of the continuing decline in corporate earnings estimates, we think the market could go down before it goes up," Raychaudhuri said.