India’s private markets stand at a pivotal moment. Capital flows are intensifying, deal sizes are scaling and the call for credible domestic participation has never been more pressing. Among the most promising contributors to this next wave are Legacycorns—India’s large, family-owned enterprises with the scale, heritage, and financial strength to influence market outcomes.

Their participation in private markets is still nascent, often limited to selective or opportunistic investments. But the landscape is shifting. Leadership transitions, professionalized governance, and a growing appetite to diversify beyond core businesses are setting the stage for Legacycorns to adopt a more structured, portfolio-driven approach to capital deployment.

As this transition gathers pace, it has the potential to unlock a powerful pool of domestic capital — fueling mid-market growth, reducing reliance on foreign investors, and building a more resilient private market ecosystem.

From Presence to Participation

| Legacycorns at a Glance | |

| Metric | Value |

| Annual Revenues | $237B+ |

| Annual Profits | $12B+ |

| Private Market Deals Since 2020 | 100+ |

Legacycorns represent one of the most promising yet underutilized sources of domestic capital in India. Today, many of these large, family-owned enterprises continue to focus primarily on operating and expanding their core businesses, allocating only a fraction of their surplus to private market opportunities.

This creates an unusual paradox — despite generating over $237 billion in annual revenues and $12+ billion in profits, their participation in private market transactions remains limited, with just over 100 deals since 2020 as per VCCEdge analysis. This gap between their financial capacity and actual activity is not accidental: it reflects limited exposure to structured deal flow, the absence of specialized advisory frameworks, and a risk perception shaped by decades of operating in traditional industries. Yet, as leadership transitions to a younger generation of decision-makers and professional governance practices take root, this conservatism is gradually giving way to curiosity and calculated ambition.

The question is no longer whether they can play a role but how strategically and sustainably they choose to engage and how this engagement can reshape India’s private market landscape.

Anitesh Dharam, Business Head, VCCircle & VCCEdge, says, “The next phase for Legacycorns is not about participation, but about purpose. Their transition from preserving wealth to building legacies through capital can fundamentally shift how India funds its own growth, reducing reliance on foreign capital and improving domestic anchoring.”

Where They Can Play Big

- Private Equity & Growth Capital: Deploying capital alongside seasoned PE funds or taking direct stakes in mid-market companies allows Legacycorns to leverage their industry expertise while participating in value creation. According to Bain’s 2025 India Private Equity Report, buyouts now account for 51% of PE deal value in India, up from 37% in 2022, showing growing appetite for deeper, controlling bets.

- Venture Capital & Startups: For next-gen decision-makers, early-stage investing offers both diversification and insight into emerging sectors like SaaS, healthtech and clean mobility—creating strategic optionality for the family-owned enterprises.

- Strategic M&A: Legacycorns can pursue buyouts, bolt-on acquisitions, and global expansion to leverage their scale and industry expertise while capturing growth opportunities.

- Private Credit & Structured Debt: The growing demand for private credit creates an attractive yield play. According to EY’s Private credit in India: H1 2025 Update report, private credit reached $9.0 billion in H1-2025 across 79 deals, suggesting increasing institutional interest in structured credit as a yield play. Here, legacycorns can participate as lenders, offering flexible structures that traditional banks often cannot.

- Impact & ESG Investments: As sustainability moves to the center of capital allocation strategies, impact-oriented investing becomes both a reputational and financial opportunity.

Catalysts That Are Shaping This Shift

Several macro and micro factors are now converging to pull Legacycorns off the sidelines:

- Generational Transition: Nearly 40% of Legacycorns are already led by second- or third-generation decision-makers, with more approaching succession according to VCCEdge. This shift brings fresh thinking and a greater appetite for diversification.

- Advisory Ecosystem: The rise of family office consultants, wealth managers, and investment platforms is demystifying private markets for first-time participants.

- Market Maturity: Stronger governance norms, co-investment opportunities, and improved deal transparency are reducing risk perception.

- Peer Signaling:The number of family offices in India has risen sharply to about 300 in 2024, from just 45 in 2018, according to an EY‑Julius Baer study. The growing number of formal family offices is creating a network effect—showing what’s possible when family wealth is institutionalized.

The Scale of the Opportunity

The scale of Legacycorn capital presents a compelling opportunity for India’s private markets. With an estimated $6 billion in annual investable surplus, even a conservative allocation of around $1 billion per year toward private market investments could materially enhance market dynamics.

Such deployment would deepen domestic liquidity, provide PE and VC funds with a stable and reliable anchor of capital and expand the availability of growth funding for mid-market companies. Moreover, increased domestic participation would reduce dependence on foreign limited partners, strengthening the resilience of India’s private markets amid global capital fluctuations.

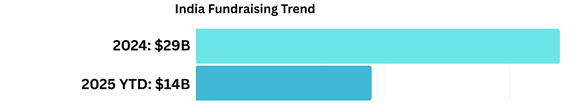

At a time when macroeconomic turbulence continues to reshape global capital flows, India’s private markets face both a challenge and an opportunity. According to VCCEdge data, total funds raised in India declined from $29 billion in 2024 to $14 billion in 2025 (YTD). This measurable slowdown in fundraising underscores the urgency for a more stable pool of home-grown investors who can anchor private equity and venture capital funds through market cycles.

This is precisely where Legacycorns can emerge as catalytic investors. By stepping in as limited partners (LPs) in private equity and growth funds, they can help bridge the funding gap created by softening foreign inflows, while also gaining access to curated deal pipelines and diversified opportunities across sectors. Their capital — backed by deep industry knowledge and long-term horizons — can bring a degree of stability and strategic depth that few other domestic investors can match.

Many of these enterprises are industrial mainstays, deeply integrated into India’s manufacturing, infrastructure, and core economic sectors. Their increased engagement in private markets would not only infuse patient capital but also reinforce the broader “Make in India” vision. Supporting this mission does not always mean establishing new manufacturing units; it can also mean backing the next generation of Indian enterprises driving innovation in manufacturing, logistics and technology.

By channeling even a fraction of their surplus into startups and mid-market companies within these segments, Legacycorns can help spur industrial growth, employment, and technological advancement — creating a self-reinforcing cycle of domestic investment and innovation. In doing so, they can bridge the gap between traditional wealth and modern enterprise, shaping a more self-reliant and resilient private market ecosystem for India.

No VCCircle journalist was involved in the creation/production of this content.