RevFin Services Pvt. Ltd, a fintech startup focussed on e-mobility, has raised $14 million (Rs 115 crore) in a Series B funding round led by Omidyar Network.

Omidyar invested $5 million in the startup. RevFin also saw participation from notable institutional investors like the Asian Development Bank, Companion Capital Limited and existing investors Green Frontiers Capital and LC Nueva.

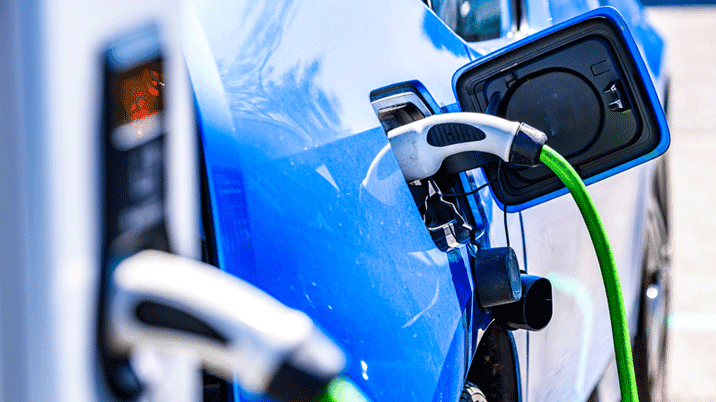

Revfin was founded in 2018 by Sameer Aggarwal, a former HSBC executive. It is a digital lending platform that uses non-traditional data such as biometrics, psychometrics, and gamification for financing. It claims to have financed over 34,921 electric vehicles and aims to finance 2 million electric vehicles in the next five years.

“This funding will empower us to improve the EV ecosystem and contribute to the growth of all types of electric vehicles in India," added Aggarwal, founder and chief executive officer, Revfin

By way of the current funding round, the startup has cumulatively raised Rs 625 crore in equity and debt to date.

Earlier, in June, the startup had secured $5 million in debt investment from the United States International Development Finance Corporation (DFC).

Last year, the startup had raised $10 million in a Series A funding round co-led by Green Frontier Capital (GFC) and LC Nueva Investment Partners, in a mix of equity and debt infusion.

In 2021, RevFin raised $4 million as part of its pre-Series A funding in equity and debt and in 2018, the company raised its seed funding from angel investors like UK-based Harash Jain, chief executive of Litejoy International and Anil K Goyal, founder of Anil K Goyal and Associates.

Notably, the investment by Omidyar Network comes a few weeks after it announced its plan to exit India and completely move out of the market by the end of 2024.

The Impact investment firm, which started operating in India in 2010 and had set up Omidyar Network India for an India-centric investment strategy with a dedicated team in 2019, said in its statement that it made the decision due to “the significant change” in context and the growth in the economic landscape that the India-based team has experienced since first making investments there in 2010.