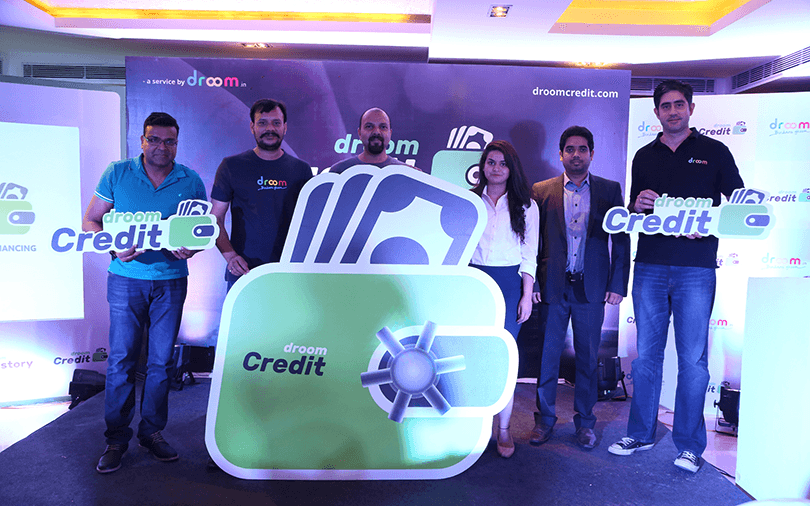

Droom, an online platform for buying and selling used vehicles, has launched Droom Credit, a loan marketplace for pre-owned automobiles it claims is the country's first.

To this end, it has partnered several commercial banks, non-banking financial companies (NBFCs) and financial technology firms. For the initial rollout, it is going live with a dozen lenders, including HDFC Bank, Kotak Prime, Tata Capital, Faircent, i2i Lending and Capital First, a company statement said.

Droom Technology Pvt. Ltd, which runs Droom, leverages its proprietary credit-risk engine to analyse the creditworthiness of an applicant. The platform, which guarantees loan approval within 30 seconds, uses the government-backed Aadhaar stack, apart from PAN verification, credit score validation and several other variables for credit evaluation.

Sandeep Aggarwal, founder and CEO, Droom, said, “Getting auto loan for used vehicles in India has been full of pain points because it takes forever, high rejection rate, lots of paperwork and unaffordable credit terms. The centre of Droom Credit is its proprietary credit risk engine.â€

Investment, business model

Aggarwal did not disclose the exact amount spent on the product, but told VCCircle it could "easily have been a couple of million dollars".

"Over the last 9-10 months, we have invested in technology and product development. Around 10-12 engineers, product managers and business analysts have been working on it. Integration with the Aadhaar Stack, NBFCs, getting the CIBIL score, all that required lots of efforts and money," he said.

As for marketing spend, the company is planning to go all out in promoting Droom Credit during Diwali this year. "We will allocate Rs 12-15 crore for the promotion," Aggarwal added.

Aggarwal also talked about Droom Credit's business models. There are three ways we are going to earn money, he said.

"First, the take rate, which will depend on who the lender is (different take rates and commission structures for different lenders). It will also depend on the category and profile of the borrower, and on the fulfilment and disbursal of the loan. We have the option of being fully impaneled with banks and NBFCs for taking the entire liability, or just serving as an aggregator. The commercials will vary depending on how deep the integration is. All in all, this would be performance-based for every loan disbursed, and we will get 1-4% of the total loan amount as commission."

Second, Droom will charge Rs 999 from borrowers. "The moment a borrower applies for a loan, he will pay Rs 299 as there is some cost that Droom incurs in terms of checking CIBIL score, fetching Aadhaar data, and so on. Droom as a marketplace is a 95% gross margin business, so that amount only covers part of the total processing fees a borrower will pay. And, when the borrower goes ahead with the loan, he pays the remaining Rs 700," Aggarwal explained.

Third, it will also charge the lender Rs 999 upon successful loan disbursal.

Droom Credit will initially restrict lending to borrowers purchasing vehicles from Droom. Going forward, however, it plans to open it to other platforms too.

"We will also look at expanding into other categories apart from auto, in the future," Aggarwal said.

Like this report? Sign up for our daily newsletter to get our top reports.