2025 wasn't simply another year of digital asset market volatility; it was a period defined by targeted extraction. More than $3.4 billion vanished due to crypto hacks and theft last year, a figure confirmed by a recent Chainalysis report.

While the industry saw its overall valuation rise, these incidents expose a troubling undercurrent in how illicit actors are operating. Attackers didn't waste time scanning for obscure bugs in smart contract code; they began hunting whales.

Chainalysis's data reveals a stark reality: the top three hacks alone accounted for 69% of all service losses. This statistic indicates that criminal syndicates haven't just moved beyond opportunistic exploits, they're striking at the heart of the industry's most critical infrastructure. This evolution from finding needle-in-a-haystack bugs to executing big game breaches forces a complete re-evaluation of how digital assets are secured at a platform level.

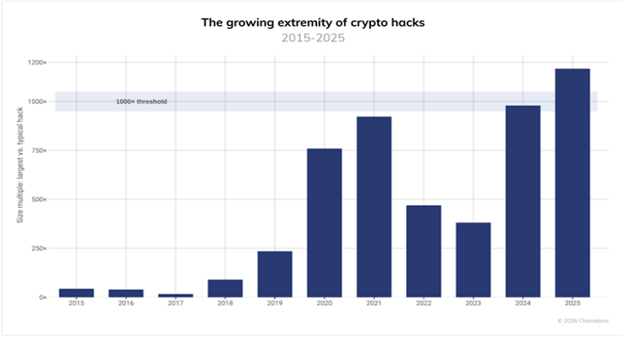

The Highest Annual Losses Since 2022

We haven't seen financial losses hit this level since 2022. While different security firms use different methodologies to track the damage, the consensus is clear: 2025 was a record-breaking year for theft.

Hacken's 2025 Yearly Security Report places the total Web3 losses even higher than Chainalysis, estimating approximately $4 billion in total damage. Data from PeckShield confirms the surge. showing a 34% increase in losses over 2024 figures. A massive chunk of that came from the February 2025 attack on Bybit that netted attackers $1.5 billion. This breach served as strong indication that centralized exchanges are still the prime target for high-level criminal syndicates.

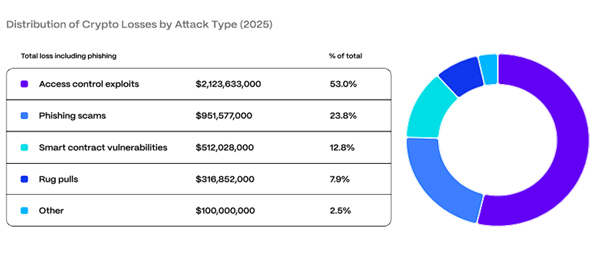

The nature of these thefts suggests that technical code audits aren't sufficient to protect user funds anymore. Hacken's analysis found that Access Control Exploits were responsible for $2.1 billion in losses, 53% of the total. This data proves that operational failures, such as compromised private keys, weak internal governance, or insufficient signing protocols, are now far costlier than smart contract vulnerabilities. As the industry scales, the infrastructure supporting it can't remain experimental; it must evolve into industrial-grade resilience capable of mitigating human error.

"Binance's 2025 numbers show scale, and most importantly, what that scale requires," says Richard Teng, Co-CEO of Binance. "[It requires] regulatory anchors like ADGM authorization, resilience and security programs that prevent real losses... and product design that reduces friction for legitimate users while raising the cost of abuse."

Teng's sentiment reflects a broader industry realization, maintaining market trust now requires a defensive posture capable of withstanding state-level aggression. The ecosystem isn't in the early phases of development where speed was the only metric that mattered. The sheer value of assets under management demands that resilience programs and regulatory compliance become the primary deterrents against catastrophic loss.

State-Sponsored and AI Attacks on the Rise

The industry is facing organized, state-sponsored entities with significant resources. Data from Chainalysis and TRM Labs points to North Korean (DPRK) actors stealing between $2 billion and $2.7 billion in 2025, pushing theft figures up by 51% compared to the year before.

Hacken attributes approximately 52% of total Web3 losses to these specific actors. This escalation represents an industrialized economic offensive where digital theft is used to finance state objectives. Elliptic further notes that these actors are increasingly targeting high-net-worth individuals, shifting tactics from broad protocol exploits to precise, person-centric social engineering.

The sophistication of these attacks has been amplified by artificial intelligence. DeepStrike reports a staggering 1,265% surge in phishing attacks and a 1,400% rise in impersonation scams, driven largely by generative AI tools. Attackers are using this tech to generate perfect, localized communications at a massive scale. Language barriers used to act as a natural filter for fraud; AI has effectively removed that hurdle.

The financial efficiency of these AI-driven campaigns is alarming. Chainalysis found that AI-enabled scams earned 4.5 times more revenue per operation. These averaged $3.2 million compared to traditional scams' $719,000. It's an efficiency that allows attackers to use deepfakes and automated social engineering to bypass human verification layers that were previously considered secure. The threat environment has effectively evolved into an arms race where defensive algorithms must outpace AI-driven offense to protect users.

Crypto Market Players Must Act Now

Combating this level of industrialized fraud requires a fundamental shift in security architecture. And the industry is looking well beyond firewalls.

A clear pattern has emerged in how market participants handle security: defense-in-depth strategies now take precedence, favoring proactive threat identification over post-breach cleanup. For custody operations specifically, crypto firms have begun standardizing around hardware security modules (HSMs) and multi-party computation (MPC). What makes these tools valuable is their ability to distribute private key material across separate environments, eliminating the single-point-of-failure risks that firms like DeepStrike and Hacken have called out as catastrophic vulnerabilities.

Real-time intervention is the next frontier in defense. Solutions like Chainalysis's Hexagate are deploying technology designed to detect wallet compromise and simulate transactions before they execute on-chain. The system can halt the transfer before finalization if a transaction simulation reveals malicious intent. DeepStrike further advocates for a zero-trust architecture paired with phishing-resistant multi-factor authentication. This approach assumes that credentials may already be compromised, requiring continuous verification for every action taken within a network.

Major market participants are integrating these independent standards into massive internal governance frameworks. To harden its defenses, Binance secured ISO 42001 certification for AI systems and ISO 27001 for info security. These steps translated directly into user protection. The company's 2025 Year in Review report shows that the platform's risk controls prevented $6.69 billion in losses across 5.4 million users.

But technology is only half the battle. The exchange also handled over 71,000 law enforcement requests, highlighting that true security comes from combining AI-driven monitoring with active public-private collaboration to track down illicit funds.

A New Standard for Digital Trust

The $3.4 billion in losses recorded in 2025 serve as a stark metric of the challenges facing the digital asset space, yet it also obscures the significant strides made in infrastructure hardening. The ratio of theft to adoption is shifting as exchanges and protocols implement institutional-grade defenses that outpace the tactics of state-sponsored actors.

The future of crypto adoption doesn't rely heavily on price action alone anymore; it relies on technological resilience. As the asset class matures, the ability to secure billions in real-time against AI-enabled threats will define the boundary between speculative experiments and the future of global finance.

No VCCircle journalist was involved in the creation/production of this content.