Venture capital firm Cornerstone Ventures, which primarily invests in B2B enterprise technology companies, has launched its second fund with a target corpus of $200 million (Rs 1,664 crore), including a greenshoe option.

The fund follows a multi-stage strategy primarily focusing on early growth-stage VC investments. Its investment ticket size ranges from $5 million to $15 million.

The fund aims to create “significant value” for ambitious entrepreneurs which goes much beyond the capital, including access to a large enterprise customer ecosystem, access to strategic funding from next-round investors and a large network of mentors and go-to-market partners, Mumbai-based Cornerstone said in a statement.

The fund will invest in emerging B2B tech opportunities across software platforms and marketplaces operating in diverse sectors such as financial services and insurance, retail, consumer goods and e-commerce, distribution and supply chain, healthcare products and services, and sector agnostic core technology innovations.

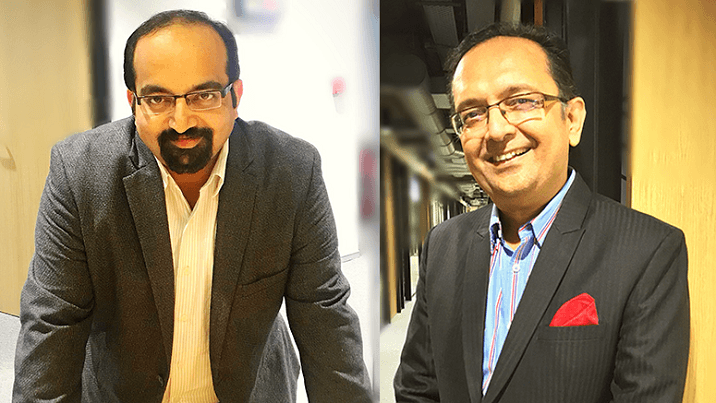

“Our second fund builds on the success of Fund-I and underscores our commitment to supporting emerging B2B enterprise-tech opportunities,” said Abhishek Prasad, managing partner of Cornerstone Ventures.

Cornerstone, which was founded by former Reliance Industries executives Rajiv Vaishnav and Abhishek Prasad, launched its first fund in mid-2019 with a size of approximately $50 million. To date, it has invested in 21 companies, primarily focused on B2B enterprise SaaS business models.

Cornerstone claims that Fund-I has achieved an “impressive” financial performance with a more than four-fold growth in the cumulative revenue base across the portfolio in about four years of investing. Its portfolio companies include BluBirch, THB, Credilo, Nimblebo, Dhiway, Enparadigm and Intelligence Node, among others.

The first fund was anchored by the Indian government’s DPIIT Fund of Funds (managed by SIDBI) and Self-Reliant India Fund managed by State Bank of India (SBI). It is onboarding several such large institutional investors in Fund-II as well.