California- and Bangalore-based WAN optimisation and cloud computing startup Aryaka Network Inc has secured $16 million (Rs 100 crore) in funding from existing investors led by Nexus Venture Partners with participation from Trinity Ventures, InterWest Partners, Mohr Davidow Ventures and Presidio Ventures.

The firm will use the money to scale up its sales infrastructure as it has seen rapid demand for its family of network and application acceleration as-a-service offerings, it said.

“The funding will allow us to support large global partners, who are excited about adding Aryaka’s capabilities to their traditional WAN offerings. We are positioned to achieve faster market growth and sustained profitability,” said Ajit Gupta, founder and CEO at Aryaka.

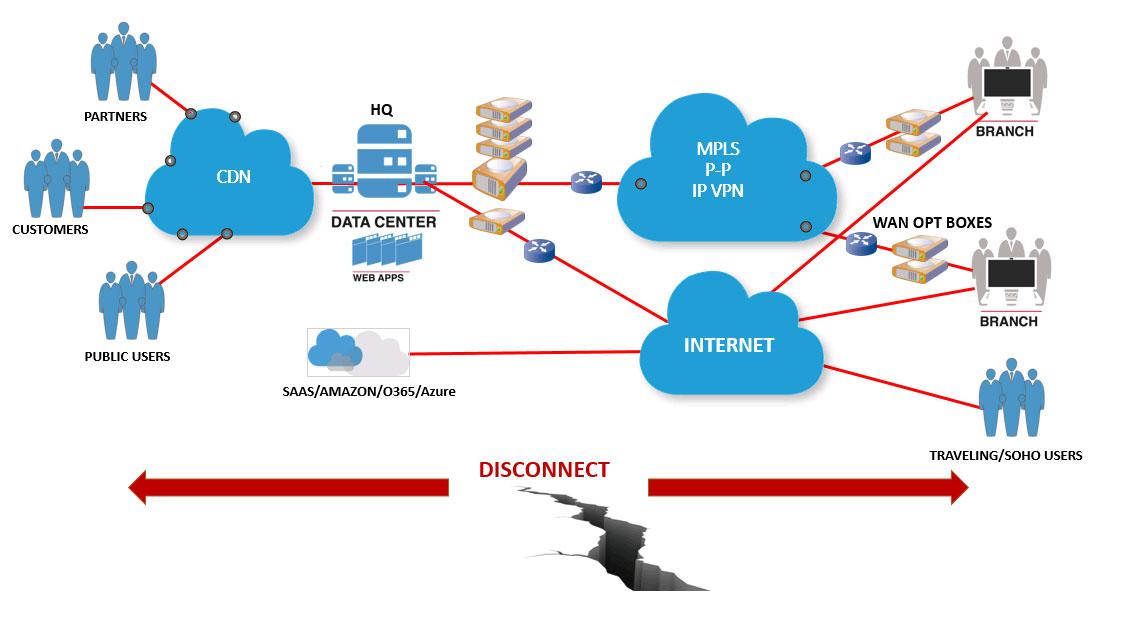

Founded in 2008 by Gupta, Rajeev Bharadhwaj and Ashwath Nagaraj, Aryaka offers Aryaka ONE, an integrated platform to address all WAN needs, including optimised connectivity of geographically dispersed offices, application delivery and cloud networks.

The company, which has an office in Bangalore, counts InMobi, NTT Data, Aruba and Avaya among its key customers. It recently expanded its global network with the addition of new Points of Presence (POPs) in Los Angeles, Miami and Dubai (UAE). The company delivers solutions to 3,000 customer sites across 300 cities in 50 countries.

“Aryaka’s technology provides a unique value proposition to companies of all sizes, leading to extremely low customer churn and expanded engagements,” Naren Gupta, co-founder and managing director, Nexus Venture Partners, said.

The company had initially raised $14 million in its Series A round from Nexus Venture Partners, Trinity Ventures, Mohr Davidow Ventures and Stanford University in September 2010. This was followed by $15 million in Series B round of funding, led by Nexus Venture Partners with participation from Trinity Ventures and Mohr Davidow Ventures.

In 2012, it secured $25 million in Series C funding from InterWest Partners and Presidio Ventures with existing investors Nexus Venture Partners, Trinity Ventures and Mohr Davidow Ventures investing afresh.

(Edited by Joby Puthuparampil Johnson)