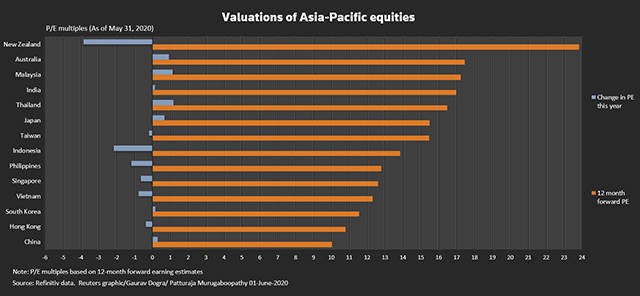

Asian stocks' valuations hit 10-year highs at end-May, tracking the rally in global shares, as businesses started to reopen across the region after shutting down to curb the spread of the coronavirus and as central banks' boosted stimulus measures.

The MSCI's broadest index of Asia-Pacific shares gained about 1.8% last month, and the index's 12-month forward price-to-earnings (P/E) ratio was at 14.34, the highest since April 2010, according to Refinitiv data.

At the same time, the MSCI's gauge of stocks across the globe climbed 4.2%, lifting its P/E ratio to 18.39, the highest since at least June 2003.

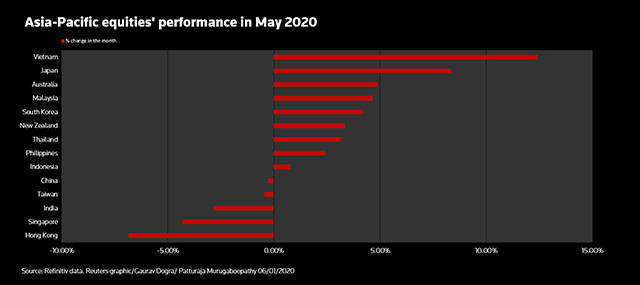

Vietnamese and Japanese stocks led Asia on price gains last month, climbing 12.4% and 8.3%, respectively.

The rally in Asian shares was due to factories and businesses starting to reopen after months-long lockdowns in most parts of the region, analysts said.

New Zealand, Australia and Malaysia shares were the most expensive in the region, with P/E ratios of 23.84, 17.44 and 17.23, respectively.

However, some analysts doubt the sustainability of the price rally, which is based on expectations of a V-shaped recovery, and say the corporates are unlikely to start recovering immediately.

"A good segment of markets being lifted out of “bear” territory, is subject to a great deal of uncertainty," Vishnu Varathan, head of economics and strategy at Mizuho Bank, said in a report.

"Critically, re-emergent US-China threat, risk of a second wave of infections and precautionary cash conservation by the private sector shaken up by the pandemic and wider uncertainties, may dampen and retard a fuller recovery," he said.