Robots that offer point-to-point delivery are poised to become hot sellers for e-commerce companies as businesses look at improving inventory control, order processing methods and labour efficiency to speed up operations, an industry expert has said.

"Point-to-point mobile robots are popular now because they can replace humans with simple, easy to operate devices that do the same job for less cost, hence a fast ROI [return on investmnet]," Frank Tobe, co-founder of ROBO Global which has developed a tracking index for the robotics industry, wrote in his blog The Robot Report.

"With labour costs rising, robot costs coming down, and so many go-for applications, these types of robots are no-brainers for businesses everywhere and for a long time to come," he said.

Tobe's ROBO Global Robotics & Automation Index covers 82 companies in 13 subsectors and tracks and captures the economic value of the global opportunity in robotics, automation and enabling technologies.

Tobe said today's e-commerce sees increasing system complexity and needs flexibility in automation.

"With complexity comes higher wages yet labour is increasingly hard to find," he said.

Tobe also quoted a VDC Research report on app modernisation in warehousing, which says that factors such as improved inventory control and order processing methods "are contributing to the need to convert warehouses and distribution centers into assets for competitive differentiation." Mobility will be front and centre in this shift, it adds.

Obstacles remain

Tobe said that despite innovations in autonomous and mobile picking-robots, autonomous trucking, and last mile delivery (by land or air), few are delivering products in large quantities or beyond the trial-and-error stage, which is one reason why the point-to-point vendors are doing well or are expected to perform better.

"Businesses of all types — from auto manufacturers to hospitals, from job shops to hotels — want to use point-to-point mobile devices instead of human messengering or towing for a variety of cost-saving reasons but mainly because it’s now achievable, cost-effective, and proven — plus there’s a real need to replace older people-dependent mobility tasks with more automated methods," he said.

Elaborating further, he said that warehouse executives face another problem - robots cannot pick up and pack items as efficiently as human workers.

However, these executives do have the option of equipping a warehouse with low-cost robots that can carry or tow items from place to place, thereby reducing costs and increasing productivity due to improved sensory equipment in these machines.

Tobe also said that there has been an industry-wide effort to modify forklifts and tugs into autonomous robots, but the pace of conversion is way slower than vendors who "serve the point-to-point mobile logistics robots market".

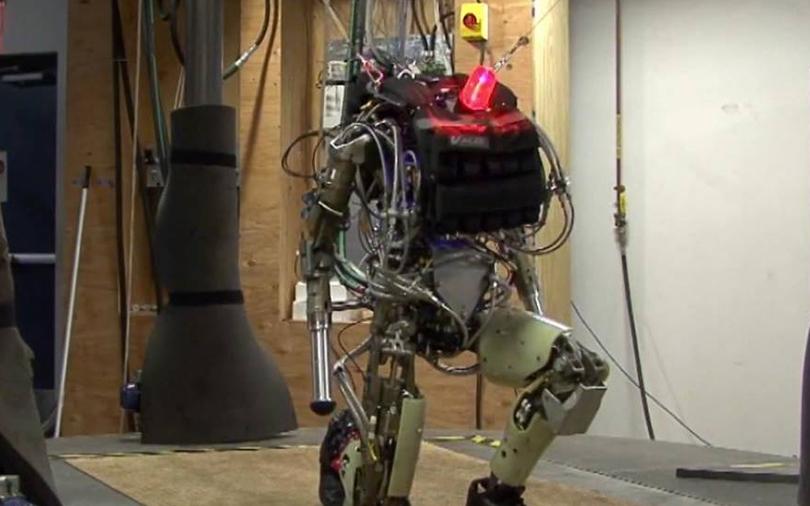

Such vendors include the likes of 2015 Danish startup Mobile Industrial Robots (MiR), a Kuka/Midea subsidiary Swisslog, Seegrid, Fetch Robotics, Clearpath Robotics, Atheon, Vecna, Amazon Robotics, Geek+, Quicktron and Grey Orange.

MiR had recently said that their 2017 sales had tripled year-on-year, 2017 unit sales exceeded 1,000 robots, employees increased to 60 and are expected to double in 2018.

MiR now has partnerships with Honeywell, Argon Medical, Kamstrup, Airbus, Flex and many other facilities globally.

Tobe also quoted a QY Research report that said that the new autonomous mobile robots market was reported to have grossed $158 million in 2016 and is projected to reach $390 million by 2022, at a compound annual growth rate of 16.26% between 2016 and 2022.

Tractica, a Colorado research firm, forecasts worldwide shipments of warehousing and logistics robots to grow from approximately 40,000 units in 2016 to 620,000 units in 2021 with estimated revenue of $22.4 billion in 2021.