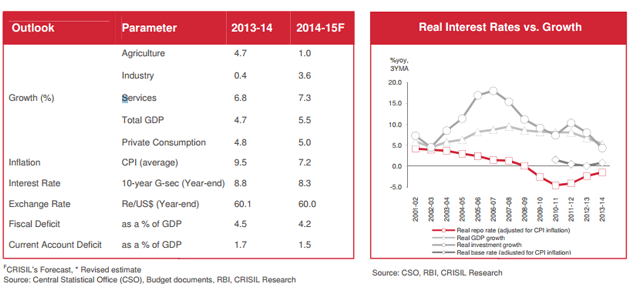

The Reserve Bank of India kept the repo rate unchanged at 8% in its latest monetary policy review on 30th September 2014. With this,repo rate has remained at that level since January 2014 and the clamour for interest rate cut to invigorate growth has, in the meanwhile, continued to grow. But are high policy interest rates indeed a major constraint to growth currently? CRISIL Research finds that they are not.

A study of the macro level data for the past decade indicates that interest rates appear to have had a relatively lesser impact on GDP growth and investments in the post-crisis period. Issues like policy uncertainty, lack of clearances and weak demand seem to haveplayed a larger role in keeping investment growth weak at a time when real interest rates have been negative. Real policy rates (reporate adjusted for CPI inflation) in India have remained negative since September 2008, averaging around -3.1% till September 2014.

Despite this, two major factors have stifled investment growth. Lending rates have remained high because slowing domestic as well asexternal demand, regulatory uncertainty and policy bottlenecks have added to the riskiness of investment projects. Moreover, the transmission of lower policy rate to lending rates in the economy was hampered by (i) tighter banking sector liquidity as negative real interest rates on deposits kept deposit growth low, and high government borrowings kept liquidity tight, and (ii) high cost of bank funds as deposit rates were kept high.

As a result of the impact of these non-monetary factors on the risk premium, the changes in lending rates do not accurately capture the prevailing monetary policy stance. Our analysis suggests that rising policy uncertainty and slowing domestic demand explain over 50% of the slowdown in investment growth during fiscals 2012-2014. We find that every 1% increase in real policy rates slashes investment growth by 66 basis points. With policy rates being negative in real terms since fiscal 2010, monetary policy has, surprising though it may seem, been supportive to investment growth throughout the last 5 years. Therefore, in a scenario where non-monetary factors are hindering a revival in growth, lowering policy interest rates may not be the sole panacea for the growth ills plaguing the economy. To the contrary, cutting interest rates at this juncture can create further inflationary pres sures.