After the dust has settled, the interesting feature of Budget 2015 is the package of fiscal, financial and monetary institution building:

- The signing of the Monetary Policy Framework Agreement, through which RBI now has an objective: That of delivering year-on-year CPI inflation of between two and six per cent.

There are other elements of institution building which are relatively disconnected from this triad. E.g. the merger of FMC into SEBI is also a step towards shifting all organised financial trading into SEBI regulation, but it is not interconnected with the above three.

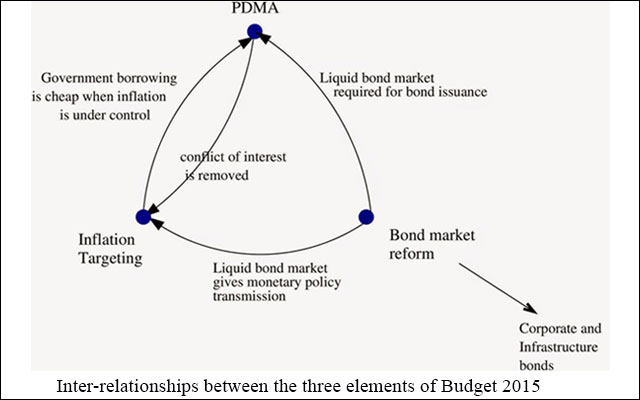

The three big reforms are interconnected; they require each other; they strengthen each other. This is why all three elements figure in all the expert committee reports.

The interconnections

When RBI is given the responsibility of achieving low and stable inflation, this is a difficult problem for two reasons.

At present, RBI has a conflict of interest: of doing investment banking for the government. This conflict of interest is removed by setting up PDMA. This is also a good thing for bond buyers as it's safer buying bonds from a person who does not know what the next interest rate decision will be.

In addition, when RBI changes the policy rate, there is a low bang for the buck as the monetary policy transmission is weak. Low competition in banking implies that rate cuts by RBI do not propagate out into the economy. The weaknesses of the bond market mean that rate cuts by RBI do not propagate out into the economy. This makes RBI ineffective: very big rate hikes or rate hikes are required (e.g. as was done by Rangarajan in the 1990s) to stabilise inflation. Bond market reforms are required for RBI to get the tools for the task at hand.

When the PDMA tries to sell government bonds, it requires a liquid bond market. Bond market reforms are required for PDMA to get the tools for the task at hand.

Bond market reforms feed into the PDMA reform (by giving PDMA the tools for the job) and the Monetary Policy Framework Agreement (by giving RBI the tools for the job). In addition, bond market reforms improves the working of the corporate and infrastructure bond market, thus improving the investment climate for infrastructure investment and private corporate investment.

For many years, each of these components was recommended by expert committees, got discussed in the run up to each budget, and not undertaken. This is partly because each of these components, if viewed in isolation, is more difficult. Budget 2015 was able to break the gridlock by doing all three in unison. The whole is greater than the sum of the parts.

There are two more respects in which this package of reforms yields gains to the economy. When RBI was doing the investment banking for government, and also controlled banking regulation, they had an incentive to get their work done without undertaking much effort, by forcing banks to buy government bonds. Once the investment banking work shifts to PDMA, we may hope that RBI will reduce the Statutory Liquidity Ratio, and thus free up greater space for banks to lend to private enterprise. This will largely benefit small and medium enterprises as this is the segment which is most dependent upon bank borrowing.

The second dimension concerns the corporate and infrastructure bond market. This market critically relies on the yield curve, that is discovered on the government bond market, and on hedging using interest rate derivatives which trade on the interest rates on the government bond market. The development of the government bond market will increase the viability of corporate and infrastructure bond markets. These gains will largely accrue to large firms, as this is the segment which dominates the corporate and infrastructure bond markets.

All this will play out slowly. Inflation targeting, the setting up of the PDMA, the improvements for the bond market, and the playing out of the downstream consequences: all these will take place over years. This is slow, important work. Once begun, it will take many years to play out.

The reform is incomplete in two respects. When, in the future, the full Bond-Currency-Derivatives Nexus is moved from RBI to SEBI, the effectiveness of monetary policy will be further enhanced, and RBI will become a full fledged central bank by world standards. When, in the future, the policy rate at RBI is set using a Monetary Policy Committee, this will improve upon the decisions of one person.

Addressing the confusion

MoF has done a poor job of explaining what has been done and why, which has given a lot of media misinformation. Here are some questions which have swirled in the discourse.

q: Does this mean that SEBI will set the repo and reverse repo rate?

a: No, RBI will set the repo and reverse repo rate.

q: Does this mean that SEBI will control or regulate the market infrastructure through which RBI undertakes repo or reverse repo transactions, which are essential to the conduct of monetary policy?

a: SC(R)A does not apply for RBI. RBI will design, build and operate the infrastructure through which RBI will do repo or reverse repo transactions in the conduct of monetary policy. SEBI will not have any say or power over these arrangements.

q: Does this mean that SEBI is now the regulator of the money market?

a: This means that SEBI is now the regulator of all government securities. This is true regardless of their maturity. Government securities with less than one year maturity would, previously, have been termed ``money market instruments''. RBI will continue to run its own repo / reverse repo operations in the course of doing monetary policy. RBI will continue to regulate the call money market.

q: What will happen when two private parties enter into a repo transaction?

a: That transaction will be regulated by SEBI as it is a securities lending transaction. SEBI will be the regulator of all aspects of the government securities market, which includes the activity of lending government securities.

q: Why is SEBI the right regulator for government bonds?

a:

- All securities are alike. Whether a piece of paper is a share or a bond, it is a security.

q: There are complex interlinkages between RBI's payment system (RTGS), the settlement system for government bonds and the working of RBI repo.

a: At present, IT systems within RBI talk to the depository for government bonds (SGL) which is within RBI. In the future, these systems will have to talk to depositories for government bonds outside RBI. This will require IT system modifications.

q: All these changes will be disruptive.

a: The Finance Bill is written in a way that the changes do not get triggered immediately. They unfold in a phased manner, alongside the implementation work, which will take a few years.

q: Has all this been thought through and analysed with a cool head?

a: Yes, numerous expert committees have recommended precisely these actions. Every single expert committee which wrote on this subject has recommended these changes: Setup a debt management office, merge regulation of organised financial trading, give RBI clarity of purpose to stabilise inflation. Setting up the PDMA is in (1) RBI annual reports, (2) the Jahangir Aziz Working Group, (3) the M. Govinda Rao Working Group that was setup under FSLRC, (4) the Justice Srikrishna Commission, (5) the Percy Mistry Committee, (6) the Raghuram Rajan Committee and (7) the Vijay Kelkar Committee on MOF restructuring. Inflation targeting and the merger of organised financial trading at SEBI (or UFA) is in the Percy Mistry Committee, the Raghuram Rajan Committee and the Justice Srikrishna Commission.

Not one expert committee has disagreed with any one of the three elements. The only critics are those motivated by self-interest.

This article first appeared on Ajay Shah's blog.

(Ajay Shah is a Professor at National Institute for Public Finance and Policy, New Delhi.)