Mumbai-based non-banking financial company (NBFC) NeoGrowth Credit Pvt Ltd has raised an undisclosed amount of funding led by Silicon Valley-based social venture investor Khosla Impact, according to a statement.

This is the third round of funding for the company, which also saw participation from existing investors Omidyar Network and Aspada Investment Company.

The NBFC will use the funding to expand its asset book and make investments in new products and platform technologies, it said.

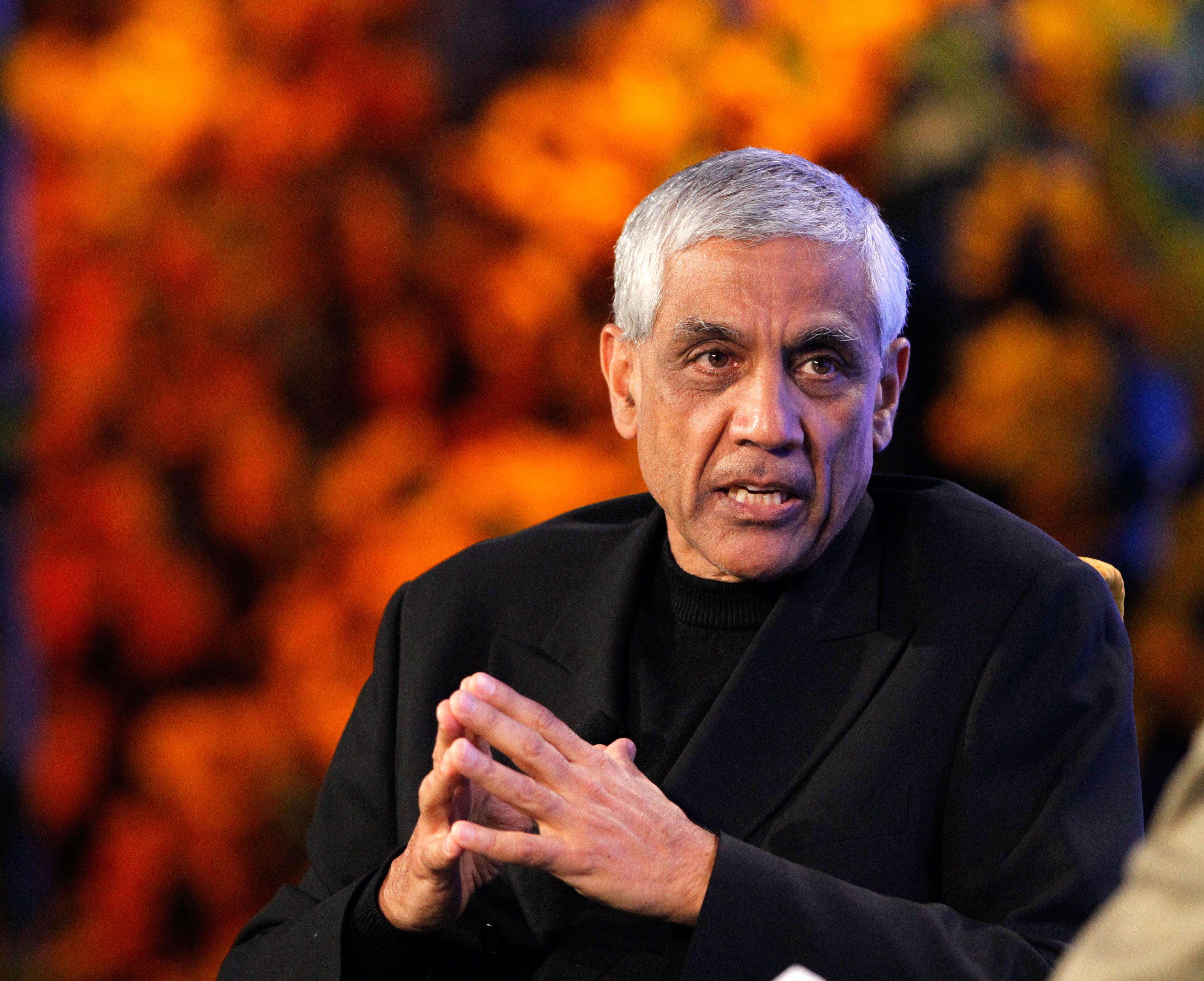

“Technology-based companies are changing the way banking works around the world. The new models for measuring risk are being built now, and NeoGrowth is leading that effort in India for the broadest base of merchants,” Vinod Khosla, billionaire venture capitalist and founder of Khosla Impact and Khosla Ventures, said in the statement.

Khosla had previously backed financial technology companies such as OnDeck Capital and Square.

Mark Straub, co-founder of Khosla Impact and C V Madhukar, director of investments at Omidyar Network, have joined NeoGrowth's board.

NeoGrowth, whose clients primarily include retailers and restaurants besides e-commerce sellers, has given out around 1,000 loans to date.

It is a non-deposit taking NBFC involved in the merchant cash advance business. It was founded by serial entrepreneurs and cousins Dhruv and Piyush Khaitan after they sold their transaction processing firm, Venture Infotek in mid-2010.

NeoGrowth has launched commercial operations in Bengaluru, Delhi, Mumbai and Pune, and plans to expand to markets across India.

Last year, it raised Rs 10 crore ($1.62 million) from Aspada Investment Company. In mid 2013, Omidyar Network had invested Rs 17 crore in NeoGrowth Credit.

The NBFC claims its product does away with the usual lengthy loan appraisal procedures which comes with a fixed EMI system and most importantly, removes the necessity of the merchant to visit the lender's location at every stage.

(Edited by Joby Puthuparampil Johnson)