Merger and acquisition activity in India’s healthcare sector has remained buoyant so far this year and back-to-back successful initial public offerings have indicated strong investor appetite, although private equity and venture capital deals have slowed in line with other sectors.

The January-August period of this year recorded 66 M&A transactions, compared with 67 a year earlier and 69 in the same period of 2014, according to VCCEdge, the data research platform of News Corp VCCircle.

“PEs will keep looking at exits as an option via M&As, which will remain buoyant. We don't see any negative on this side,†said Amit Varma, co-founder and managing partner at healthcare-focused private equity firm Quadria Capital.

M&A

Of the 66 M&A transactions during the period, 38 were domestic, eight were inbound and 13 were outbound. The biggest M&A deal in the space was China's Shanghai Fosun Pharmaceuticals (Group) Co. Ltd's acquisition of a majority stake in Hyderabad-based Gland Pharma Ltd for up to $1.26 billion.

IPOs

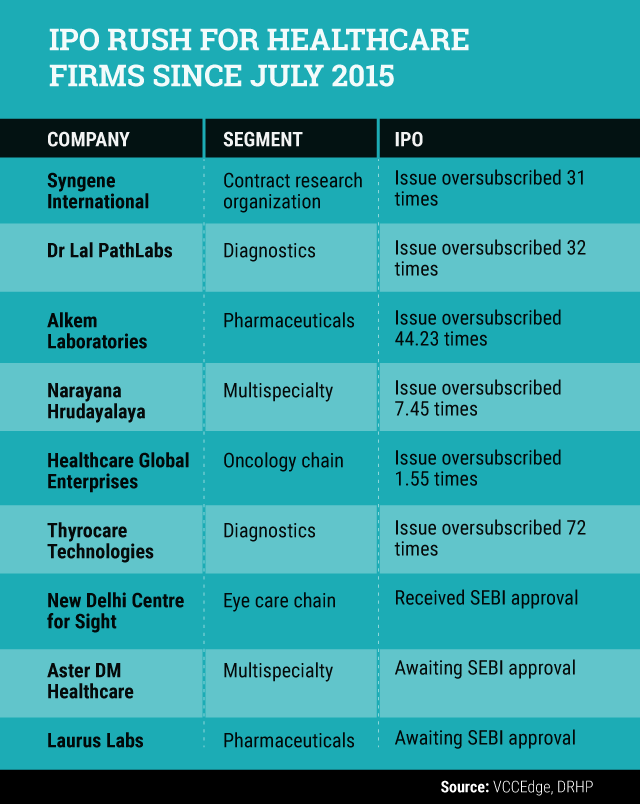

The IPO marathon for healthcare companies began with Syngene International Ltd, the research and development subsidiary of Indian biopharmaceutical major Biocon Ltd, in July 2015. The company made a strong debut on the stock exchanges, listing at a premium of 18% to its issue price of Rs 250 in August last year. Its share price has hit a high of Rs 510.

After Syngene's listing, diagnostics chains Dr Lal PathLabs and Thyrocare Technologies, pharmaceuticals company Alkem Laboratories, multispecialty hospital chain Narayana Hrudayalaya and oncology chain Healthcare Global Enterprises (HCG) launched IPOs and got listed. Barring HCG, all the companies had a spectacular listing. The oncology chain listed way below its issue price but its shares have now surpassed the issue price.

“We are very positive on IPOs across sectors. In the healthcare space even HCG prices have corrected as the company is meeting analysts' forecast and target," said Varma.

More healthcare companies are waiting in the wings to float an IPO. Eye-care chain New Delhi Centre for Sight has got market regulator Securities and Exchange Board of India's approval for its IPO. Multispecialty hospital chain Aster DM Healthcare and drug ingredients maker Laurus Labs have also filed for IPOs.

PE/VC deals

The number of PE/VC deals in the sector hit a five-year low of 29 in the January-August period, according to VCCEdge. The deal value is also the lowest in five years but it is not directly comparable as the value of some transactions is undisclosed.

Varma said he does not see PE activity in the segment falling and that it will maintain the momentum. The VC segment, however, is unlikely to experience the euphoria it noticed about a year back and activity in the space may remain muted, he added.

The biggest private equity deal in the sector was in the pharmaceutical segment with Quadria Capital picking up a minority stake in Ahmedabad-based drug maker Concord Biotech for $71.4 million.

This was followed by Hong Kong-based private equity firm ADV Partners' investment of around $45 million in Chennai-based healthcare company Dr Agarwal's Healthcare Ltd. It was a tie for the third spot with TPG Growth investing $33 million each in mother and child care firm Rhea Healthcare Pvt. Ltd and South Asia-focused cancer treatment provider Cancer Treatment Services International.

Like this report? Sign up for our daily newsletter to get our top reports.