As detailed in our earlier article, the Union Budget 2010 had proposed amendments to the Income-tax Act, 1961 (‘the Act’) inter-alia on taxability of notional income on receipt of shares in a closely held company (‘Target’) by another such company or a firm (‘Investor’). The aforesaid provision, proposed to come into effect from June 1, 2010, have now been supplemented with valuation rules notified by the Central Board of Direct Taxes (‘CBDT’).

The valuation guidelines would result in levy of additional upfront income-tax on Private Equity/ Foreign Venture Capital investors, who wish to invest in distressed assets or in a right/ preferential issue which could be below the Fair Market Value (‘FMV’). The proposed amendment to the Act deems the difference between the FMV and the transaction value, to be income taxable under the head ‘Income from Other Sources’. This could add a new dimension to transaction evaluation, as investors would have to factor tax on notional income in addition to the capital gains tax on exit.

Alerted by the proposed amendments, investors are gearing up to manage the challenges that they could expect to face in future deals. Given the significance of the developments, we have discussed potential implications of the proposed amendment and related matters.

An analysis

As per the valuation rules notified by the CBDT, FMV of unquoted equity shares would be computed having regard to the networth (being difference between the assets and liabilities), in the ratio of paid-up value of the shares to the paid-up capital of the Target.

The Bill had carved out exceptions from the application of tax on notional income provisions of in case of a merger or demerger. However, many other transactions were not specifically exempted. An illustrative set of transactions that are not exempt are:

--Transactions between holding and subsidiary companies.

--Preferential issue of shares to investors/ existing shareholders.

--Put or call options pursuant to Shareholders’ Agreement, etc.

--Distress sale of shares.

It was expected that the valuation rules would provide purposive guidelines in handling such unrelated entity transactions and possibly deem the value agreed between such unrelated parties to be good consideration. Further, straight jacket valuation norms have been prescribed for equity shares. There is no distinction in respect of equity shares with differential rights or in respect of equity shares of different paid-up value etc.

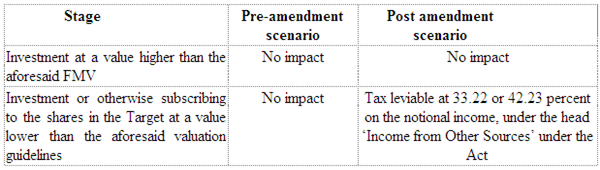

If the proposal is enacted in its current form, the impact in typical scenarios would be as follows:

In connection with the above, it should be noted that the aforesaid taxes payable would be in addition to the capital gains taxes (which are lower if the shares are held for more than 12 months) payable on exit. However, the value deemed as income for the purposes of section 56 would be regarded as part of cost of acquisition for the purpose of computing capital gains that would arise subsequently.

Impact on Investors

Typically, foreign investors make their investment into India from tax friendly jurisdictions. Their incomes in such jurisdiction(s) suffer minimal taxes, if any. Foreign investors may need to explore whether the proposed deemed income can be claimed to be not taxable in India under treaty provisions. Thereby, this proposal could pose comparative risks and higher tax costs for domestic investors.

To overcome any unintended tax challenges, investors may look at or forced to look at aligning valuation of shares and books value, regard being had to accounting principles.

Way forward

The fact that the extant provision of the Bill and valuation rules don’t expound any specific considerations for commercial necessities, the legislature or tax authorities could tackle the above challenges by adopting one of the following modes:

--Amend the provisions of the Bill prior to its enactment;

--Provide clarification through supplementary rules; or

--CBDT to issue circular providing clarifications in respect of the aforesaid matters.

It would therefore be important from domestic as well as foreign investors’ perspective to explore tax mitigation strategies for unintended notional income taxation, if none of the above remedial measures are used by the legislature or tax authorities to carve out exceptions for bona fide commercial transactions.