The Reserve Bank of India (RBI) on Tuesday cut interest rates by 25 basis points (bps), even as the central bank’s monetary policy review said that global growth projections remain a worry, especially for emerging markets like India.

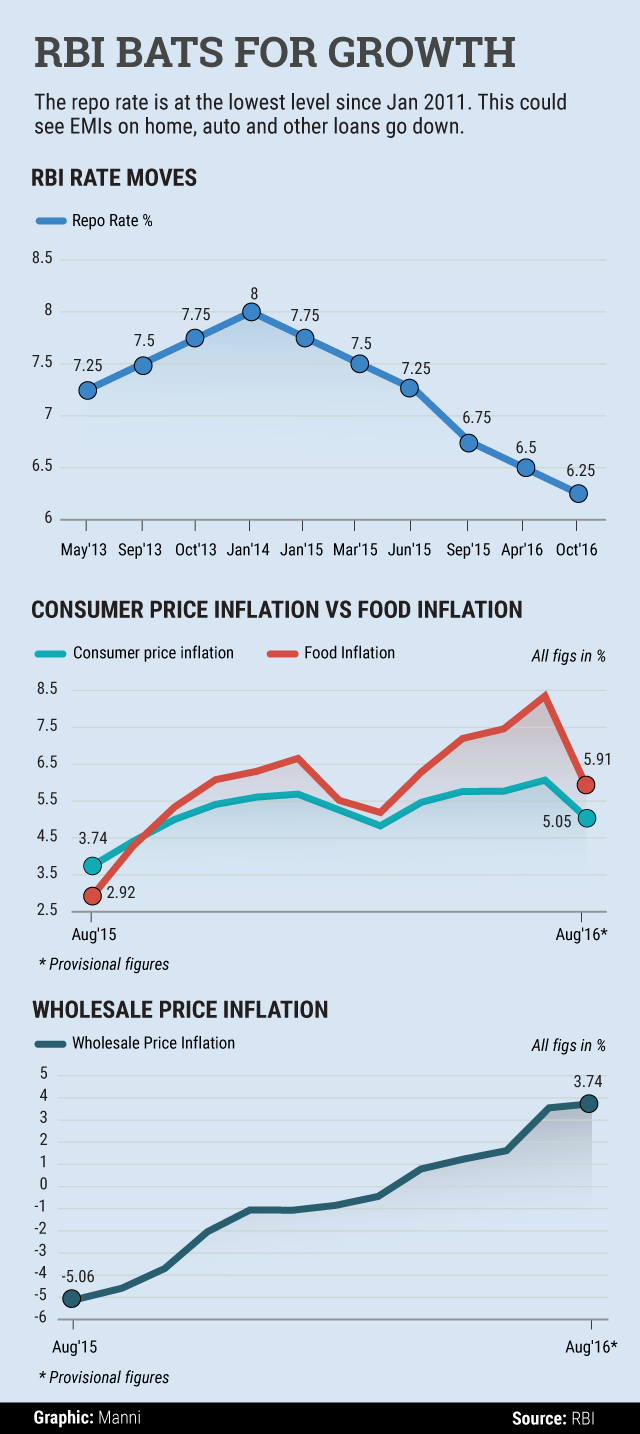

After the cut, the new repo rate will now be 6.25%, and the new reverse repo rate will be 5.75%. This is the lowest interest rate since January 2011.

The RBI believes that there is a case for a rate cut as food inflation has eased and because there are fewer upside risks to the 5% target of Consumer Price Index (CPI) inflation by March next year.

Not only was this Urjit Patel’s first monetary policy review as the RBI chief, it was also for the first time that the decision was taken by a six member Monetary Policy Committee (MPC), which has three members each from the RBI and from academia. All six of them voted in favour of a rate cut. The RBI is expected to release the minutes of the MPC meeting over Monday and the first half of Tuesday by 18 October.

The rate cut should bring some cheer to borrowers, who could see their Equated Monthly Instalments (EMIs) on home, auto and other loans come down, especially ahead of the festival season beginning Dusshera and culminating in Christmas and the New Year.

“The Committee expects that the strong improvement in sowing, along with supply management measures, will improve the food inflation outlook. It notes that the sharp drop in inflation reflects a downward shift in the momentum of food inflation – which holds the key to future inflation outcomes – rather than merely the statistical effects of a favourable base effect,†an RBI release said. “The Government has announced several measures to cool food inflation pressures, especially with regard to pulses. These measures should help in moderating the momentum of food inflation in the months ahead,†the release further added.

Retail inflation had breached the 6% mark in July, but fell sharply to 5.05% in August.

The RBI said that following a good monsoon this year, the “outlook for agricultural activity has brightened considerably†and that barring cotton, sugarcane, jute and mesta, kharif sowing this year has surpassed last year’s acreage. This, the RBI believes should improve the food inflation outlook.

The central bank, however, said that it had factored in the “potential cost push pressures that may emerge†owing to various factors including the 7th pay commission award, and the increase in minimum wages, “with possible spillovers through minimum support prices.†The central bank said that although inflationary risks were still tilted towards the upside, the slant was lower than during the monetary policy reviews in June and August.

Although Patel had said little about his stance on the interest rate, he had reportedly told a closed door meeting of economists that the central bank will have a growth oriented outlook and will be ‘dovish’ on interest rates.

The central bank said that global growth had slowed “more than anticipated†in 2016, with “weak demand and trade damping aggregate demand.â€

The RBI said that “risks in the form of Brexit, banking stress in Europe, rebalancing of debt-fuelled growth in China, rising protectionism and diminishing confidence in monetary policy have slanted the outlook to the downside.†It further said that “the outlook has worsened†with the recent falling off of imports by advanced economies from emerging market economies like India.

On the issue of lenders not fully passing previous rate cuts to consumers, the RBI said that the “easy liquidity conditions†following the rate cut, should enable the smooth transmission. “Furthermore, banks should find added impetus for better transmission by the recent downward adjustment in small savings rates,†the RBI said.

The change in interest rates comes, the first since April this year, when former RBI governor Raghuram Rajan had brought down the rate from 6.75% to 6.5%. Rajan had however held a hawkish stance on interest rates, refusing a further cut, despite pressure from the industry and sectors within the government. This landed him in a controversy, with Bharatiya Janata Party leader Subramanian Swamy making several unsubstantiated allegations against him. Following this public controversy, Rajan decided not to seek a second term at the central bank.

Like this report? Sign up for our daily newsletter to get our top reports.