Life's transitions, from single to married, from renter to homeowner, and from employed to retired, just to name a few, are never easy, since the rules change, as do the measures of success and failure and that is perhaps the reason that they are accompanied by ceremonies (weddings, housewarming, retirement parties). The life of a business is also full of transitions, and not only are they just as difficult for investors, traders and managers, but they often occur without ceremony, and can go unnoticed. In the last three years, social media companies have claimed center place in market conversations, first when they went public at prices that old-time value investors found inconceivable, and then as their ups and downs became part of market lore. In the last few weeks, we have seen this fascination with social media companies play out again, first in the market reaction to Mark Zuckerberg's post earnings statements about Facebook's future investment needs and then in Twitter’s struggles to reclaim its narrative at its analyst meeting last week. I get a sense that we are on the cusp of a transition, where the time for pure story telling (and its metrics) is ending and more traditional metrics (revenues, profitability) will come to the fore. That does not presage, as some are suggesting, the end of the social media party and a collapse of social media market capitalizations, but it does mean that investors, traders and managers have to recalibrate to a different game, where they will be judged not on pure sector momentum but on their capacity to cull winners from losers and find the right metrics for making those judgments.

The Business Life Cycle: Investing and Valuation Dynamics

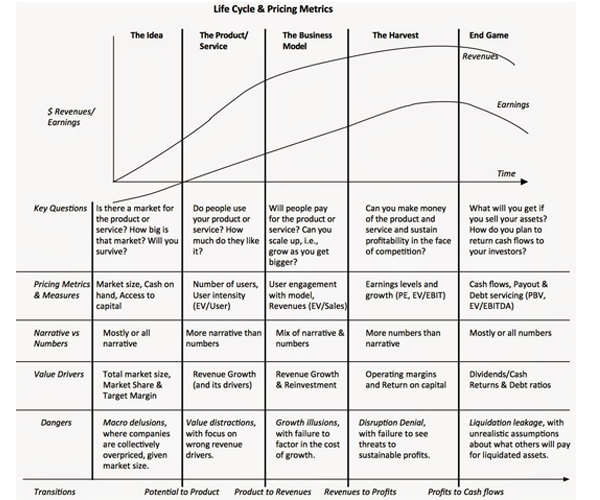

In an earlier post, I made the argument that the center of gravity in both valuing and pricing shifts as a business evolves from an idea to a product to a profit-generating business. The figure below summarizes those shifts and expands on the implications.

When a business is at the idea stage, both value and price are driven by market potential and by narrative, rather than numbers. As the business transitions to a product phase, the questions become more specific, with both investors and traders looking at how well the product/service attracts customers, with usage statistics driving pricing. Further along the life cycle, the test becomes whether usage can be converted to revenues and revenues to profits, with numbers driving narrative. The table also highlights what I see as the biggest dangers at each stage of the life cycle. In the early phases, the dependence on the macro story (the macro delusion) can lead investors to value companies in a promising market too highly, in the aggregate. The perils become more company-specific as you move through the life cycle.

The Social Media Reality Checklist

The social media sector is a young one, with even its most established companies are still only a few years old, even if you throw Google into the mix. In the last three years, the first wave of social media companies have been listed in public markets and investors have had to price them. Using the life cycle framework developed in the last section, these companies were priced using “macro†stories about market potential (online advertising) generally, with revenue drivers (number of users, subscribers or downloads) more specifically determining market standing. That is neither surprising nor irrational, and reflects what investors have typically done in other young sectors (dot com in the 1990s, for instance) in the past.

As the social media sector ages (and technology companies should have their lives measuring in dog-years, aging much faster than the rest of the market), the question becomes whether we are approaching a transition point, where investors start asking more pointed questions about revenue growth (and what it is costing) and profitability. I may be jumping the gun but the market’s shocked reaction to Mark Zuckerberg admitting that Facebook will be spending a lot to generate growth and Twitter’s attempt to sharpen its narrative suggests that the shift is close. Consequently, if you are an investor, a potential investor or manager in a social media company, it is time for a reality check, both to prepare for the transition and to make better decisions. While these reality checks will vary across social media companies, there are a few that I think apply specifically to those that are in the online advertising space.

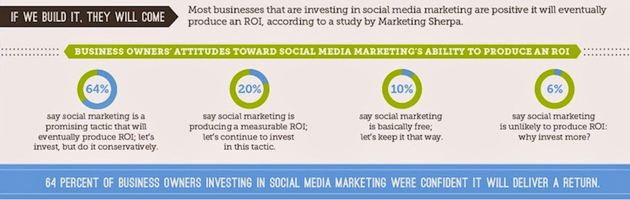

1. We don't know much about the effectiveness (or lack thereof) of social media advertising: While companies have jumped on the social media advertising bandwagon, the evidence on whether it is effective is mixed, partly because it is still too early to pass judgment. It is true that social media sites can use the information that they have accumulated about users to sharpen advertising focus, but I have not found many comparative studies that indicate that social media advertising is more effective than traditional (television or other) advertising. As someone who has never clicked on a sponsored tweet and finds them intrusive, I may be out of the loop, but I would be glad to hear from anyone who has strong evidence on this issue. In fact, surveys of advertising executives at the companies that use social media advertising show that they are just as unsure about this experiment and are withholding judgment.

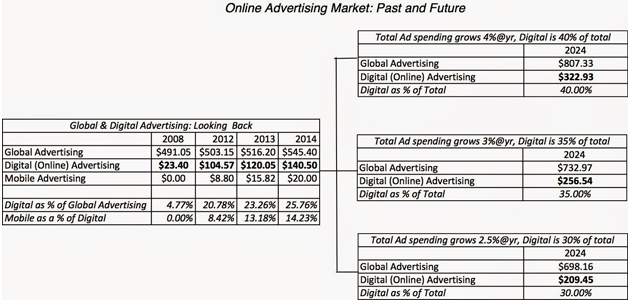

2. The online ad market is growing but it is finite: At the risk of stating the obvious, the total advertising market is a finite one, since it is a cost item to (advertising) businesses, who have to watch their bottom line. It is true that online advertising is a growing part of the total advertising budget, but it also, by definition, finite. One troubling aspect of the sales pitches for social media companies that I have heard over the last few years has been an unwillingness to be specific about the size and limits of the online advertising market. Last year, when I valued Twitter for its IPO, a company that was promoted for its online advertising potential, I examined this question by looking at both the size of the overall advertising market and what percentage of it was in online (digital) advertising. Recapping and updating, global advertising revenues have grown about 4% a year for the last 5 years, and online advertising has surged from less than 5% of total advertising revenues, in 2008, to 25.76% of revenues, in 2014, with an increasing portion attributable to mobile advertising. Allowing for growth in the total advertising market and an increase in the online advertising share of it yields an estimated market of between $209 billion and $323 billion for the entire online advertising market in 2023. It is this market that social media companies are competing for and the revenues for each of them has to be measured against this whole.

3. The Online Ad market is getting more competitive: The growth potential of the online advertising market is attracting new entrants, some of whom are still private (like Snapchat) and some in the process of being created. While much of the initial growth in social media companies has come at the expense of other types of advertising (print media, in particular), growth will become harder to find as online advertising becomes a larger piece of the pie. It is a given that at some point, sooner rather than later, the revenue growth at one online advertising company will have to come at the expense of another online advertising company. Thus, if you assume that Twitter will have revenues of $35 billion in a decade, you will then also have to identify the losers in the market (Facebook? Google?). This additional competition will also lead to pressure on operating margins, with companies cutting prices to get revenue growth, making the trade off between revenue growth and profitability front and center.

Growth will become more expensive and the accounting will remain opaque: As social media companies compete for a slower-growing online advertising market, they will have to reinvest more to generate growth. That reinvestment, though, will often take forms that accountants still do not categorize as capital expenditures and will not show up in balance sheets (as assets) or on cash flow statements (as capital expenditures). It will take the form of R&D, customer acquisition costs, product development costs or acquisitions of other companies in the space (often with stock, rather than cash) and none of these are dealt with well or consistently by accountants. Customer acquisition costs, R&D and product development costs are treated as operating expenses (when they should be considered to be capital expenditures) and stock-based acquisitions often disappear into thin air (or the footnotes to financial statements). The result of this confusion is that financial statements for social media companies don’t measure what they claim to: income statements do not measure earnings, balance sheets do not reflect the assets owned and the capital invested to get them and cash flow statements are skewed by the use of equity (to compensate employees and pay for new investments).

While all of these have been true for the entire existence of social media companies, they can be glossed over in the early phases but cannot (and should not) be overlooked as companies age.

Market Consequences

If you buy into the notion that a transition is coming, there are predictable consequences for investors and markets:

1. Unexplainable volatility: During transition periods, there will be struggles that play out in markets between investors on either side of the transition, some holding on to the old metrics and measures and others moving on to new metrics. With social media companies, the former will include investors who still focus on users and user intensity measures to price companies, whereas the latter will look at revenues, investment and earnings. The market will reflect this schizophrenia on the part of investors, with wild and completely unpredictable swings in prices, as one group or the other tries to assert its dominance.

2. Market shake out: As the focus shifts to revenues and earnings, the market will start culling the herd, knocking down the prices of the losers and sustaining the pricing of the winners. The game will change for both traders and investors; traders will no longer be able to ride sector momentum (as they can in the early phases of a life cycle) and investors will find a bigger payoff to focusing on fundamentals.

3. Macro to micro focus: When a sector is young, the game belongs to the story tellers and especially those who tell macro stories (about shifts in the business and disruption). As the sector matures, it shifts to those who bring the more prosaic skills of assessing individual companies to the forefront.

If this is a transition, there is stormy weather ahead but that can work to your advantage, and if you can keep your wits and make it through, you will be rewarded.

Advice (unsolicited and perhaps unwelcome) for social media companies

If life cycle transitions are difficult for traders and investors, they can be even more shocking for managers and especially so for those who were successful playing the old game. With social media companies, for instance, where increasing the number of users and user intensity has created positive payoffs for the last few years, managers will have to change how they manage companies, what they emphasize in earnings reports and how they frame their narratives. This is not going to come easily or without pain, even for the most successful and adaptable managers . I know that the they will get lots of advice (and will pay for it) from consultants and bankers, but here is mine, if they care:

1. Manage for investors, not analysts: Don't operate under the presumption that the equity research analysts that tout your stock are market leaders and trend setters. Equity research analysts are more followers than leaders, creatures of momentum rather than arbiters of value and catering to their fickle demands will not protect your stock from getting battered, if the market mood turns.

2. Be open about investment needs and market challenges: Growth is never free and while there are some investors who are willing to be deluded, most sensible investors would prefer honesty from you, where you lay out the costs that you think you will bear in your pursuit of growth. It is this context that I think Mark Zuckerberg was right to admit what should have been obvious from past history. Facebook is spending large amounts of money to maintain its pathway to dominance of online advertising. (After all, they just spent $22 billion consummating the Whatsapp acquisition.)

3. Be transparent in your accounting: Dispense with the games that you may have played in the past. Stop adding back stock-based compensation to come up with adjusted EBITDA and acting like acquisitions made with stock really cost you nothing. It is true that accounting rules are neither logical nor consistent and that you may be bound by them in preparing your financial statements, but your pro-forma statements can be used to reveal more about your business (rather than to obscure it).

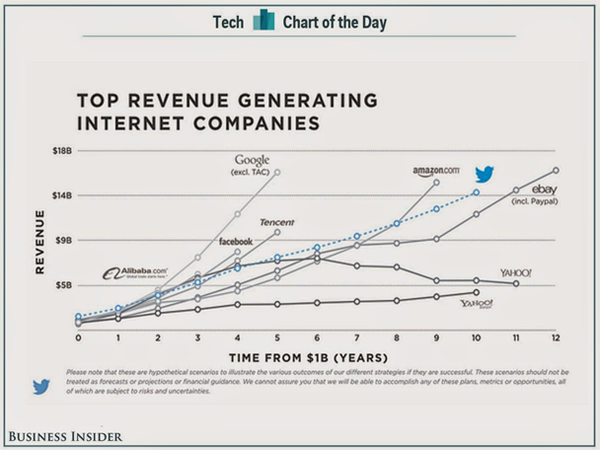

It was through these lens that I looked at Twitter's presentation to analysts during Twitter Analyst Day in San Francisco. While Anthony Noto, Twitter's CFO, may have impressed investors (to cause the price to jump 7.5%), old habits die hard and the presentation violates all three of my suggestions: the talk was tailored to analysts (violating rule #1), there was no mention in the presentation of how much Twitter will have to spend to grow (violating rule #2) and the report culminated with the obligatory adjusted EBITDA (completing the violation trifecta). There were, however, moments of substance, especially on what the company sees as its revenue path for the long term. In addition to presenting tweaks to the product (improved time line, boosting video and improving interaction), Mr. Noto announced that the company intended to be "one of the top revenue-generating Internet companies in the world", pushing implicitly to be put in the company of Google and Facebook and provided analysts with his projection for Twitter's revenues over the next decade:

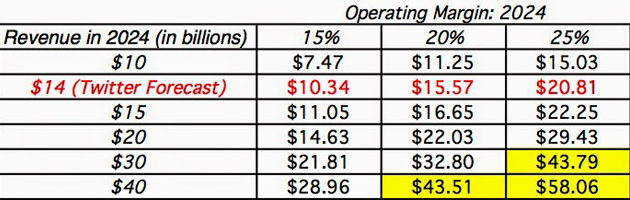

I must confess that I was underwhelmed by the end number, and here is why. In a post in August 2014, I valued Twitter at $22.53/share, with a projected revenue of almost $15.2 billion in 2024. If the projection in Twitter's own graph for revenues is credible, I may have been a little too optimistic in my valuation; using a $14 billion revenue estimate in 2024 yields a value per share of $20.81. Put more bluntly, for Twitter to be valued at more than $41.85/share (the price on November 14, 2014), you would need a lot more revenues than Mr. Noto is projecting in this graph for 2024. The table below lists breakeven points to justify today's price:

Twitter has its work cut out for it. It has to either find ways to grow much faster than it is projecting or it has to work at bringing investor expectations down, with the caveat that there are no soft landings for high-flying companies. If online advertising remains Twitter's primary business, getting the break-even revenues ($30-$40 billion) will be problematic, partly because of external factors (more competition and limited advertising budgets) and partly due to internal constraints (limits on the sponsored tweets users will accept in their time lines). There remains the possibility, perhaps even a probability, that Twitter will be able to find other ways to monetize their user base (retailing, for instance) but that is a work in progress, and the operating margins in these new businesses will not come close to the 25% operating margin that I am assuming for the online advertising business.

Transition Breaks

As I watched and read about the Twitter extravaganza, I was reminded of the ancient Jewish tradition (mirrored in other religions) of "bar mitzvah". In that ceremony, a Jewish adolescent "come of age", studying the Torah and with the guidance of a rabbi. The ceremony is designed to put the world on notice that the child has become an adult, with the associated responsibilities and accountability. Realistically, no one expects overnight changes, since a teenager will still be a teenager after the ceremony, but it still serves as an important reminder that the rules are changing. As an aside, the seeking out of venture capital by a start-up can be analogized to a much earlier and more painful ceremony that all Jewish infant boys have to go through, with the pain of giving up a slice of your business going with the relief when it is done.

Though the notion of a ceremonial coming-of-age for companies may strike you as outlandish, that is the role that getting listed in a public market played in the decades before the 1990s. Thus, companies like Apple and Microsoft both had established business models before they went public in the 1970s and 1980s. The rules changed in the 1990s, when dot-com companies leapfrogged the process to go public much earlier in the life cycle, and as that trend has continued in the social media space, investors and managers have invented new (and sometimes bizarre) metrics to cope. It may not be a bad idea to have the equivalent of corporate bar mitzvahs, where investors, traders, and managers are reminded that a company has come of age. My one reservation with Twitter's bar mitzvah was that Anthony Noto, Twitter's CFO, seemed to be playing the role of the rabbi (because of his street cred with analysts) in the ceremony, with equity research reports operating as scripture. I think it is wisdom, not street credentials, that you look for in a rabbi and timeless truths, not passing glory, in your holy books. The Twitter ceremony would have been a lot more persuasive, if Warren Buffet had been officiating, reading out of Ben Graham's Security Analysis. Perhaps, next time!

(Aswath Damodaran is a professor of finance at the Stern School of Business at NYU.)

To become a guest contributor with VCCircle, write to shrija@vccircle.com.