It’s a panel of domain specialists who provide their expertise and frank advice to help a company achieve its long-term goals.

If your legal board does not provide substantive business and succession help, you need an advisory cabinet. It is a major step ahead of the prevalent legal boards, which are mostly wired to resolve issues of regulatory and fiduciary requirements. Hence, the contribution of the legal board, as often observed, is a relatively inconsequential exercise to customarily fulfil the compliance requirements of a state. This, along with its composition, time constraints and relationship to the chief executive officer (CEO), rarely allows for substantive contributions towards the organizational growth agenda in a quantifiable way. In many family-controlled corporations, board meetings get reduced to posturing with a few presentations made and questions raised, but with no clear path highlighted to promote business growth.

With this realization, and an acknowledgement of the fact that companies which have adopted transformation agendas have gained a higher growth trajectory far quicker and with enhanced prospects of becoming high-growth-responsive businesses equipped for the future, an increasing number of businesses are adopting an advisory cabinet. Which in turn draws its strength from five structural pillars: Operations, ecosystems, people and leadership, innovation and technology.

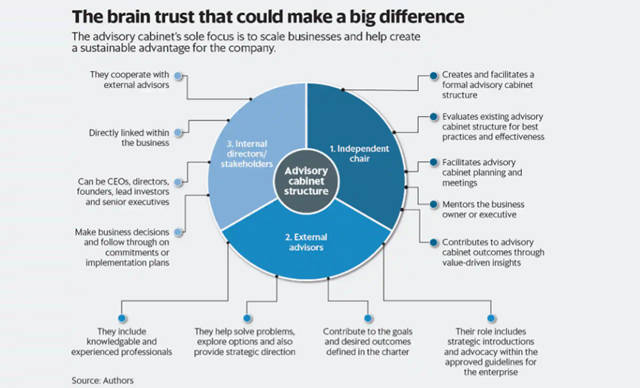

What is an advisory cabinet and its role? It is a group of 4-6 subject-matter experts, who through a structured programme engage with external advisors, acting as a sounding board for directors, owners and other stakeholders to gain new insights and advice to explore untapped opportunities and solve business problems by stimulating quality conversations for strategic overview. Thus, the cabinet guides the leadership on the company vision, innovation, risk management and profitability, necessarily including the internationalization, platformization and scalability of business, apart from identifying and increasing talent, funding leadership and influencing customer networks.

Though these domain experts provide advice, critical thinking and analysis to the management, they don’t have the authority to vote on enterprise matters. They are the ones who bring in the outside-in view. They are chosen precisely for their insights, expertise, perspective, globally diverse networks and judgement on strategic issues that the CEO and owners require for a successful transformation. Cabinet members offer a balance of external advice, facilitation and crucial follow-through oversight of implementation. Their sole focus is to scale businesses and build a sustainable advantage for the company.

Thanks to external engagements and networks, the leadership stays in tune with the volatile global context, with all its threats and opportunities. They help prepare the company and its owners to deal with uncertainty/complexity and detect sound opportunities. An advisor, for instance, could recommend an acquisition.

Advisory cabinet members don’t come to make money or gain prestige. They want to contribute without going through the skulduggery of the arcane formal governance playbook. They relish the changes wrought by their advice and influence, as also the effect of the cautions they issue against disastrous moves. Many businesses today leverage management consultants to decode and solve pressing issues. Nothing is wrong with that, but a sound advisory cabinet can act as an independent and neutral coach evaluating the pros and cons of decisions.

Advisory cabinet composition: Getting this right can be an arduous task. It is best to start with one person who can then attract others. Aim for someone you specifically want and be clear why, irrespective of who that person is. Pursue good choices with persistence and show why your business deserves their time, intellect and relational capital.

As a mini case study, let’s consider a family firm with revenues of $100 million whose founder decided that one cabinet member must have a digital DNA. The founder picked a director at Apple Inc. With this done, it was easier to attract three other former CEOs and directors of other global companies. Together, as an advisory cabinet, they were able to create immense value on talent, clear land-mines in global execution, and balance short- and long-term budget allocations. Within a year, the company’s share price rose from $5 to $9.

You cannot attract such people unless they believe in your business vision, potential attractiveness and credibility. And, of course, in you as a leader and your values.

How to recruit the people you want? First, drop all inhibitions in approaching retired CEOs and directors. They’re likely to be pleased with your offer. Second, define what you need. Third, use a search consultant who has networks of such individuals and knows them on a first-name basis.

The typical tenure is three years, after which you would need a different cabinet composition as business conditions change. Typical remuneration entails $100,000-$250,000 in cash per annum, plus an equity award vested after three years.

This cabinet will help you with succession, bring an entire family of owners and leaders onto the same page, and add value in multiple ways. Initially, it will help if you outline how aiding you success will benefit them. Let them pick their pace of work and engagement. They don’t need monthly in-person meetings. It is their judgement, set of contacts and ability to help resolve difficult issues that matter most. They aren’t employees; they are unique. And a single insight can make a big difference.

How to get value from your advisory cabinet: Be sure to consider the following. First, are you asking the right questions to learn your advisors’ views? Second, are you actively listening to them? Third, if you disagree with them, are you ready to discuss your counterview in depth and with due courtesy?

Here is why asking those questions is essential. Imagine a publicly-listed infrastructure company with $2 billion in revenue, 65% family-owned and run by the family head. Here, when an advisor asked who the next chief financial officer (CFO) should be, the discussion grew very spirited. The retiring CFO was unequivocal in supporting his loyal subordinate with 20 years of service. When the advisor questioned whether the internal candidate had the necessary skills, the outgoing CFO’s view influenced the family head, and he decided to go with the internal candidate, a known quantity with long service. This was irrespective of the fact that this candidate did not have global risk assessment and management skills. As a result, the company got into messy contracts in Mexico and Argentina, and given the magnitude of debt taken for it, it eventually had to be sold. Here, if the CFO had listened to the advisor, the story could have turned out differently.

Given a clear appreciation of the role and value of an influential advisory cabinet for your business, it may be time for you to go ahead and put one together with the requisite expertise and influence at minimal cost. If well chosen, this cabinet will give frank advice, predict future trends, and help keep your business in line with its vision and sustainable long-term goals.

Geri Willigan contributed to this article.

Ram Charan & Shalil Gupta are, respectively, a business advisor, author and speaker; and a business leader, management consultant and transformation advisor to global enterprises and start-ups.