The initial public offering (IPO) of government-owned and operated railway infrastructure engineering and construction company Ircon International Ltd received demand for nearly 10 times the shares on offer on the third and final day on Wednesday.

The public issue received bids for 96.06 million shares on day three after attracting interest from investors across categories. That translates to demand for 9.7 times the 9.9 million shares on offer, stock-exchange data showed.

The portion set aside for retail investors was covered 9.45 times. Shares reserved for institutional buyers was subscribed 12.3 times, while non-institutional investors comprising corporate bodies and high net-worth individuals (HNIs) bid for nearly five times the shares reserved for them.

Retail investors and eligible employees were entitled to a discount of Rs 10 on the price at which shares are allotted.

The IPO is entirely a secondary market sale of 9.9 million shares by the government, including stock reserved for employees.

Ircon’s public issue was subscribed 30% at the end of first day on Monday. The public issue picked pace, receiving full subscription at the end of day two on Tuesday.

Ircon is seeking a valuation of Rs 4,467.44 crore ($620.47 million when announced) at the upper end of the Rs 470-475 price band for the IPO.

The public issue will result in 10.53% stake dilution by the government, which currently owns 99.69% stake. The Centre will get three years from the date of listing to bring its stake down to 75% or lower, as per regulatory guidelines for listed firms.

VCCircle had in June last year reported that the government had hired merchant bankers for various state-owned companies, including Ircon, with a view to taking them public.

IDBI Capital Markets & Securities, Axis Capital and SBI Capital Markets are the merchant bankers managing the IPO.

It is aiming to boost rural and infrastructure spending as well as contain fiscal deficit ahead of the 2019 general elections.

VCCircle had previously reported that the government was the biggest beneficiary of the IPO boom in 2017 after taking four state-run companies public. In all, the government raised about Rs 21,118 crore, besides selling stakes in listed firms.

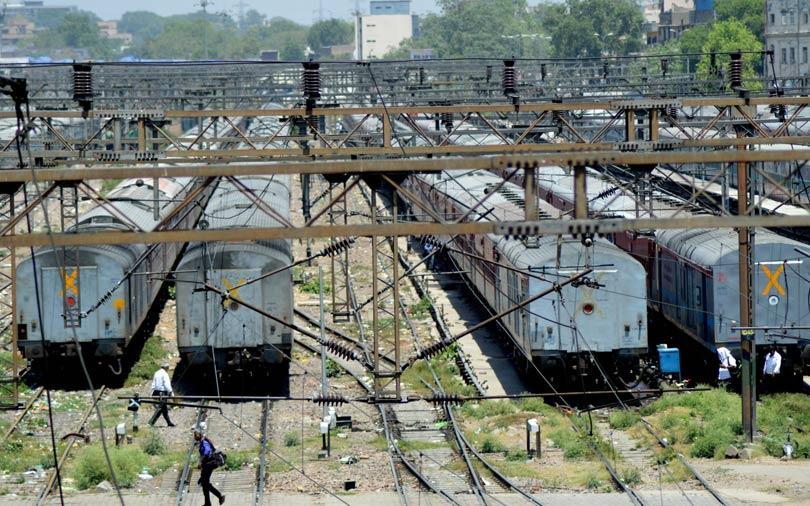

Ircon International, which was incorporated in April 1976, is an integrated engineering and construction company specialising in major infrastructure projects, including railways, highways, bridges among other residential, commercial and industrial infrastructure activities.

The company is headquartered in New Delhi and operates through 26 project offices and five regional offices in India, besides five overseas project offices in Sri Lanka, Bangladesh, Malaysia, South Africa and Algeria.

With a total workforce of 1,175, Ircon had an order book of Rs 22,406.79 crore as on March 2018.

Its core business verticals are construction and infrastructure development. Under its construction vertical, the company has undertaken 35 railway projects in India and overseas.

Railway projects contributed 68.95% to its total revenue for the financial year 2017-18, as compared with 68.26% and 77.12% for 2016-17 and 2015-16, respectively.

Under the infrastructure development division, the company develops and maintains railways and roads on a build, operate and transfer (BOT) basis.