Capital First Ltd, a non-banking financial company (NBFC) majority owned by private equity firm Warburg Pincus, is raising Rs 340 crore ($51 million) from GIC, Singapore’s sovereign wealth fund, it said.

GIC, through an affiliate Caladium Investment Pvt. Ltd, will pick around 4.8% stake in the NBFC via a preferential allotment of 4.78 million shares at Rs 712.70 each, as per VCCircle estimates.

Post the transaction, the total capital (including tier I and tier II capital) of the company will increase to Rs 3,263 crore on a consolidated basis and capital adequacy will increase to 21.6%, it said.

V Vaidyanathan, founder and chairman, Capital First, said the company has received a proposal from Caladium to become a new shareholder and provide growth capital. The funding would help the company continue its future growth plans on a strong capital base.

In the quarter ended 30 September, the company reported a profit after tax of Rs 57.6 crore, an increase of 40% from Rs 41.0 crore in the same quarter last year.

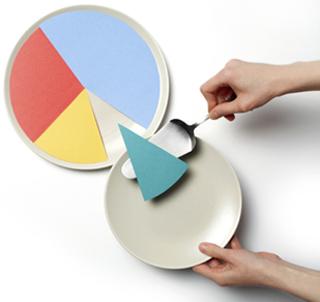

The company’s asset under management (AUM) grew 32% to Rs 17,937 crore as on 30 September, 2016 on a year-on-year basis, with its retail loan portfolio contributing to 90.1% of overall AUM. The firm has shifted its focus from wholesale lending to retail loans over the past seven years. The share of the retail book grew from 10% of the total in FY2009-10 to 89% in the first quarter of FY2016-17.

The NBFC specialises in micro, small medium enterprises (MSME) and consumer financing supported by proprietary credit evaluation methodologies and credit scoring platform. It offers SME loans, loan against property to Indian MSME players and also provides home loans, two wheeler loans and durable loans to entry and mid-level salaried employees of corporates as well as self-employed individuals. As of September 30, 2016, it has financed over 3 million customers.

Acquisition

The firm is also looking to diversify its loan book into several retail segments and is considering inorganic growth options.

Warburg Pincus has been pushing for diversification and is helping the company scout for an acquisition.

The NBFC, led by chairman and managing director V Vaidyanathan, had engaged with another Warburg Pincus-backed firm, AU Financiers (India) Ltd, which was looking to trim its stake in Gujarat-based M Power Micro Finance Pvt. Ltd for a potential acquisition. However, AU Financiers, an early investor in M Power, pared its holding from 38.5% to 9.5% by selling part of its stake to a group of Rajasthan-based affluent individuals recently.

GIC

GIC is a leading global investment firm with over $100 billion in AUM. Established in 1981, the firm manages Singapore’s foreign reserves. It invests across a range of asset classes, including real estate, private equity, equities and fixed income with investments in over 40 countries and has been investing in emerging markets for more than two decades.

GIC, one of the most active sovereign wealth funds in India, has made several big-ticket investments in the Indian financial services space.

In May 2015, GIC became a shareholder in MFI-turned bank Bandhan Bank through a fresh equity infusion of Rs 1,020 crore.

It also co-invested with a few existing shareholders of Janalakshmi Financial Services Pvt Ltd to help the micro-lender raise $150 million (Rs 1,000 crore). The funding round was led by existing investor and global private equity firm TPG.

GIC also owns stakes in HDFC Bank and Kotak Mahindra Bank, two of the four top private-sector banks in the country, besides a host of other financial services firms.

Like this report? Sign up for our daily newsletter to get our top reports.