Kubera Partners is a unique investment firm in the sense that it is the only pure play private equity fund in India to be listed on London Stock Exchange's Alternative Investment Market (AIM). Focused on cross border space, the firm has made seven deals till now from its first fund of $225 million which it raised from institutional and individual investors in 2006. A two-third of the funds have been deployed. The fund's share price has remained flat in the last two years, however, mainly because it's too early for the fund to show any exits while there is no third party analysing the fund's holdings in terms of valuation appreciation.

Kubera is co-founded by Ramanan Ranghavendran, an ex-senior Partner at TH Lee Putnam Ventures (THLPV) and Kumar Mahadeva, an ex- Chairman and CEO of Cognizant Technology Solutions Corporation. Kubera plans to make a few PIPE transactions now and is evaluating sectors like logistics, food-processing and financial services, while it's also considering raising another fund using traditional limited partner route instead of public markets. VC Circle's Sahad PV talks to Ramanan Ranghavendran, Managing Partner, and Abhishek Maheshwari, Principal, Kubera Partners, to know more about the firm's strategy, and the experience so far. Excerpts:

Kubera is co-founded by Ramanan Ranghavendran, an ex-senior Partner at TH Lee Putnam Ventures (THLPV) and Kumar Mahadeva, an ex- Chairman and CEO of Cognizant Technology Solutions Corporation. Kubera plans to make a few PIPE transactions now and is evaluating sectors like logistics, food-processing and financial services, while it's also considering raising another fund using traditional limited partner route instead of public markets. VC Circle's Sahad PV talks to Ramanan Ranghavendran, Managing Partner, and Abhishek Maheshwari, Principal, Kubera Partners, to know more about the firm's strategy, and the experience so far. Excerpts:

Though there have been several real estate and film funds that are listed on AIM, Kubera Partners is unique in the sense that it is the only pure play private equity fund in India which is listed on AIM. What went into this?

RR: You are quite right on that. There have been several real estate funds but we raised our fund 18 months back and since that time no fund has been raised with a private equity concept. The reason for that is that it's not easy raising a fund in this fashion because apart from having a good track record, the strategy itself needs to be a little different. There is more to strategy than saying, "let's just go to India and do some deals". The cross border angle is really our differentiator. In our size range there are two things that make us structurally different- one is the AIM structure and the other is cross-border focus. There is whole range of things in India we don't do as a consequence. All the hot sectors of 2007- power, infrastructure, real estate, which by the way are bad sectors of 2008, we don't do. We only invest in businesses which seek a global presence of some kind.

Why did you decide to go in for an AIM listing to raise money rather than private pension funds or LPs?

RR: When we decided to go for this listing no one had done this and no one has done this ever since, which probably says something. There are two real reasons for it. One is the relative shortness of the fund raising process, which means we don't have to spend 18 months on the road. This means we get done relatively quickly and we get to invest relatively quickly. The second and a more important reason is that I analysed the pros and cons of this kind of a structure from the viewpoint of both investors and fund managers. There are huge benefits for investors which don't show up in the traditional fund. Particularly because it's traded and it offers liquidity.

In a traditional fund there is 10-year illiquid lockup. In our case, if the investor wants to trim down his position because they have cash needs, it's pretty straightforward to do. What we have learnt over the last 18 months is that the investor has the ability to buy into the fund easily. The traditional PE funds once they are raised, they are raised. If you are a new investor and you want to buy into the portfolio, it's pretty much impossible.. Here, if you decide that Kubera sounds like a great thing and you decide to put Rs 10 lakh ($25,000) into Kubera, you actually can. One can't do that pretty much in any traditional LP structure.

Abhishek Maheshwari: Even the flipside for the companies is obviously set up advantages around just us having permanent capital, so we can typically take longer term view for our investments than a traditional equity fund which has five to seven year period. Typically when we invest in a company, the first question is about how are we going to exit. Our timelines are similar to other funds but we, given the structure, can have the advantage of taking a longer term view of our investments, especially in the mid-sized and family-owned businesses. Their view is for generations, so there we can take a longer term view than an average investor.

When a company lists on the stock exchange, the shareholders gain from the share price appreciation by, for instance, selling those shares to someone else. Is it the same for a Kubera investor? If I buy Rs 10 lakh worth of Kubera shares, how does it go into Kubera?

RR: If you were to buy Kubera shares, it would be literally and metaphorically the same as you buy (any other) shares in the market. It would be a secondary purchase - like one buying Infosys shares. You can also be part of the Kubera story. Our shareholders in Europe have over time built up their positions. This flexibility does not exist for the traditional funds.

Are you planning to raise another fund? There were reports saying that you are planning another $200 million fund.

RR: We are not an active fund raising outfit. When we are done with this fund our ideal desire would be to raise more capital capital into the entity. But we also have other options. We have been approached by several investors, who for whatever reasons cannot make investment in traded funds like ours, and said, "Gosh, only if you had a traditional fund structure it would all make sense." We are in the midst of finding out whether we want to do that or not.

So you can raise a traditional fund? How will that work, who will be the owner of traditional fund?

RR: There are hybrid structures that exist on the London Stock Exchange, where the listed company owns a small piece of the traditional fund and so on and all are affiliated. Right now we are thinking of these as two very separate entities as and when we get to them. 3i and Candover are like that.

How much of your first fund has been invested so far? What was the size of that fund?

RR: About two-thirds, so we can probably look to make a couple of more investments and then figure out our next pool of capital. The size of the fund was $220 million.

When do you expect to exhaust this fund? How many deals have you made?

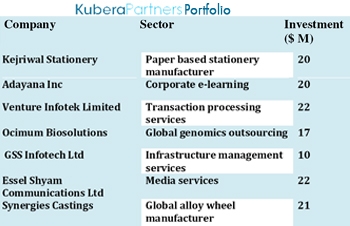

RR: We have told our investors that we will be fully invested by 2008. We believe that this is an incredibly good time to invest, so we are just being judicious about where we put our money. We have seven disclosed deals and we have one undisclosed deal which is very small so we are keeping that under the radar for the while.

All the seven investments are based on the theme of cross-border deal?

RR: Yes. Our fund is a cross-border fund in both directions. We invest in Indian companies that seek to establish a global footprint, we can also invest in US companies that want to use India. All our seven companies are headquartered in India, the reason for that is we see great growth, valuation, equation in India itself versus elsewhere. If that changes, suppose that US becomes a more attractive market, we can use our this fund or we raise a different fund.

What is the kind of share appreciation that you have come across in the last 18 months?

RR: It's been completely and totally flat. And we feel much better about it this year than we did last year.

Why do you think it has remained flat?

RR: That is the pattern of funds like this. The reason is very straightforward, our stockprice should move pretty closely to our net asset value (NAV), and our NAV is pretty much the cash we have on our balance sheet or the cost of our investments. You will see the NAV appreciating if there is a third party evaluating or analysing the portfolio company's performance or when there is actually an exit. Until then NAV remains relatively flat. Now for those investors who want to come in and spend time with us and actually analyse the underlying portfolio companies' performance, they can see what true value is. Accounting rules around NAV are pretty straightforward. The interesting thing that we have been hearing from investors for the last few months is that what that implies is very low volatility. And this is an interesting statistic- the sensex has done a full roundtrip since our listing, it went up 70 per cent and it went down 70 per cent. The investors are valuing the fact that our stock prices are flat.

There are a couple of issues here. One is that a shareholder would not know how Kubera is performing since the share price remains flat. Do they have to wait for exits or are there any analysts tracking you?

RR: We have one investment firm that covers us but they haven't been putting out regular research reports. But now that we have built a portfolio and there is something interesting to talk about we are now in the process of expanding our research coverage, primarily outside of India. In the middle of last year we had two companies to talk about, now we have seven companies hopefully going to 10. So over the next three to six months, our hope is we will expand our research coverage and get two to three firms to really understand what our portfolio is.

When do you expect some of the exits from your portfolio?

RR: Wish I could give you a concrete answer, your crystal ball is as good as mine. What we have told investors is that traditional holding period in PE are three to five years and everyone should be prepared for that kind of timeline. Having said that, strange things do happen and one can well see exits before that depending on what happens with a specific company in a specific market situation.

Are you happy with being listed on the AIM as a fund?

RR: We are simply delighted with the AIM listing and if we can raise more capital with the AIM listed entity that would be by far a preferred choice. It is a great structure for the investor and great structure for the manager. It's really a win-win. AIM market provides great deal of flexibility on a slightly smaller fund such as ours and doesn't impose any onerous requirements. In a public company there are several stringent requirements on the main market. There is no reason for us to consider main market any time soon.

What is the economics of your fund?

RR: It's the same as a traditional PE fund (Management fee of 2% & profit share of 20%).

There are so many funds being raised in India. Why do you think they go for the traditional fundraising route and not for AIM listing? Do you think AIM is the best road to raise a fund?

RR: To raise a fund on AIM is really not easy. You need a very strong track record to be able to raise it because people are giving you blind bull capital and its all being raised at once. Second, the story also needs to be pretty differentiated. No matter how lofty and what a great brand name, you can't behave as I am another guy raising an India fund to do India deals and here is where our cross-border angle plays. Its very process is intensive and you are running a public fund. Its dynamics and management are a skillset of its own. Traditional PE funds have long history; people understand how their limited partners work and how the general partner works and so on. With an AIM listed fund of our size, those expertise just do not exist. We now have it and we have built it. It is not that easy.

Abhishek Maheshwari: What my understanding is that a lot of people who raise funds do it around an anchor investor, the anchor investor typically want to have more control in the eventual outcome and investment committee. By definition as it's a public fund and will not give any shareholder extra rights over another, that's always a challenge.

What do you think about the general investment climate at the moment? What are the valuations looking like for the companies, especially those who are focused on the cross border nature? What are the challenges being faced by the companies in the IT and outsourcing front?

RR: Our logic has always been and you are seeing signs of that in some of the stock prices this year that export oriented businesses are weirdly suited to benefit from the turmoil. You will find large corporations in the west making cost rationalisations decisions which invariably work in the favour of companies that use offshore resources. We have seen reasonably strong performance in our portfolio. The biggest hurdle that these companies face is not a desire on part of the end customer to go offshore whether it's for IT, manufacturing or anything else. It's more decision paralysis. Because when there is a credit crunch everybody puts everything on hold. Fortunately we have not seen much of that. But I have highlighted that because nothing is just bed of roses. That's on the business performance side.

On the valuation side, I am sure you are hearing this from everyone, the massive correction in public market valuation clearly, usually works in the favour of private equity guys like us. Having said that, we found that in the unlisted markets where we primarily operate although we have the flexibility to do listed companies as well, there is always a lag. It will be a quarter or two before promoters really understand that they can't expect professional investors like us to be paying a 20 per cent premium to where the public comparables trade. That takes time and we are starting to see mindset changes and I would expect them to change throughout the year and hence our feeling is that next 18 months are going to be particularly good periods to invest.

Except GSS America there are no publicly listed companies in your portfolio. As the market valuations are going down do you plan to make any PIPE deals?

RR: Yes, we are hardly unique in that sense. In India you have to be opportunistic because there are so many micro-cap and mid-cap companies which never should have gone public in the first place. We are almost obligated to look at these businesses and we have and will continue to do so. We have come close couple of times but could not get to the finish line. Now that the valuations corrected to the degree that they are many of these companies which seem to be spectacular opportunities with good management teams, steady business models, financial performance trading at high single digit or low double digit P/E ratios. These are great valuations.

I think for us, one qualifier I would make, is that our investors don't pay us to go out and buy stocks. When we buy into a public market opportunity there has to be some relation with the management, some ability to add value to that company. So making a pure passive public market investment is not for us. We want some direct line to management so that there is some receptivity to our advice. We are open to various alternatives. We are looking at several PIPE deals right now.

What is the broad vision for Kubera? Where do you see yourself five years from now?

What kind of a fund size are you looking at? Where do you see the current 2/20 swelling to?

RR: That is really tough to answer. What you would hear in our office is being best at what we do. Being best in what we do have a huge economic component, which is making great investment and getting great returns. The other part in being best is we have a great team which is really motivated. Third, which is more relevant is that we want to be "the go to financial partner" for a business that seeks to establish a global footprint.

In our investment range, which is $20-50 million, there is a promoter somewhere in India who has somehow found his way to a small export business and is really thinking, "Gosh I wish I could take this to the next level and wish I had capital partner', we want be the first name that comes to his mind. So in the next five years if we get to that point it will mean everything else has happened."

What is your IRR expectation?

RR: It's the standard private equity IRR. What we have marketed to our investors is 25 per cent IRR target on every investment and we will see how that unfolds for the portfolio as a whole.

Within the cross-border space, what are the businesses that you are looking at?

RR: If you look at the current portfolio, our investments are sector agnostic. We are in IT, ITES, Life sciences, manufacturing and media. We find logistics very appealing and are looking at a couple of transactions in that space. We find food and food processing areas very appealing. We are also looking at companies in the financial Services who has cross border angle as we have a lot of expertise in that area. In financial services it could be asset management company where the aim is to go beyond India. Our historical expertise is in IT/ITES and this seems to be great time to do more of that.

Lastly, besides Kubera you have also been making angel investments?

RR: I have done some occasionally in the past. I continue to do it occasionally. A vast amount of my networth is invested in Kubera.

You have invested in Netscribes. What is your status on that?

RR: Netscribes was done through a very a early stage VC firm (Connect Capital) that I ran, and I continue to oversee the legacy portfolio. Netscribes was a part of that portfolio. The company has done reasonably well, grown through the years and is profitable.