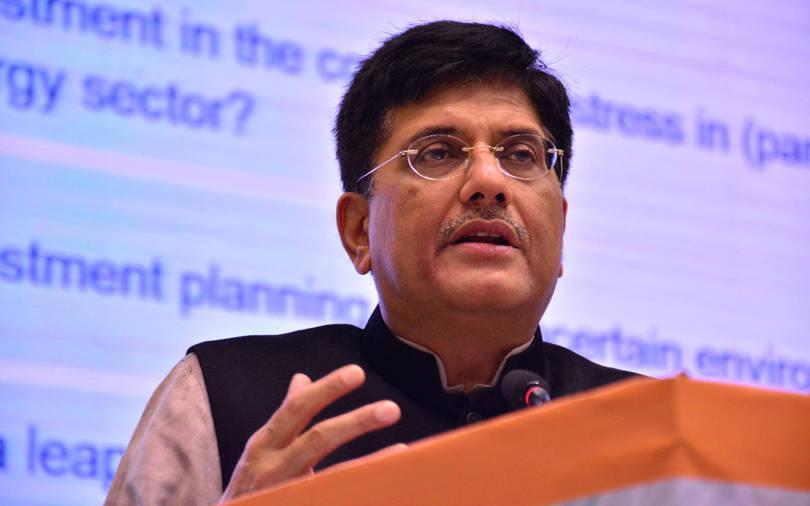

Minister of commerce and industry Piyush Goyal has assured representatives of Confederation of All India Traders (CAIT) of a “robust e-commerce policy” and a fresh Press Note 3.

The new press note will plug the loopholes in the Press Note 2 issued in December 2018 by the Department for Promotion of Industry and Internal Trade (DPIIT), the minister said in a meeting last week with the industrial body that represents brick and mortar traders.

Press Note 2 had clarified that Foreign Direct Investment (FDI) will not be permitted in inventory-led ecommerce models and also mandated that marketplace e-commerce entities file audited reports in compliance with the FDI norms. It also prohibited marketplace e-commerce entities from directly or indirectly influencing the price of goods sold on the platform and sale of exclusive products on the platform by a seller.

Further, Press Note 2 also prohibited sale of more than 25% of a single vendor’s purchases from being originated from the marketplace entity including its wholesale unit. This saw online e-commerce marketplaces such as Amazon pulling out private labels from their platform temporarily.

In 2020, a separate traders body, Delhi Vyapar Mahasangh had alleged anti-competition practices and violation of FDI rules by e-commerce players Amazon India and Flipkart. Based on the complaint the Competition Commission of India had initiated a probe into the business models in January 2020 which was later stayed by the Karnataka High Court in February 2020. CCI’s appeal to the Supreme Court to clear the stay was turned down, directing CCI to approach the High Court.

During the meeting, CAIT also suggested that all e-commerce entities buying and selling goods in India be asked to obtain mandatory registration. The trader body also requested for simplification of the Goods and Services Tax system.