Software startup accelerator Upekkha, on Thursday said it has deployed over $3 million (around Rs 24.7 crore) to back 29 early-stage startups in 2022.

Upekkha, which counts homegrown private equity firm West Bridge Capital as its investor, made the infusion at an average ticket size of $100,000 in pre-seed rounds.

Some of the companies backed by Upekkha include automation platform Kapittx, attendance management firm Truein, content writing assistant platform Longshot AI, healthtech company Medpiper and AI firm Cogniswitch.

“Indian SaaS founders usually have limited access to capital. So they build startups that have capital efficiency embedded in their DNA from the very beginning. This helps them tide past troubled waters and, in fact, thrive in this economic environment,” said Upekkha’s partner Prasanna Krishnamurthy.

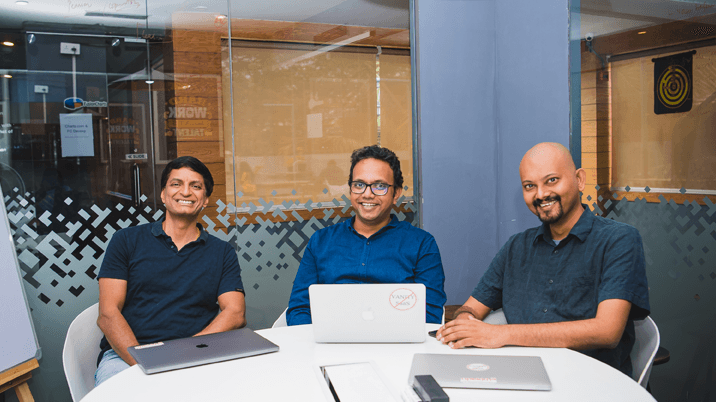

Founded in 2017 by Krishnamurthy, Thiyagarajan Maruthavanan and Shekar Nair, Delaware and Bangalore-based Upekkha has a community of over 250 founders and 125 startups.

It says that 100% of its first cohort has hit $1 million ARR and 90% of its initial 20 startups continue to grow 50% year-on-year.

Last year, the firm raised $9 million from WestBridge Capital towards its rolling fund to back up to 60 startups. This was the first of its kind alternative investment fund in India.

In 2020, Upekkha launched an incremental fund called UP Funds to invest $2.5 million per year in global software businesses.

Incremental funding comprises partial funding of a contract or an exercised option, with additional funds anticipated to be provided at a later time. Such funds are termed rolling funds.