Private-sector lender RBL Bank floated a blockbuster initial public offering on the stock market a year ago. Going public, however, hasn’t diminished the lender’s appetite for fundraising from private equity investors.

Deal: On 7 July, less than a year after its IPO, the bank said it planned to raise Rs 1,680 crore ($260 million) from a clutch of investors led by UK-based CDC Group Plc and private equity firm Multiples Alternate Asset Management Pvt. Ltd.

RBL Bank is raising capital by selling a 7.97% stake via preferential allotment. The funds will augment the bank’s tier-I capital for supporting business growth and help it capitalise on merger and acquisition opportunities, it said.

Seller: RBL Bank is a mid-sized commercial bank and has been operational for 74 years. The lender, earlier known as Ratnakar Bank Ltd, was incorporated as a small regional bank in Maharashtra with two branches in Kolhapur and Sangli. It underwent a transformation after 2009-10 when a new management team took control.

The bank’s IPO, in August last year, was covered more than 70 times. RBL Bank was the first private-sector lender to float an IPO in nearly a decade.

Ahead of the IPO, RBL Bank had raised Rs 364 crore by selling shares to anchor investors including private equity firm ChrysCap and Wipro chairman Azim Premji’s private investment arm, PremjiInvest.

Buyers:

CDC Group Plc: The UK government-owned fund-of-funds has $4 billion assets under management. The firm focuses on the emerging markets of Asia, Africa and Latin America, with an emphasis on South Asia and sub-Saharan Africa. The firm seeks to invest in a range of sectors including manufacturing, agriculture, infrastructure, finance, construction, healthcare and education. It typically invests between $10 million and $20 million.

Over the past several years, CDC has supported RBL Bank more than once. CDC made its first direct investment in RBL Bank in 2014, picking up a 4.8% stake. In September 2015, CDC provided debt financing of Rs 330 crore to the lender.

CDC is also a limited partner, or investor, for Multiples PE’s funds. Multiples is also an investor in RBL Bank.

Multiples PE

Multiples Alternate Asset Management is investing in RBL Bank through its $690-million second fund. The PE firm provides expansion, growth-stage and buyout capital to companies operating in India.

The firm seeks to invest in financial services, information technology (excluding traditional services), healthcare and pharmaceutical, and consumer sectors. It typically invests between $50 million and $100 million in its portfolio companies.

Multiples has also invested in the bank through a separate entity called Plenty CI Fund. This fund provides capital to companies operating in information technology services, consumer, financial services, healthcare, logistics and agriculture sectors.

Apart from CDC and Multiples PE, other investors include ABG Capital, HDFC Standard Life Insurance Company Ltd, ICICI Lombard Insurance Company Ltd, LTR Focus Fund, Steadview Capital and Global Ivy Ventures LLP, the investment firm owned by former Hero MotoCorp joint managing director Sunil Munjal.

After the stake sale, ABG Capital will hold a 0.39% stake in RBL Bank, CDC 6.9 and LTR Focus Fund 0.45%. Steadview Capital Mauritius Ltd and Steadview Capital Master Fund Ltd will hold a 1.15% stake in RBL Bank.

Valuation: The transaction puts RBL Bank’s enterprise value (EV) at $8.12 billion (Rs 52,389 crore), more than double the valuation at which the lender went public in August 2016. The valuation is 2.5 times the EV at which RBL Bank raised $73 million (Rs 486 crore then) in the last round before its IPO in September 2015.

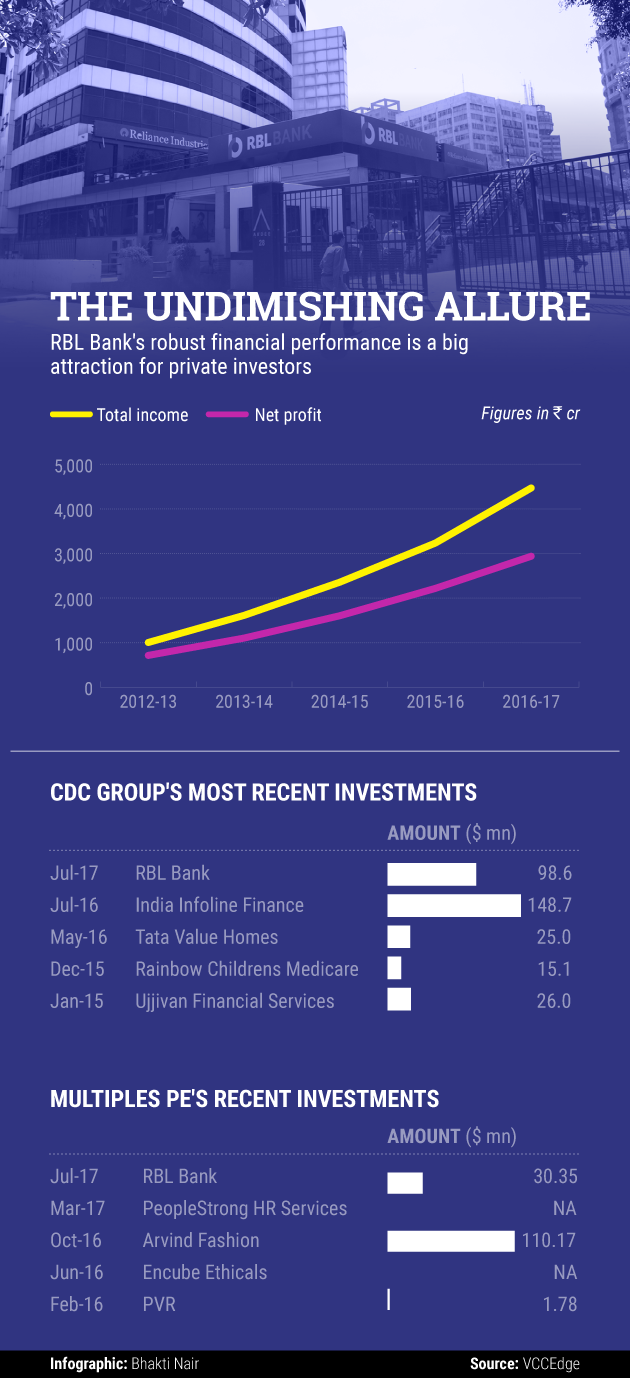

The EV of RBL Bank was 12 times its total income in 2016-17 and 18 times its net profit. This was up from the EV of 9.4 times its total income in September 2015 and 14 times net profit.

RBL Bank appears to be undervalued when compared with a recent deal involving Kotak Mahindra Bank.

In March, Kotak Mahindra Bank raised $338 million from Canadian pension funds CPP Investment Board and CDPQ. The EV for Kotak Mahindra Bank was 15 times its Total income 24.4 times its net profit.

However, the deal multiples for RBL Bank look high as compared with another mid-sized lender—South Indian Bank. In January, South Indian Bank raised $9.5 million from ChrysCapital at an EV of 9.27 times its total income.

The big picture: RBL Bank has the potential to record strong growth in the next few years thanks to a strong leadership team, a niche business model and consistent improvement in operational parameters.

The bank has been aggressively growing its balance sheet ever since the management change in 2010. Its loan book has grown at a compound annual rate of 58% since 2010.

RBL Bank is also investing heavily in branding, technology and branch expansion. The rapid expansion has pulled down RBL Bank’s capital adequacy ratio from 17.1% in 2012-13 to 12.9% in 2015-16.

The latest capital infusion will help RBL Bank fuel its growth plans. The recent investment also becomes significant considering that RBL Bank is reported to be in talks to acquire microfinance institution Bharat Financial Inclusion Ltd.