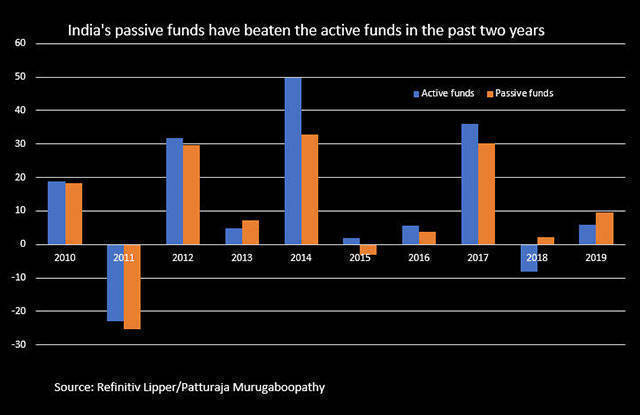

India's passive index-tracking equity funds are set to beat their active stock-picking counterparts in returns for a second successive year as fund managers grapple with volatility and the challenges of outperforming benchmark indexes.

According to Refinitiv Lipper data, India's passive funds have delivered an average return of 9.6% so far this year, much higher than active funds' 5.7%. In 2018, passive funds posted 2.3% gains, while active funds had negative returns.

Active funds have historically outperformed passive funds in India when share price moves were more broad-based and market inefficiencies helped stock pickers as they hunted for shares whose prices were not truly reflective of their worth.

But India's stock market rally has been much narrower in the past two years, with investors preferring some well-established heavyweights over smaller ones owing to broader uncertainties around a slowing domestic economy and the U.S.-China trade war.

For instance, the Nifty index has risen 9.67% so far this year, but the Nifty Midcap index has shed 6.2% and the small-cap index has slumped 11.4%.

Pratik Oswal, head of Passive Funds at Motilal Oswal Asset Management Company, said 85% of the Indian stock market had become efficient.

"Finding mispricings has become harder than it was 5-10 years ago," he said.

"A sharp correction in mid and small caps, coupled with mega caps becoming larger, has led to underperformance of most active fund managers."

Also, the Securities and Exchange Board of India's (SEBI) rules on holdings of large-cap and mid-cap firms have affected the performance of active funds, analysts said.

At the end of 2017, SEBI said a large-cap equity fund must invest at least 80% of its portfolio in large-cap stocks and mid-cap funds must invest at least 65% in mid caps.

Prior to that, active fund managers had the flexibility to allocate larger amounts to other categories to boost their funds' performance.

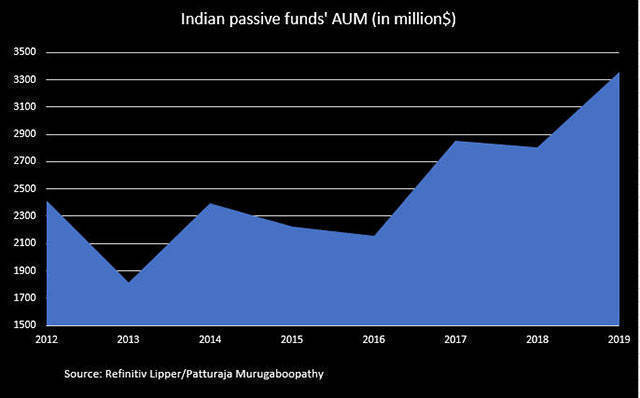

Nonetheless, active funds remain more popular with Indian investors who still haven't taken to index investing, unlike in developed markets.

The passive funds' assets under management (AUM) is lower than that of active funds, according to Refinitiv Lipper data. Active funds' AUM stood at $94.4 billion at the end of third quarter, while passive funds' AUM were just $3.3 billion.

In the United States, passive funds' AUM stands at more than half of the active funds' AUM, the data showed.

"We don't have a lot of long-term money flowing into index, the way it does in America or other developed markets," said Dhirendra Kumar, founder and chief executive officer of Value Research.

"Indian investors have become curious and they are beginning to invest (in passive funds). But I don't think it is very big time."