Printland Digital India Pvt Ltd, that runs an online printing solutions startup Printland.in, has raised an undisclosed amount of funding from SIDBI Venture Capital Ltd, a wholly-owned subsidiary of Small Industries Development Bank of India (SIDBI).

“Proceeds from the investment will be used towards the growth of the business for better customer experience through investment in technology, launch of new products and acquisition of new clients," said Sandeep Behl, founder and CEO of Printland.

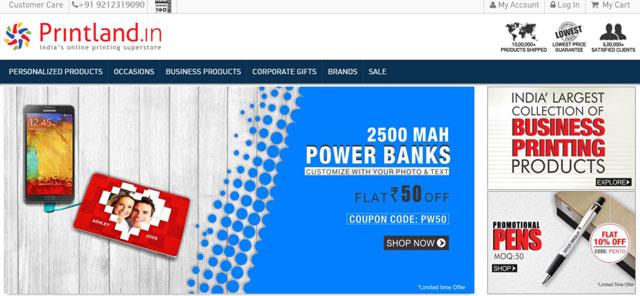

Founded in 2011 by BITS Pilani alumnus Sandeep Behl, New Delhi-based Prinland provides corporate printing, individual printing, corporate merchandise and corporate gifts focused on the SME sector. It also provides personalised gifts like mugs, T-shirts, photo rocks, key chains, greeting cards, phone covers, ceramic plates, pen drives, notebooks, mouse pads, glass clocks, sippers, laptop sleeves, picture puzzles and stickers.

In March 2013, Printland raised Rs 90 lakh from Delhi-based angel-cum-seed fund Evista Venture Capital. After six months, the company raised another round of funding led by SIDBI in which existing investors also participated.

SIDBI has three funds apart from India Opportunities Fund, which was established in August 2011 with a life of 10 years. The other three funds are Samridhi Fund, SME Growth Fund and National Venture Fund For Software and IT Industry (NFSIT).

India Opportunities Fund was floated to provide growth capital to MSMEs operating in emerging sectors such as light engineering, clean-tech, agro-based industries, logistics, infrastructure, educational services, IT/ITES, etc.

This is the fifth known investment by SIDBI this year, according to VCCEdge, the research platform of VCCircle. The other investments include Annapurna Microfinance Pvt Ltd, Power Research and Development Consultants Pvt Ltd, Synergistic Financial Networks Pvt Ltd and Natureland Organic Foods Pvt Ltd.

Langham Capital acted as the exclusive financial advisor to Printland on this deal.