Motilal Oswal Private Equity Advisors Pvt Ltd, the PE arm of Motilal Oswal Financial Services Ltd, has acquired a 4.1 per cent stake in Indian Energy Exchange (IEX) from Jindal Power Ltd for Rs 98 crore (about $14.7 million), as per a press statement.

The PE firm acquired the stake through two of its funds, India Business Excellence Fund-II and India Business Excellence Fund-IIA.

The transaction values the exchange at Rs 2,390 crore ($361 million), higher than previous deals last year that valued it around Rs 2,150 crore.

In September 2015, Financial Technologies (India) Ltd (FTIL) had said it would offload a 19.06 per cent stake in IEX for Rs 410 crore (over $62 million then) to a clutch of buyers, including DCB Power Ventures Ltd, Kiran Vyapar Ltd, Agri Power and Engineering Solutions Pvt Ltd and Aditya Birla Private Equity.

A month later, FTIL had entered into an agreement with Madison India for sale of a 1.58 per cent stake in IEX for Rs 33.96 crore (over $5.2 million then).

In November, FTIL exited IEX by selling its remaining 0.37 per cent stake to a fund run by Madison India.

Also, home-grown PE firm TVS Capital had picked up a 3.1 per cent stake in IEX for Rs 72 crore in September. A month later, it had increased its stake in IEX to 4 per cent by shelling out Rs 9 crore more.

IEX also counts other private equity and venture capital investors including Multiples PE and Lightspeed Venture Partners.

“IEX is a one of the best bets on the undergoing power sector reforms without taking any balance sheet risk,†said Vishal Tulsyan, managing director and chief executive at Motilal Oswal PE.

The PE firm is picking up the stake that Jindal Steel & Power Ltd agreed to offload earlier this month. Jindal Steel had not disclosed the name of the buyer or the deal amount at the time, saying only that the stake sale by its unit Jindal Power was part of a monetisation plan and that the deal was likely to close by March-end.

The India Business Excellence Fund II, a Rs 950-crore fund, was raised by the PE firm in 2012 and is currently in investment phase. The PE firm has so far made eight investments through the fund. This is its first deal this year. The PE firm also manages three real estate funds.

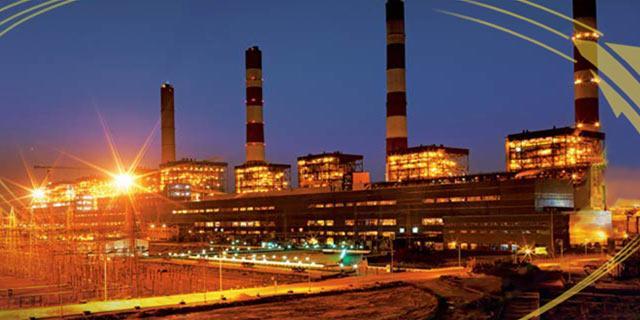

IEX was set up in 2008 as India’s first exchange for trading in electricity and renewable energy certificates.