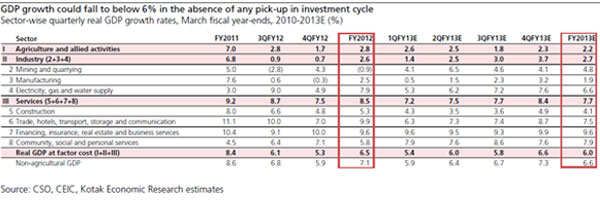

Staring at the abyss. The 4QFY12 GDP growth print of 5.3% underlined yet again that the pains for the Indian economy are here to stay. The message remains that India’s growth story is not reflecting much confidence even as the debate may continue on whether the print was due to data revisions. Services showed signs of weakness, inturn echoing some domestic consumption moderation in the days ahead. We reduce our FY2013 growth estimate to 6.0% after holding on at 6.6% since late-2011, contrary to consensus expectations of above 7% numbers. We remain concerned that monsoons might not be as healthy, chances of revival of investment sentiments could be weak and overall structural impediments to growth can continue.

Agriculture may disappoint in FY2013

Real GDP at factor cost for the full year was at 6.5% (lower than our expectations of 6.7%) with trend growth rate in agriculture (2.8%), significantly reduced industrial sector growth (2.6%) and start of a moderation in services sector growth (8.5%). In FY2013 agriculture growth can fall below this year’s growth as monsoons may be sub-normal (see our report dated April 26, “Less than 50% chance of ‘normal’ monsoon”). We expect agriculture growth for FY2013 at 2.2% with chances of an upside revision in case of a normal monsoon.

Not much upswing in industrial sector growth should be expected

We expect industrial sector growth to be ~2.5%, in line with FY2012 outturn. Manufacturing sector is likely to be the major drag in FY2013 for the industrial sector. In FY2012 due to regulatory issues, the mining sector contracted by 0.9% and also contributed along with the manufacturing sector to the drop in industrial sector growth rate. The investment rate (calculated as gross fixed capital formation to GDP at market prices) was at 28.6% in 4QFY12, down from 29.4% in 4QFY11 and 31.2% in 1QFY12. In FY2013 we expect the headwinds to the investment climate to continue emanating from a combination of (1) high CAD, (2) high and sticky inflation, (3) high fiscal deficit, and (4) limited headroom for monetary policy loosening which precludes a pick-up in investment cycle and pushes the potential growth lower.

Consumption moderation will reflect in the services sector growth

Given the contribution of services sector in the GDP, the moderation in growth in ‘construction’, ‘trade, hotel, transport and communication’ and ‘community, social and personal services’ led to the sharp decline in GDP growth in 4QFY12. Specifically, through FY2013 we expect services sector to remain weak with discretionary spending slowly being reduced. Hence, private consumption expenditure (in real terms) is likely to remain closer to 5.5-6% in FY2013 which will be reflected in the components like hotel, transport, personal services, etc. With equities markets remaining weak, it is likely that the adverse ‘wealth’ effect will further deter in discretionary consumption expenditure. We expect services sector growth at ~7.5% in FY2013. Post Lehman in FY2009, services sector growth remained high owing to the push from 6th Pay Commission.

RBI’s call for a pause unlikely to change

Talks have started doing the rounds that the RBI could cut policy rate in the June 18 meeting. However, we do not think this as a likely event. With no hints of fiscal consolidation yet, effect of monsoons yet to emerge and inflationary pressures from currency depreciation to probably sustain, the RBI should be on a wait-and-watch mode even now. We also do not anticipate any CRR cut in the next policy meet and the fire-power of the CRR is likely to be maintained for distressed times.

Why do we change our forecast now? We were already at a low of 6.6% for FY2013

since late-2011 and we needed further clarity in terms of direction from consumption and the services sector to change our numbers. For our current FY2013 growth estimates of 6.0% we have factored in (1) seasonal effects on the quarters, (2) lower agricultural sector growth due to impact of weaker monsoons, and (3) moderation on the services sector given increasing pessimism on the consumption expenditure side and the effect of a slower industrial growth.

Our concerns are now more on structural imbalances rather than only on the lower growth readings. We are definitely concerned about the falling growth rate given

the implications from a welfare perspective in the long run. For a developing economy like India, the long-term objectives of poverty eradication, inequality moderation, financial inclusion and improvement in the standard of living is directly dependent on the growth rate of the economy. A sustained growth rate of 6-7% in unlikely to be of significant help for any of the above.

Our concern for the economy is now at a more fundamental level. To achieve a sustained higher growth rate of ~8%, the policy makers would need to break some of the vicious cycles that have led to the structural imbalance in the economy. Some of these are discussed here.

Remedy for structural imbalances lies with the Government rather than the RBI.

Important to note is that if the structural imbalances are sustained, the current dynamics of low growth can compound itself in the medium to the longer horizon. Some of the key areas that we look into are: (1) high structural fiscal deficit leading to lower growth potential, (2) unsustainable current account deficits and its consequent impact on currency depreciation, and (3) currency depreciation leading to liquidity squeeze and hence lower growth bias.

- Fiscal deficit to lower investment. The reason that we start with the fiscal side is to replicate the situation in post-Lehman era when the Government provided fiscal stimulus to push growth. The higher expenditure through MGNREGS, farm loan waiver and pay commission fueled consumption demand which in turn helped a V-shaped recovery. The long-term sustainability of growth suffers as near-term upshot in growth is consumption based rather than investment focused. This in turn leads to a demand-supply mismatch in the short term that increases inflationary pressures and leads to a wage-price spiral. In response to this spiral, RBI tightens policy interest rates. Sustenance of relatively high interest rates in the economy affect investment sentiments over a longer time horizon. High market borrowing could also preclude private investments in the event of lower capital flows into the economy. Hence, potential growth starts to fall off.

Unfortunately, the market currently puts a heavy reliance on RBI/monetary policy to revive the growth in the economy. However, the above discussion clearly indicates that Government policies should now play a bigger role in alleviating the structural imbalances in the economy.

(Indranil Pan is chief economist at Kotak Mahindra Bank.)