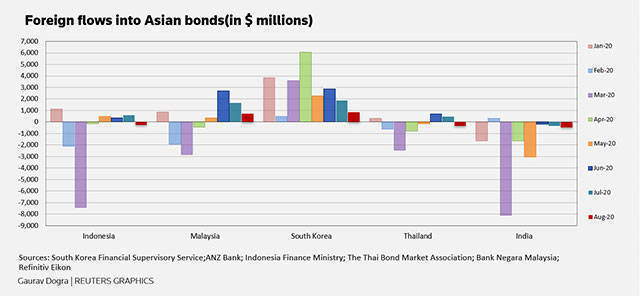

Asian bonds recorded a third straight month of net foreign inflows in July, but buying slowed due to an escalation in Sino-U.S. tensions and the worsening pandemic situation in some areas.

Foreigners purchased a net $489 million worth of Asian government and corporate local currency bonds last month compared with $3.97 billion in July, data from regional banks and bond market associations in Indonesia, Malaysia, Thailand, South Korea and India showed.

Khoon Goh, head of Asia Research at ANZ, said the slowdown was due to worsening U.S.-China tensions, with the U.S. imposing technology sanctions on Chinese telecommunications giant Huawei.

But he remained constructive on portfolio flows in the near-term.

"True, the overall growth outturn over Q2 was worse than expected. But investors’ focus has shifted to the pace of recovery now," he said.

In August, South Korean bonds received a net $839 million of foreign money, which was the eight successive monthly inflow this year, while Malaysian bonds attracted a net $715 million.

On the other hand, foreigners sold a net $264 million worth of Indonesian bonds, on worries over its fiscal deficit and ailing economy.

This month, Indonesian bonds have fallen further on concerns about new lockdown measures and a parliamentary panel's recommendations for changes to the central bank law, which could reduce the central bank's independence.

At the end of August, foreign holdings in Indonesia's local currency government debt were down to 28.24%, the lowest since August 2010.

Overseas investors also sold a net $449 million in Indian bonds, which was the sixth successive month of net sales this year.

The world's second-most populous country lags only the United States globally in overall number of infections, but it has been reporting more daily cases than the United States since mid-August.

Thai bonds also witnessed a net $351 million worth of foreign outflows last month.